Additional insight to the USO situation — pyramids can spontaneously construct themselves. – Ilene

A self-propelled pyramid?

Posted by Izabella Kaminska at FT.Alphaville

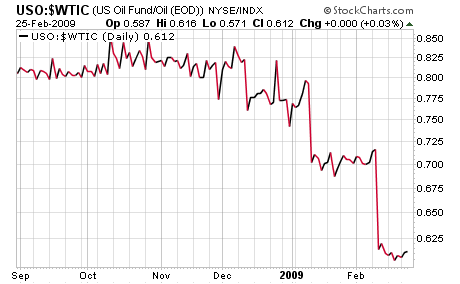

Stephen Schork of the Schork report jumps on the United States Oil Fund issue on Wednesday. He too is blaming the size of the ETF for current distortions in front-month Nymex WTI contracts. [Chart on left shows how poorly USO has been tracking $WTIC – courtesy of Adam Warner.]

He refers specifically to the March/April roll when spreads moved from $3.26 to $8.18 and expired at $1.09. Quite a volatile move. He explains (our emphasis):

"As we outlined at the time, this volatility was largely attributable to “the roll” by long-only commodity index funds, particularly the United States Oil Fund ETF (USO). Open interest in the March contract was 363,757 on February 05th. Per the fund’s website, the USO rolled 85,057 contracts the next day. In other words, the USO held sway over the market, i.e. these funds (USO, S&P GSCI et al) are artificially skewing the front of the NYMEX curve; putting downward pressure as they sell a massive percentage of open interest in the spot over the course of a few sessions.

The USO has since announced it will roll over the course of four sessions instead of one; the April/May roll will take place in between March 06th and 09th. The fund is holding length of 61,940 NYMEX futures, 4,000 NYMEX WTI financials and 30,583 ICE futures, 96,523 contracts in total with a market capitalization (as of last night’s close) of $3.86 billion.

All this length will have to get rolled in a couple of week’s time. What’s to prevent front running the roll? Nothing, that’s what. Over the last three sessions the April/May contango has moved from $2.14 (-5.1%) to $2.80 (- 6.6%)."

All this length will have to get rolled in a couple of week’s time. What’s to prevent front running the roll? Nothing, that’s what. Over the last three sessions the April/May contango has moved from $2.14 (-5.1%) to $2.80 (- 6.6%)."

Which leads him to make one very brave assertion, a comparison to a pyramid scheme. To clarify – Schork is not saying the USO is an outright pyramid scheme itself. He is asserting the nature of the market, the established participants and the fund’s structure is such that it inadvertently encourages a passive self-propelled pyramidization to take shape. One fuelling the other so to speak. As he explains:

"So how is this like a pyramid scheme? A pyramid scheme is funded by a constant flow of dollars into the venture by new investors. The second investor knowingly and willingly pays the first investor on the assumption he will get paid by the third investor… and so on. It’s similar to a Ponzi/Madoff scheme, with the key difference, investors don’t know (or don’t want to know as long as those alleged returns keep rolling in) they are being scammed.

The USO is being funded by a proliferation of new retail investors looking to diversify into “alternative investments” (which as far as we have been able to ascertain, alternative investment is a euphemism for Las Vegas style bets on commodities by retail investors tired of watching their 401Ks drop). More importantly, these investors are obviously out of their league, i.e. taking buy-and-hold positions in a contango which raises their cost basis every month they roll into the higher priced deferred contract.

We assume they are buying the USO because they are bullish. But in a peculiar way, their actions could be helping to prevent the market from rallying. These new investors are not funding a pyramid per se, but they are helping to fund storage. That is to say, with global demand in the doldrums, the contango will persist. And, as long as it lasts, traders will continue to front-run the rolls, which in turn will exacerbate the contango, which will then incentivize storage builds further, which will then ultimately weigh on oil prices."

The important thing to remember is that all of the above conditions create a very unfavourable investment climate for retail investors holding USO. Oil market participants win precisely because they can play the contango trade effectively and predictably. Retail investors just lose and will continue to do so until either the contango disappears or the oil price shoots up beyond the rate of their losses.  Yet many analysts agree the oil price is unlikley to ascend much higher while the contango is in place, and as Schork highlights, the contango is unlikely to disappear while the market can continue to benefit from its structure.

Yet many analysts agree the oil price is unlikley to ascend much higher while the contango is in place, and as Schork highlights, the contango is unlikely to disappear while the market can continue to benefit from its structure.

The question is what happens when, and if , the whole thing does eventually go pop?

This is something the CFTC may be worried about too, note their latest proposed rule changes on commodity pool operators, which are calling for more detailed reporting of among others the sums invested “different type of markets” by commodity pools in connection to their trading strategy…

The question to be asking therefore is not what will happen when the whole thing goes pop, rather what will prompt it to go pop. The answer potentially is any slowdown in investment flows, which are currently propping up the fund’s NAV and allowing it to service its expenses (including the cost of its rollover). The larger it gets though, the more inefficient it gets in the current market.

Read entire FT.Alphaville article here.