Boy this week is flying, that was two very exciting days.

I was going to be excited about today too as this was going to be the comeback. GS pulled out the big guns and kicked LEH, MER, GS and JPM while they were down and I thought Goldman was done attacking the economy but this morning, around 6am, they reversed a sell-off in oil by coming out with yet another "report" stating oil prices will head back to $149. This shot oil back to $115 and turned gold around back over $800.

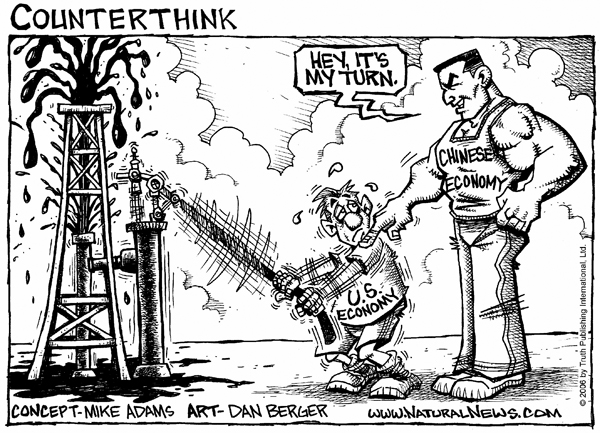

This fits in with my impression that Goldman is very much on the wrong side of the trade, long on commodities and short on financials and the action post-July 15th simply caught them with their pants down, so they are doing their best to engineer a reversal. GS and their hyena pals have been attacking the financials all week, forecasting a global economic meltdown and a protracted US recession. Now that they have taken down the financials low enough to weasel out of their positions, they are going to tell you how strong global demand will support high oil prices.

I noted yesterday that there are only 65,000 contracts left to dump on the NYMEX. Even though the market is not driven by speculators according to former GS CEO Hank Paulson, strangely all but 65M of the 320M barrels that were "demanded" at the NYMEX for September delivery have already been canceled, depriving US inventories of 63M barrels PER WEEK that were in the hands of traders just last week. Today is an inventory day but the NYMEX traders dumped all but 20M barrels that were scheduled for August delivery last month – 5M barrels a week less than what they normal short-change us for. Despite this, inventory draws have been subdued, indicating massive demand destruction continues – we'll see how they try to spin it today…

Meanwhile, those 65,000 remaining oil contracts were churned traded 178,631 times in yesterday's trading as the NYMEX pump crew is forced to play hot potato with the last remaining September crude contracts as it is very obvious nobody really wants them. Nobody has wanted oil in May 2011 since it was $70.91 a barrel, nor July 2011 ($70.91) or Feb, March, April, July, Aug, Sept, Oct or November of 2012, all with $70 contract prices at the last sale. Oil has not been $70 since last September so we are coming up on an entire year, with over 72Bn contracts traded on the NYMEX and NO ONE has shown an interest in buying a single contract for oil in those 2011 or 2012 dates at more than $70 per barrel. You know how con men make up a room to look like a big office but it's really just the room and if you look behind the curtain you'll see how there's nothing there? This is kind of like that!

Of course, we expected a bottom for this drop at $110, that was my target for quite some time. Still that didn't stop us from hoping we'd break the support level and the market has given us a less-than-enthusiastic response to what amounts here to simply a 38% Fibonacci retrace of the recent run up. My upside target is now $130, where we plan on going short for the next drop. There are NO fundamentals at all behind oil's rise, this was just the logical place that we expected the manipulators to reassert themselves until Congress gets back and cracks the whip or they run into the huge pile-up of barrels in the December contract period in mid November (175M barrels already on order as traders try to roll contracts to the end of the year). There are 634M barrels scheduled for delivery (already paid for) between now and the end of the year – unfortunately, the United States will actually get less than 100M of those barrels as NYMEX traders continue to dump oil in order to keep up the pretense of tight supplies.

Of course, we expected a bottom for this drop at $110, that was my target for quite some time. Still that didn't stop us from hoping we'd break the support level and the market has given us a less-than-enthusiastic response to what amounts here to simply a 38% Fibonacci retrace of the recent run up. My upside target is now $130, where we plan on going short for the next drop. There are NO fundamentals at all behind oil's rise, this was just the logical place that we expected the manipulators to reassert themselves until Congress gets back and cracks the whip or they run into the huge pile-up of barrels in the December contract period in mid November (175M barrels already on order as traders try to roll contracts to the end of the year). There are 634M barrels scheduled for delivery (already paid for) between now and the end of the year – unfortunately, the United States will actually get less than 100M of those barrels as NYMEX traders continue to dump oil in order to keep up the pretense of tight supplies.

Shenanigans began last week as the EIA noted that we imported 538,000 barrels a day LESS crude than the week before while EXPORTING 1.5M barrels a day of product, creating a weekly draw on US inventory of 14M barrels. As recently as July 11th, US net imports were 12,492,000 barrels a day yet the inventory report of 8/8, just 30 days later, had a net daily import total of 10,756,000 barrels a day. That's 1,736,000 less barrels per day coming into the US per day, 12M barrels a week by that count as well (and we're not including the false demand caused by our 10.5Mb weekly export). So anything less than a 12M barrel draw in crude in today's report is essentially the level of demand destruction. If you look at the historical chart, you'll see that as recently as last year, we imported 13M barrels of crude per day.

Interestingly, despite being told to stop by Congress in June, the President managed to put another 1.259M barrels of crude in the SPR since July. Total US crude stocks are amazingly at 1.69Bn barrels, UP from 1.67Bn barrels on the July 4th inventory report which was taken BEFORE the holiday weekend. Again, looking back in history, we are as well supplied as we ever were with crude and demand is falling fast – THOSE are the fundamentals and all the cancelled delivery contracts in the world and all of Goldman's manipulations won't change that fact!

China made a huge comeback this morning with the Hang Seng jumping back 446 (2.2%) points in a very strong session but that was nothing compared to the Shanghai, which jumped 7.63% as investors there took my Monday morning comments to heart and started bargain hunting in China. The catalyst in China was speculation that the government was considering a fiscal stimulus package as JPM economist Frean Gong said "China may be considering a stimulus package of at least 200 billion to 400 billion yuan ($29.2 billion to $58.32 billion), which would include tax cuts and measures to stabilize the capital markets and support the housing market." What an interesting coincidence: GS knocks down the US economy here and JPM pushes the China economy there, making the US less attractive and China more attractive. Gosh I hope these guys don't have ugly sisters they want to force us to date…

Unfortunately, a Chinese stimulus package would also stimulate oil consumption over there and that's another good reason for the oil bulls to attack $115, which they must hold this week in order to mount any sort of recovery. Japan was aware of this and that oil-based economy traded flat on the day but recovering off an early dip of 50 points. The Nikkei still has a big test at 13,000 ahead of it and the Hang Seng needs 3 more 400-point days to get back to 22,000 so we're not impressed just yet.

Over in Europe, the markets there are up about half a point ahead of the US open (8am) but led by miners and oil producers so not really our kind of rally. Russia is playing the part of the gaint, uninvited dinner guest that refuses to leave and occupies your home and keeps taking over more and more bedrooms in a terrible metaphor for their continued occupation of Georgia. NATO ministers "struggled against the limits of their powers Tuesday at a meeting in Brussels. They called on Russia to withdraw its troops from Georgia immediately, but stopped short of saying what they would do to punish noncompliance."

The Administration has already lost UK support for its tough stance on Russia, making the US's efforts even less effective. "I am not one that believes that isolating Russia is the right answer to its misdemeanors," said U.K. Foreign Minister David Miliband, in a statement, before the NATO meeting Tuesday. This was to be expected as the Russian defense of South Ossetia is not that different from the UK's decades-long issues in Northern Ireland.

In an opinion piece for The Wall Street Journal, Russian Foreign Minister Sergey Lavrov said his country will "continue to seek to DEPRIVE the present Georgian regime of the potential and resources to do more mischief." He called for an embargo on arms to the "Tbilisi regime."

"Allied aircraft enjoy air superiority, and we are using that superiority to systematically DEPRIVE Saddam of his ability to wage war effectively. We are knocking out many of their key airfields, we're hitting their early-warning radars with great success. We are severely degrading their air defenses." – George Bush the first, Sept 23, 1991

"The passing of Saddam Hussein's regime will DEPRIVE terrorist networks of a wealthy patron that pays for terrorist training and offers rewards to families of suicide bombers. And other regimes will be given a clear warning: That support for terror will not be tolerated." – George Bush the second, Feb 22, 2003

Goldman has DEPRIVED the US markets of a chance of recovering swiftly but we'll see if we can hold Aug 4th support at Dow 11,300, S&P 1,250, Nas 2,300 (way above that), RUT 710 (way over), SOX 335 (way over), NYSE 8,250 (already below) and Transports 2,350 (way above). As I said in yesterday's post, the NYSE is our leading indicator and their steep drop and lack of recovery yesterday morning kept us out of trouble. We need the NYSE to retake 8,300 or there is no rally and we need the Nasdaq to pop back over 2,410 or it may be time to drift back to more cash.

If we can't recover, then our FRE play from Monday needs to be dumped for a loss as it starts looking too risky but, if the financials perk up, then we can double up at $4.20 or less, reducing our basis to $4.60, buy back the $5 callers for .60, reducing our basis to $4.45 and sell the $4 calls for $1, reducing the net basis to $3.45 on 10,000 shares vs. $4 on 5,000 shares with a 16% upside if we get called away at $4 vs. a 20% upside if we get called away at $5 on the current set-up. If $4 does not hold for a day's close, we need to close it down for a loss anyway.

We ran a very extensive bottom fishing watch list in yesterday's member chat for long-term plays under LTP notes starting at 10:36, make sure you look those over if you are thinking of doing a little fishing down here!