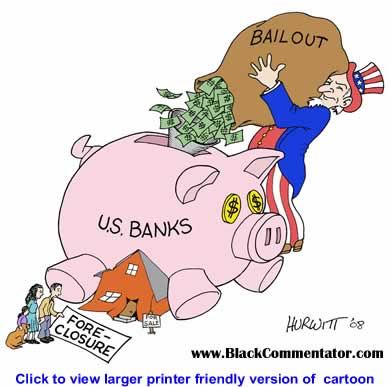

Here’s an article on the $700 Billion bailout and the misallocation of the first half. Alan Binder argues that Congress should reject Paulson’s request for the remaining TARP money.

"Missing the Target With $700 Billion"

Courtesy of Mark Thoma, at Economist’s View, citing the NY Times article Missing the Target With $700 Billion, by Alan Binder.

Alan Blinder isn’t happy with Treasury Secretary Paulson’s use of TARP money:

Missing the Target With $700 Billion, by Alan S. Blinder, Economic View, NY Times: …It pains me to say this, because I was among the first to call upon Congress to create two institutions to deal with the financial crisis: one to buy and refinance home mortgages, the other to buy what came to be called “troubled assets.” The legislation signed in October empowered the TARP to do both. Sadly and amazingly, it has done neither. … Instead, taxpayer money has been used [by Treasury Secretary Henry M. Paulson Jr.] mainly to recapitalize ailing banks. …

Because about half of the $700 billion remains uncommitted, let’s review the arguments supporting the three main uses of the TARP:

Mortgages: The financial crisis began with falling home prices and fears of rampant mortgage defaults — fears that are now coming true. Those fears depressed the values of securities based on mortgages, making them “troubled.” … It is hard to see a way out of this mess without seriously reducing foreclosures. Understanding that, Congress directed the Treasury secretary to use the TARP to get mortgages refinanced. But he has not.

Mortgage-Related Securities: There were several rationales for buying troubled mortgage-backed securities. First, panic had virtually shut down the markets for these securities… Second, one source of that panic was that nobody knew what the securities were worth. A functioning market would establish objective valuations. Third, many mortgages are buried in complex securities. Buying the securities would let government refinance the underlying mortgages.

Mr. Paulson says he changed his mind about buying troubled assets because the facts changed. I’m sure that many facts changed. But what new facts invalidate the rationales above? …

Recapitalizing Banks: Granting the secretary catch-all authority to buy “any other financial instrument” was a sensible addendum to the law. It offered much-needed flexibility to respond to unforeseen circumstances — an auto bailout, for example. But whoever imagined that the addendum would consume nearly all the TARP money, leaving nothing for its two stated purposes?

But suppose you believe (though I don’t) that recapitalizing banks was the best use of all the money. Even then, the secretary’s execution leaves much to be desired. Never mind the lack of transparency and the management issues recently cited by the Government Accountability Office. Think about this:

Treasury has bought preferred stock with no control rights. The 5 percent dividend rate that taxpayers will generally receive is half what Warren Buffett got from Goldman Sachs. Banks receiving capital injections through the front door are generally allowed to pay dividends out the back door. And there are no public-purpose quid pro quos, such as a minimal lending requirement. So banks can just sit on the capital… Clearly, Mr. Paulson bent over backward to make the terms attractive to banks. …

So here we are, looking at an all-too-familiar story. The administration that brought you the Iraq war and the Katrina response is locking in another disaster before it leaves town. What to do?

Fortunately, the TARP legislation … Congress a mechanism for blocking release of the second $350 billion. With the first tranche now committed, Mr. Paulson said he would soon request release of the second. Based on his performance to date, Congress should reject that request unless he agrees to spend most of the next installment on TARP’s two stated purposes.

Failing that, we can wait a month for the new Treasury secretary, Timothy Geithner.

Read full article here.