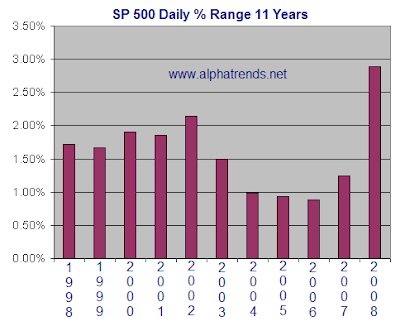

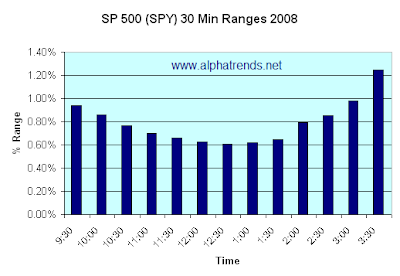

Brian Shannon, at AlphaTrends, provides a graphic view of the S&P 500’s volatility in 2008. In the first chart, you can see average volatility surging at the end of the day. As a whole, volatility more than doubled from that during the previous 4 years and was substantially higher than in the previous 10 year period.

S&P 500 Volatility 2008

The average daily range of the SPY in 2008 was 2.89%, well ahead of the 11 year average of 1.77%