Alan Abelson at Barron’s reviews the week and discusses a recent paper on the troubles that lie ahead. H/T to Barry Ritholtz at the Big Picture.

Woe Is Us

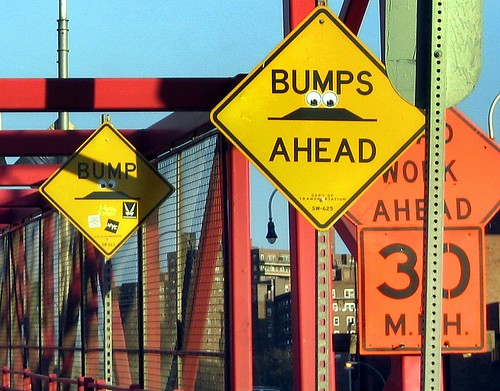

A new study points to more bumps ahead for the economy and the markets. A new president — and old problems.

IT’S NO SURPRISE THAT BARACK OBAMA HAD TO BE SWORN in as president twice. Chief Justice Roberts, who administered the oath, was appointed to the Supreme Court by George Bush — and he wasn’t about to add to the departing president’s sorrows by crowning his successor in his presence. So he indulged in a little syntactical hanky-panky, and Mr. Obama had to do it all over again the next day, but this time in private, so Mr. Bush’s ears wouldn’t turn even redder. Dick Cheney, always a man of staunch principle, decided he’d be damned — after all the nasty things the Dems said about him during the campaign — if he stood up when Mr. Obama was sworn in, so he arrived in a wheelchair. Bill Clinton was there, too, embracing everybody in sight but his wife…

The new administration got off to a running start, although it’s not entirely clear where they’re running to; given the state of the economy and the world, we wouldn’t blame them one whit if it’s for the nearest exit.

Most of the cabinet nominees gained quick nods on Capitol Hill. A notable exception was Timothy Geithner, who ran into a delay because he plumb forgot to pay some taxes for several years, an oversight which might strike nitpickers as unseemly for a would-be secretary of the Treasury. But Mr. Geithner won over the few congressional skeptics by standing proud and saying taxes, schmaxes, he was going to make the Chinese cry "Uncle!"

At first blush, you might not think that was a particularly persuasive pledge since we owe Beijing something like a trillion smackers. But maybe Mr. Geithner plans to threaten China that if it doesn’t make nice, he won’t borrow any more money from it.

THE SPOTLIGHT SHIFTED FROM Washington toward the end of the week when John Thain was unceremoniously given the gate. As all the world knows, Thain had been top dog at Merrill Lynch, newly acquired by Bank of America, via a shotgun marriage, largely through his efforts (and a friendly nudge by the feds).

Instead of being eternally grateful to Mr. Thain, B of A’s CEO Ken Lewis gave him the heave-ho. And all because Mr. Thain neglected to inform Mr. Lewis in the course of their brief time getting acquainted before tying the knot, that Merrill was chock full of dubious loans. And — wouldn’t you know? — a bunch of those billions’ worth of loans had to be written down just about as soon as Lewis and Thain engaged in the obligatory handshake sealing the deal…

ACADEMIC PAPERS ON THE ECONOMY AND finance are for the most part like uncooked oatmeal — hard to digest. Particularly unappetizing is that they invariably are peppered with arcane equations, signifying nothing except the need of the author or authors to amortize the time and money wasted in their misspent youths wrestling with advanced math. The point of the exercise is to impart some veneer of gravitas to their pedestrian piffle. Nine times out of 10, the effect is to set even the most determined reader adrift with glazed eyes and nodding head…

The paper bears the title, "The Aftermath of Financial Crises," and it’s by Kenneth Rogoff of Harvard and Carmen Reinhart of the U of Maryland. By this time, anyone with a pulse and half a brain realizes that the wretched mess we and the rest of humanity are mired in ranks high up there among the worst financial crises since man dropped down from the trees.  So, we’re all very much indebted to Rogoff and Reinhart for providing us with a glimpse of what’s likely in store for us in the months and years immediately ahead, even if, alas, it isn’t very pretty….

So, we’re all very much indebted to Rogoff and Reinhart for providing us with a glimpse of what’s likely in store for us in the months and years immediately ahead, even if, alas, it isn’t very pretty….

So what do their painstaking calculations bode for us? Nothing very good, we fear, and we’re not just being our usual saturnine self…

No matter how you look at them then, Rogoff and Reinhart’s findings strongly suggest that in both duration and depth, the aftermath of our current financial woes has yet to run its course. At the very least, you’d do well to brace yourself for more pain…

Full article here.