This is getting tedious!

This is getting tedious!

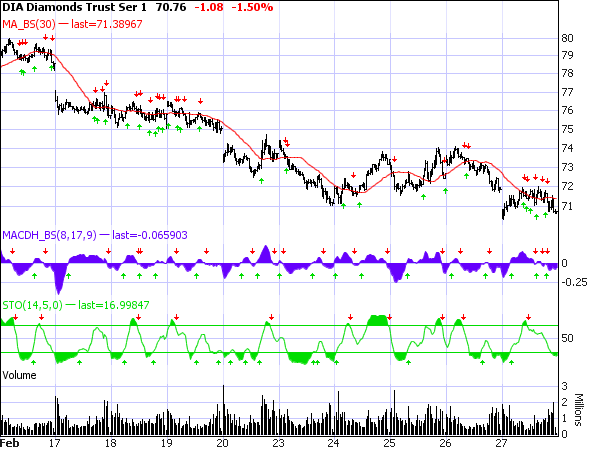

We were bearish going into the week but not this bearish. It is unusual though that we have a weekly wrap-up with nothing but negative plays as we did last week but there was nothing very positive in the outlook after the action of the week of the 16th through the 20th, pictured here on this chart.

As I said in the last Weekly Wrap-Up: "Of course nothing beats sector specific covers against your own mix of positions but we like using the DIA puts as general virtual portfolio coverage although, as I mentioned last week, both the DAX and the Qs may now have farther to fall." The Qs ended up dropping 8.5% for the week while the DAX tumbled 6%, underperforming other global indexes as we had expected it would. Our hedge play , the DIA June $77 puts, which we went with at $8.22 on Friday and half covered with March $75 puts at $3.85 ended up at $9.85 and $5.40, not much improvement but accomplishing it's goal of converting a net $6.29 entry into puts that are now 100% in the money to our net entry. At this point, every point down on the Dow is a penny we realize in intrinsic value. Per our original plan, the $75 puts can still be rolled to 2x the Apr $66 puts, now $2.32, allowing for our long puts to be $11 in the money against the puts we sold. The reality is more complex than that as we day-traded the covers around and rolled up the longer puts but we went into this weekend with the same bearish half-cover, not wanting to take chances after Friday's poor performance.

On Monday morning, I was not at all enthusiastic about our prospects for the week as we had the Bernanke testimony Tuesday and Wednesday and Trichet started us off with a thud by stating: ""In recent weeks we have seen the first signs of falling credit flows. An important part of this fall is demand-driven. However…there are indications that falling credit flows reflect also supply-side factors and tight financing conditions associated with a phenomenon of deleveraging. If such a behavior became widespread across the banking system, it would undermine the raison d’etre of the system as a whole." Perhaps he was channeling Nouriel Roubini, who on Saturday had told the Wall Street Journal: "J.P. Morgan took over Bear Stearns and WaMu. BofA took over Countrywide and then Merrill. Wells Fargo took over Wachovia. It doesn't work! You can't take two zombie banks, put them together, and make a strong bank. It's like having two drunks trying to keep each other standing."

Now THAT made the front page of the WSJ and Time Magazine, but when Mr. Roubini's assertions on WFC were challenged by Bankstocks.com's Tom Brown (who has actual facts and figures, rather than exaggerated pronouncements), Roubini retreats by saying: "I never made any prediction about credit losses in individual US banks. I only used macro variable to forecast average losses on tranches of different types of loans and securities for the AGGREGATE of US banks. So you may or may not be right about what is happening at Well Fargo; but the comments you make have NOTHING to do with what I have written. So you should correct the record on this. I never wrote that Well Fargo has an additional $117 billion of losses. I have provided an estimate of aggregate credit losses for all US financial institutions based on standard estimated of average losses from macro assumptions." THAT statement, unfortunately, is buried in the comment section at Seeking Alpha and WFC got hammered on Monday's open and was again attacked on Friday by the hyenas, who smell blood once again.

We sold $12 puts on WFC for $1.75 and we'll stop at $2.50 (the price we sold other puts for on Monday in a spread) as we don't want to be holding another bank that is going to zero, whether for good or bad reasons. Hopefully one day the madness will end but I'm way ahead of myself as that was a Friday move and we only just started talking about Monday. Focus, focus… I pre-summarized the week on Monday morning, saying: "It’s going to be a busy and scary data week… I guess you can call this a "wall of worry" and we’ll see how high we can climb this one before slipping back." As it turned out, our pre-market pop on Monday was all there was before the big slip! My morning play at the bottom of the post anticipated this: "We were a little bearish going into Friday’s close with 1/2 covers on our long DIA puts and I will remind all that the strategy is to roll up the long end first, then add more cover with tight stops on the new half, we’re certainly not going to be impressed by anything under 1.25% today (a 20% bounce off last week’s drop) and it will take a full 2.5% move higher by Wednesday for us to break the overall downtrend. We have a lot of rough data to get through and still plenty of earnings so let’s continue to be careful out there!" As you can see from the chart above, we had just about a 1% jump at the open before failing miserably for the day.

I rarely pick an unhedged stock play but I was very pleased with F this week. We were in at $1.60 and out at $2.10, not bad for a few days and back in at $1.90 as we only got out because we were worried about GM scaring everyone out of Ford. The original idea of the play was to just stick it under our mattress for 10 years and see what happens but 37% in a week on a stock is a lot to leave on the table, especially in this market! I thought we were getting a bargain on UNH Monday morning but the Jan $20s already fell 40% to $4.60 and the Apr $26s sold as cover at $1.50 covered very little of the damages but they do pay for a roll down to the July $15s at $5.85 and that's still a good looking price as we assume the panic in health care may have run its course. We also bottom fished on X but there was no bottom and hedged a DDM entry that's working (so far) and, of course GOOG $350s at $10.40 were too much to resist in the afternoon, those jumped 60% the next day but for the rest of the week we resisted temptation.

We were pretty well balanced overall. Right next to the UNH play Monday morning was an FXP (ultra-short China) play for the April $35s at $8 (hedged), those jumped to $10.10 already. That's all we're looking to do with our hedged positions, make enough money to improve our longs at each leg down. If we keep adjusting back to 50/50, it leaves us with a large amount of cheap positions, which will be nice if the market ever does turn up (one can always hope). We kept trying to get positive on the financials Monday (I picked FAS at $4.76) but it was too hard to hold onto although we did finish the day 55% bullish.

We were pretty well balanced overall. Right next to the UNH play Monday morning was an FXP (ultra-short China) play for the April $35s at $8 (hedged), those jumped to $10.10 already. That's all we're looking to do with our hedged positions, make enough money to improve our longs at each leg down. If we keep adjusting back to 50/50, it leaves us with a large amount of cheap positions, which will be nice if the market ever does turn up (one can always hope). We kept trying to get positive on the financials Monday (I picked FAS at $4.76) but it was too hard to hold onto although we did finish the day 55% bullish.

Monday evening we ran a Big Chart Review and I said: "Once again we are in a market that environment that reminds me of the Simpsons episode where Homer jumps over a gorge, crashes, is taken up by a helicopter (Ben) smashing against the wall along the way only to fall all the way from the top again. Pain, pain and more pain every time we try to get long." I reiterated the need for downside protection and noted our QID March $65s and short EWG plays (from the previous week) were still working: "These are the ways you need to protect your virtual portfolio – we need to identify the stocks or sectors that will underperform the market and use them as a bearish balance to our bottom fishing plays, where the bottom seems to get lower and lower every single day." There is no need to watch your virtual portfolio value shrink every day when there are so many good ways to play the downside as well.

I added XLU to the short side on Monday evening although they didn't fail our level test at 25.60 until Friday, MDY was in the same boat as our watch level held until Friday and the June $60 puts got cheaper, now $1.90 and still good "just in case" protection. While the indices were failing, we did hold our commoditiy levels (Copper $146, oil $37.50, DBC $18, BDI 1,800), which means the economy still isn't totally dead but perception is everything. We were expecting a bounce on Tuesday, of course, as I said in Monday night's post: "Keep in mind we are now 55% bullish – these are just in case we need to flip…" My closing comment for that post: "I wish I had something optimistic to say here but I don’t."

I added XLU to the short side on Monday evening although they didn't fail our level test at 25.60 until Friday, MDY was in the same boat as our watch level held until Friday and the June $60 puts got cheaper, now $1.90 and still good "just in case" protection. While the indices were failing, we did hold our commoditiy levels (Copper $146, oil $37.50, DBC $18, BDI 1,800), which means the economy still isn't totally dead but perception is everything. We were expecting a bounce on Tuesday, of course, as I said in Monday night's post: "Keep in mind we are now 55% bullish – these are just in case we need to flip…" My closing comment for that post: "I wish I had something optimistic to say here but I don’t."

Tuesday morning I drew lines in the sand at 7,245 on the Dow, 738 on the S&P and 1,352 on the Nasdaq, all 15% drops from the 9th. We did manage to hold them for the week but the NYSE (4,675) and the Russell (400) finished below their marks at 4,617 and 389, worse than we started Tuesday at. Keeping a strict eye on our breakout levels helped too as NOT breaking them in Tuesday's "rally" kept us bearish overall.

Despite our expectations of a bounce my overall outlook was no better on Tuesday as I closed with: "Our wall of worry continues to be a steep one. After yesterday’s failure we do not expect too much out of today, we’ll be happy to just see a bottom at this point but it’s looking a little more likely that we’re heading into a capitulation event that can take us down to frightening levels. The 60% line is a line the markets dare not cross but, as I pointed out yesterday, we already lost the SOX and the Nikkei, with the Hang Seng and the BSE hanging on by a thread. Let’s take these levels very seriously, if the administration can’t turn it around this week – the downward momentum can easily pick up steam."

Being pessimistic doesn't spoil all our fun and we grabbed JPM as our first play of the day, sold X Jan $10 puts for $2.05 as a bet they don't go bankrupt (still $2), picked up IP at $5.62, which jumped up and but is back there again all within a half hour of the open. After a break, at 11, we sold the VNO $30 puts for $1.90 (now $2), bought AIG for .40 (just a gamble) and a well-hedged position on HMY. M was a hedged entry in the afternoon, an IYR spread is certainly not working so far but if we get another shot at the SKF bear put spread, we should take it as that turns out to be a huge payoff if we time it right. BAC was a good gamble at $4.40 at they topped out at $5.80, which is pretty good movement for a stock. Now they are back at $3.95 but we didn't want them the second time around.

By 1:34, as the Dow was rising, I was done being bullish and we upped our covers by rolling up existing ones setting stop outs on our short covers. Making these adjustments DURING the rallies helps keep you balanced. We were back and forth about covers into the close and ended up with a 1/2 cover (55% bearish) into the close as we weren't sure what, if anything, Obama would accomplish in his speech to Congress but his track record to date did not give us much confidence.

By 1:34, as the Dow was rising, I was done being bullish and we upped our covers by rolling up existing ones setting stop outs on our short covers. Making these adjustments DURING the rallies helps keep you balanced. We were back and forth about covers into the close and ended up with a 1/2 cover (55% bearish) into the close as we weren't sure what, if anything, Obama would accomplish in his speech to Congress but his track record to date did not give us much confidence.

Wednesday morning I was happy with Obama's speech but I said in the morning post: "As we expected, there is no "quick fix" in Obama’s speech and we’ll see how well the markets hold yesterday’s gains… We also want to see the SOX over 200, still pathetic but something and let’s not even consider being bullish with the Transports below 1,600 (7% to go)." We expected Bernanke's second day to go worst than the first, a combination of him being tired and the poor quality of questioners he was going to face in the house. Not surprisingly to us, Ron Paul's opening statement set the tone for the hearings and CNBC anchors were caught so off guard by what apparently was a change is script (they actually said "this is not going as planned", that they cut away from the hearings! Congressman Paul continued his attack with his next 5 minutes, sounding the warning on hyperinflation that can come from increasing the money supply (our gold premise).

My first comment of the day to members on Wednesday was: "There is nothing at all encouraging on the Dow in 15, 30 or 60 min charts – be very careful. I’m going full naked on DIA puts until we cross back on NYSE and RUT." That tilted us back to 60% bearish for the ride down as we dropped 200 points from the open. By 10:14, having had a chance to look over the internals, I decided to re-run Tuesday's very successful game plan saying: "ON THE OTHER HAND – We were clearly oversold at 7,100 yesterday so I’ll be looking to do the same kind of bottom fishing today, using all the lovely cash that is building up on the DIA put play. We missed FAS yesterday so maybe a second chance today. This was our spike low time yesterday as we got Case-Shiller. We shook that off and we will very possibly shake this off so I’m going to take a chance here and cover the DIA puts with 1/2 the $74 puts at $4 and I will cover with more at $3 if we head up or roll those to 2x the $70s if we break 7,000 but I think we hold this bottom."

Using our DIA long puts and covers (along with mattress layers if necessary) allows us to quickly adjust our stance between 60:40 bullish and 60:40 bearish. Of course, timing is everything but the key is to work out your point of equilibrium in your virtual portfolio so you know exactly what single adjustment you can make to change direction. AS LONG AS YOU CAN GET TO NET NEUTRAL WHEN YOU ARE NOT SURE, YOU HAVE WON HALF THE BATTLE! Not losing money on the bulk of virtual portfolio allows us to pick up quick day trades like the FAS Apr $4s at $1.88 at 10:21, which shot up to $3 by the day's end and is back there now so hopefully we'll have reason to take another swing next week! The oil report at 10:30 was bullish for crude and I called that one before the timer even ticked to 10:31 on the chat, putting us 60% bullish again.

WFR was a great hedged entry, MSFT was a spread, we missed HOV (target entry was .80) , CY took off like a rocket from out $5 entry (hedged to $3.40) and IWM $37s were a quick momentum play but at 2:05, the DIA put covers stopped out, flipping us once again bearish at 7,275 as we were getting too many mixed signals to keep riding the bull uncovered. Even after that, HCBK still seemed like a good idea (hedged to $9.50) but we gave up on FAS at 3:37, pretty much the high of the day. After the close, I set up a QID (ultra-short Nas) spread for the next day as I still thought the Nasdaq looked weak. QID jumped from $57 Thursday morning to $62.65 at Friday's close (our upside cover was the Apr $67s, now $9.20). It didn't take a genius to figure out that Thursday was going to be a rough one as I had been warning all week that a $1.75Tn deficit, officially to be announce on Thursday, would not sit well with investors.

We had a bullish open on Thursday but I warned that anything less than: "Dow 7,400, S&P 780, Nasdaq 1,450, NYSE 4,850, Russell 415" would not be good and the Dow topped out at 7,400 on the dot, S&P just under 780, Nasdaq couldn't make 1,445 and the NYSE very briefly spiked over 4,850 but fell right back, dashing all of our hopes and dreams for a rally by 11 but I had already made my mind up at 9:40, when I said to members: "Gold is off $24 this morning while oil is up 3.5% so interesting dynamics. V is down a bit, LVS shot up but, overall, it looks weak to me so I’m taking out DIA putters and going naked on the long puts into the 11 am budget." We layered on the bear plays with XLF March $10 puts at $1.90, which hit our $2.50 target the next day.

The big mistake of the morning was thinking ISRG was cheap at $99.50. We took a bearish hedge with the Apr $90 puts and calls sold, netting $78.55/84.27 but ISRG fell all the way to $90.96 and that same play now nets $72.76/81.38 – $3 lower on the assignment side and I still like them! On the brighter side, we jumped all over IBM's positive announcement at 10:44 and made a quick play on the Apr $95s at $2.40, which are now $3.95 but I took a very quick .50 (20%) and ran. I would have stuck with it but I was so down on the overall market I didn't want to chance throwing away a good profit. As I said to members just after the Budget announcement at 11:20: "I do expect a big temper tantrum this week. I know I threw one at Bush’s last budget (in fact it was BECAUSE it hid so many costs) and the GDP is going to back up the Doom and Gloom squad tomorrow so still balanced bearish off this level as we haven’t hit one of our goals yet: Dow 7,400, S&P 780, Nasdaq 1,450, NYSE 4,850, Russell 415. Keep that in mind."

The big mistake of the morning was thinking ISRG was cheap at $99.50. We took a bearish hedge with the Apr $90 puts and calls sold, netting $78.55/84.27 but ISRG fell all the way to $90.96 and that same play now nets $72.76/81.38 – $3 lower on the assignment side and I still like them! On the brighter side, we jumped all over IBM's positive announcement at 10:44 and made a quick play on the Apr $95s at $2.40, which are now $3.95 but I took a very quick .50 (20%) and ran. I would have stuck with it but I was so down on the overall market I didn't want to chance throwing away a good profit. As I said to members just after the Budget announcement at 11:20: "I do expect a big temper tantrum this week. I know I threw one at Bush’s last budget (in fact it was BECAUSE it hid so many costs) and the GDP is going to back up the Doom and Gloom squad tomorrow so still balanced bearish off this level as we haven’t hit one of our goals yet: Dow 7,400, S&P 780, Nasdaq 1,450, NYSE 4,850, Russell 415. Keep that in mind."

At 11:43 I reiterated my QID play, catching it just off the bottom at $58 yet we continued bottom fishing with BKC at a very attractive $20.30 (hedged entry). At 1:33 I decided we had confirmed the downtrend and said to members: "Not good on XLF – see they tested $8.40 to upside and failed. That puts them on path to test $8.20, which is light resistance on the way to a real test at $8 and below that we are back to $7.60 so be careful if this starts breaking down" and XLF finished the next day at $7.60 to the penny, but we also tested it first thing Friday morning. I often say to members – No, I don't MAKE the markets do this stuff, I can only tell you what is going to happen… 😎

To offset what was becoming some extreme bearishness, I picked the FAS Apr $7.50s at $1.05 but XLF didn't hold our level and we only took some on Thursday, with more at Friday at .85 (and those aren't working either!). At the end of the day I found 3 naked puts I wanted to sell for sure: RAH, APOL and GMCR along with AMGN once we were sure they were done going down. The first 3 held up nicely on Friday but we're still wondering where the floor is on AMGN. I wasn't upset about the markets on Thursday but I was really upset about Mad Money, where I found out Cramer was peddling my mortgage solution as his own – something I discussed in Friday Morning's post.

To offset what was becoming some extreme bearishness, I picked the FAS Apr $7.50s at $1.05 but XLF didn't hold our level and we only took some on Thursday, with more at Friday at .85 (and those aren't working either!). At the end of the day I found 3 naked puts I wanted to sell for sure: RAH, APOL and GMCR along with AMGN once we were sure they were done going down. The first 3 held up nicely on Friday but we're still wondering where the floor is on AMGN. I wasn't upset about the markets on Thursday but I was really upset about Mad Money, where I found out Cramer was peddling my mortgage solution as his own – something I discussed in Friday Morning's post.

While it was somewhat encouraging that things did not get singificantly worse on Friday, putting it that way in itself tells you how terrible things are. On the bright side, the financials did not lead us down and we did hold out 20% off levels that I posted in the morning of Dow 6,995, S&P 724, Nas 1,260, NYSE 4,600, with the NYSE coming closest to failing during the session. The Russell was already over the cliff at 400 and must lead us out next week or we're not going anywhere. We did pick up some long RUT calls just in case but it's hard to get enthusiastic about anything after a week like this.

In addition to the FAS bottom fishing we went for BAC $4 calls at .98 (now .81) and DDM $20s at $1.85, now $1.83. We repositioned out long put spreads to take some profits off the table but rolled up into a still-cautious stance into the weekend. VLO was an irresistible bargain at $19.35 (hedged), NYX looked cheap at $17 (hedged) but got a little cheaper by the end of the day. We added SKF puts and IYT calls, blew day trades on XOM and DXD but no real damage as I nailed it right at 12:41 saying: "Damn, time to cover for a pullback!" A few minutes later I said to members: "Watch XLF $7.80, if that breaks the market will likely follow until they find a floor. Nas went red, that’s our on/off switch at the moment and the RUT is barely holding it together and must hold 393, which isn’t very impressive anyway. C needs to retake $1.60 (is that so much to ask?) and BAC needs $4.40 – something is wrong in financials." $7.80 held for another hour but then began to break down. It turned out to be a new batch of WFC rumors taking the financials down but, as we've been following this one all week, we were happy to sell the $12 puts for $1.90 with a stop at $2.50 (we like them but we've been burned too often to let a bank stock ride!).

Our final move was a to go naked on our long puts and 60% bearish into the weekend. We hope our lower levels hold but it was such a sickening week and we had plenty of new upside plays that we'd rather take a small hit on our short side for a change than watch another round of longs hurt us. Notice the balance as it played out over the week – we get bearish, the bear side pays off, we look for offsetting bullish plays. The bull side begins to pay off and we look for more bearish plays to balance out the other side. As we are long-term (very long-term) bullish, our goal is just to have a nice base of stocks down at the bottom and let them run when we do finally turn around (if ever). Meanwhile, we ride the waves on the way down and pick up what profits we can.

If I didn't think we were way oversold here, my strategy would be different but I do. As I said in my review of Berkshire Hathaway's Annual Report, I have to go with Warren on this one, there's bargains to there to be had and no one ever made a dime by panicking BUT – a little cautious hedging goes a long, long way!