Oil's back at $120 – Yipee!

Oil's back at $120 – Yipee!

We'll see if they can hold it there but the CNBC weather team is on the ball with the most pessimistic possible forecasts, repeating Katrina over and over like a mantra even though Gustav is projected to max out at category 3 and Katrina was a category 5 hurricane. I gave the weather report in last night's wrap-up so I won't get into it here but, overall, I'm seeing this storm as a great opportunity to grab some oil shorts.

Meanwhile, it's still a day-trading environment as stocks continue to yo-yo up and down at an incredible rate (ironically as the VIX continues to decline). We hit our target on the XOM play we initiated in the Tuesday morning post with a nice 37% profit and made similar profits on MRO, BAC, LVS and PRU from yesterday as I got nervous at 2:09 and decided to cut and run with the quick profits. This is not a good thing though, you shouldn't be able to make 25-50% in a day trading that variety of options, it just shows how volatile the market has become and it's a very tough market to gut out as it twists and turns day in and day out.

As I said last week, the best thing you can do in a market like this is just ignore the madness and stick to your game plan – hoping your macro-view will win out over time. We had a small victory in our macro view yesterday with a much better than expected durable goods report and those numbers had nothing at all to do with stimulus checks, which is the knock that is being used against today's GDP report, even before the numbers are released by bearish pundits – of which there is no shortage these days.

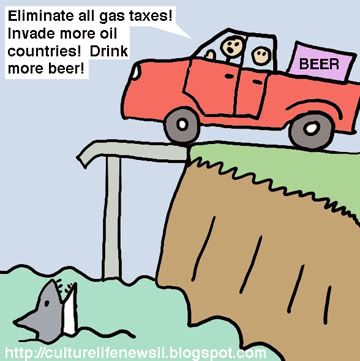

I'm not as bullish myself with oil back at $120. Improvements in short-term consumer confidence in this week's poll were very much the result of a $35 pullback in oil prices, which helped to strengthen the dollar and drive down food and other commodity costs as well. I've maintained for a long time that this is what we need to save the economy and clearly there are NO fundamental reasons for oil to be at $120, or even $100 for that matter, so ideally, the normalization of commodity prices would put $1Bn+ per day back into the hands of consumers so they can pay their debts and buy some stuff at retail stores. The $365Bn a year that is represented by the difference between $95 oil and $145 oil is enough money to pay the mortgage on $5Tn worth of loans – pretty much the entire total held by FRE and FNM!

That's the underlying bull premise, that commodities are the same bubble that housing was and will crash the same way housing did but, unlike housing, a collapsing commodity bubble doesn't hurt the average person, only speculators – and only dumb ones at that as they are plowing money into a "dip" in crude pricing to $120, which is still 2.4 TIMES the price at the beginning of 2007 and still 50% higher than the price of oil at the beginning of 2008. Copper is still at insane levels as is most of the CRB, despite the 20% pullback in July.

It was very painful to hang onto our positions yesterday but we knew there was no way the GDP would disappoint us after looking through the Durable Goods report and we've already looked at the retail sales numbers etc. so it's no surprise this morning (to us anyway, apparently it's a shock to "economists") that the Q2 GDP has been revised up to 3.3%. This is improving the mood of the markets considerably and will hopefully carry through to get us back up over 11,600 to stay for more than a day – which is going to be a tall order into the holiday.

Not only did the economy grow at 3.3% from March through June, BEFORE the final third of the inflationary stimulus checks went out (anticipation of hich drove the price of oil up to $145, stimulating the bottom line of Bush/McCain's contributors more than anyone else), but Unemployment claims fell slightly to 425,000 this week although continuing claims indicate it is still hard for those who are unemployed to get back to work. Corporate profits in Q2 rose 1% to $1.36Tn after declining 7.7% in Q1 – this is also something we expected as we took the radical economic approach of paying attention to earnings reports…

As we expected yesterday, the original assumption of inventories that hurt the preliminary GDP last month was way off. After originally subtracting 1.92% from growth, the commerce department has adjusted the figure to 1.44%, a 25% difference in one of the most critical economic reports we get! Either way, a significant drawdown in inventory like this is GOOD for future growth as there is less downward pressure on production going forward (kind of like the declining housing supply in some areas).

Exports were better than originally estimated (thank you pathetic dollar) and THAT number was adjusted up from 9.2% to 13.2% – a 43% difference to the plus side! Imports were down 7.6% vs. down 6.6% reported last month and consumer spending was up 1.7% vs the 1.5% originally reported and way above Q1s 0.9% gain. Missing by 0.2% may not seem like a big deal as far as government incompetence goes but keep in mind that consumer spending accounts for 70% of all economic activity and 0.2% is a 13% miss off 1.5% so things are MUCH better than we thought at the beginning of August, when the market drove up to 11,867 before the economic hit team of Goldman, Cramer and Whitney decided to launch an all-out assault on our financial markets.

Exports were better than originally estimated (thank you pathetic dollar) and THAT number was adjusted up from 9.2% to 13.2% – a 43% difference to the plus side! Imports were down 7.6% vs. down 6.6% reported last month and consumer spending was up 1.7% vs the 1.5% originally reported and way above Q1s 0.9% gain. Missing by 0.2% may not seem like a big deal as far as government incompetence goes but keep in mind that consumer spending accounts for 70% of all economic activity and 0.2% is a 13% miss off 1.5% so things are MUCH better than we thought at the beginning of August, when the market drove up to 11,867 before the economic hit team of Goldman, Cramer and Whitney decided to launch an all-out assault on our financial markets.

Asia was mixed with the Nikkei flat, the Shanghai up half a point and the Hang Seng dropping 492 points, back under 21,000 on a slew of broker downgrades, hitting hard in the telcom sector but spilling over into retail. Pakistan figured out how to stop their market from falling as the KSE's board of directors imposed a FLOOR at 9,144, announcing NO stock can be traded below Wednesday's closing – now why didn't we think of that? A stock-exchange official said more than 100 police officers were deployed at the Karachi Stock Exchange to avert any agitation from investors. In July, investors, incensed over plunging shares, went on a rampage and damaged the exchange.

Europe cheered right up this morning on getting our GDP report so it's all up to us on what is usually a very light volume day to hold some decent levels. We'll do a Big Chart review this evening but for now we can sit back and enjoy the ride this morning – we'll have to play it by ears as to how much coverage we think we need but we certainly want some going into the weekend as the weather can shift at any moment!

We have enough bullish plays on the table that we certainly don't need to be adding more but we will be watching for opportunities to short oil into the weekend as a hit is already being priced in and a miss will send prices plunging next week as the big money comes back into play.