Adam Warner at Daily Options Report explains the perceived disconnect in the inverse relationship existing between the S&P and the VIX.

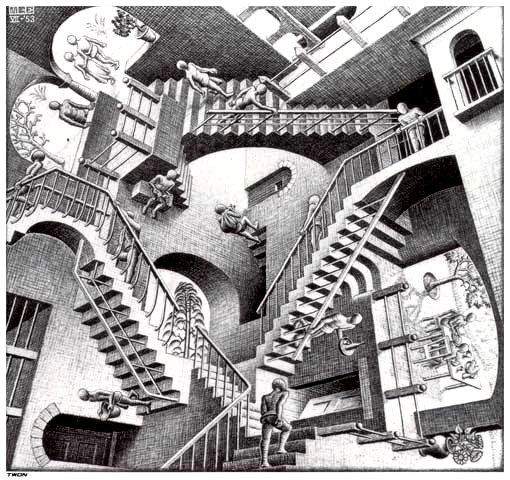

Volatility Point

Courtesy of Adam Warner at Daily Options Report

So let’s say hypothetically we have a down day in the market. I know, I know, sounds far-fetched. But remember back, oh, last week. It happened quite often.

Now let’s go all Vantage Point. One observer, sitting at home, looks at the VIX and sees it lift all day and close high and last. His conclusion? Fear has increased.

The other observer, a guy standing in the SPX options crowd, trades all day. And notes that despite the decline in the market, the volatility on the board has not budged.

Now how can that be? The VIX is an index that measures volatility on the SPX. One of them must hit Happy Hour a bit earlier than announced.

But guess what, they are both correct. And it all ties into the month’s old question we get asked every day, "why the so-so VIX" in the midst of what was until recently an incredibly ugly market. Edward K. Tom, a Credit Suisse derivatives strategist, has a report out this week, covered nicely by Stephen Sears in Barrons, [Should Investors Nix the VIX?] and it reminds me of this, and brings to light other salient points.

The Inverse relationship between VIX and SPX has much to do with the skew of the options board and the formula used in any volatility calculation. What I mean is in normal skew, the lower the strike, the higher the volatility. And the closer to to the money, the more weight that strike has in the volatility calculation. So ergo a decline of the SPX in and of itself will, in the very short term, produce a higher VIX reading, EVEN IF THE VOLATILITY OF EACH AND EVERY SERIES REMAINS UNCHANGED as the crowd trader observed above. It’s simply a function of lower strike/higher volatility options now closer to the money and greater weight in the volatility calculation.

Over time, perhaps as soon as that afternoon, perhaps not, the board will often adjust and the "new" ATM strikes will trade at the same volatility the old one’s did yesterday.

Over time, perhaps as soon as that afternoon, perhaps not, the board will often adjust and the "new" ATM strikes will trade at the same volatility the old one’s did yesterday.

Now the SPX has obviously declined an awful lot this year, but not much move in the VIX. Why? As per Tom’s [report], the VIX will adjust over the course of a month or so via the process laid out above. What that implies is that over the course of time, an SPX of a given value will not couple with a specific VIX. Or, in his words "…the Standard & Poor’s 500 can be at 700, and VIX could be at 50, 100, or 20, without any sense of incongruity whatsoever.""

That’s kind of what we’ve seen. A walk down and gradual readjustment of the options board to the new absolute price levels.

And you know how we have noted endlessly that the VIX has simply reflected realized (historical) volatility that is just not as high now as it was in the Fall? Well guess what, his report agrees. 94% of the decline in the VIX (from the Fall highs) can be explained by the drop in realized volatility.