Basically, there’s a time for investing, and a time for trading. Now is a time to trade.

So What’s This Market About?

Courtesy of Karl Denninger at The Market Ticker

Several things, really.

About a week ago there were signs of an imminent breakdown in the capital markets. Very bad – like critically, "we’re done" style bad.

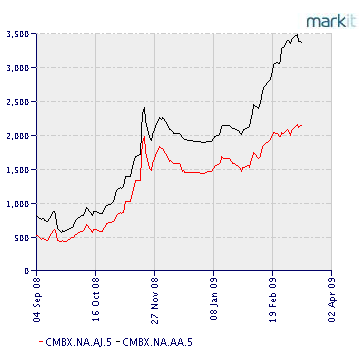

There are many charts depicting "how bad"; I’ll pick on just one:

These are spreads on commercial real estate loans. As you can see, they had gone basically vertical (higher = worse) over the previous month or so, looking very much like they were headed for the moon.

The last few days they have curled back downward and "in" just a bit, which is improvement – not a lot of improvement, but improvement.

The same sort of credit deterioration was evident in a lot of other places. It had even started to show up in LIBOR again, although not to the degree in September and October.

In the end the markets are all about one and only one thing: confidence. If you’re not reasonably confident that the person you’re dealing with isn’t going to rob you blind, you simply don’t do business with them.

At all.

China is starting to rattle their saber on confidence:

“We have lent a huge amount of money to the United States,” Wen said at a press briefing in Beijing today after the annual meeting of the legislature. “I request the U.S. to maintain its good credit, to honor its promises and to guarantee the safety of China’s assets.”

Uh, what part of being a banker and making loans do you think you’re exempt from? Banking is a tremendously profitable enterprise, provided you’re prudent; if your banking policy is simply "we’ll loan you money to buy our crap" without regard for whether the borrower is overlevered or asset prices are getting totally out of rational relationships to income, then you’re headed for bankruptcy as a bank, because inevitably your borrower will default.

China loved the United States when our citizens were spending more than they made, treating their homes as ATM machines to finance their consumption, lapping up cheap DVD players and widescreen TVs. They were direct enablers of this nonsense by buying securitized paper of all sorts including mortgages, without analyzing the credit-worthiness of those consumers behind that paper. They didn’t do this to help us, they did it to help themselves sell their goods into our market without regard for whether we could afford the level of consumption we were engaged in.

China wants to both have and eat it’s cake – sorry, no can do Wen-do-wu. If they wish to act as a mercantilist without regard to their customer’s ability to pay, pumping cash into our debt without examining what they’re buying and the sustainability of the practices they’re fueling, they deserve to lose money and the correct answer from Obama and company is best expressed with one finger raised erect.

In fact we must stop attempting to spend more than we can afford, both as a government and as individuals. China should be looking square at the sustainability of not only our consumer debt but our government debt as well, and were I Mr. Wen I’d be erecting my middle finger in the direction of Washington DC in terms of purchasing any debt instrument that does not have a demonstrated ability to pay not only the interest but also principal from ongoing cashflow! Since the Federal Budget hasn’t been in that state for a few decades I would not be doing any buying, and in fact would be using the current "panic-driven strength" as an opportunity to sell.

In fact we must stop attempting to spend more than we can afford, both as a government and as individuals. China should be looking square at the sustainability of not only our consumer debt but our government debt as well, and were I Mr. Wen I’d be erecting my middle finger in the direction of Washington DC in terms of purchasing any debt instrument that does not have a demonstrated ability to pay not only the interest but also principal from ongoing cashflow! Since the Federal Budget hasn’t been in that state for a few decades I would not be doing any buying, and in fact would be using the current "panic-driven strength" as an opportunity to sell.

Ultimately wealth comes from the Sun, with only three means of realizing it – you can mine something, grow something or manufacture something, and pushing paper around doesn’t count. An imbalance in global trade based on wage arbitrage where the producer makes 10 cents a day and the consumer "structures debt" to hide their lack of credit-worthiness is unsustainable and now everyone on both sides of that deal are discovering reality, applied with a baseball bat to the head.

During this Bear Market we have had several very sharp rallies like the last three days. I’ve provided a chart showing the ones that may be the most instructive in highlight:

Note that in one case the rally led to an imminent rollover and collapse down another 100 SPX points from where the rally initiated (!), and in the other we had a very nice little reprieve that lasted about a month, albeit choppy, before we resumed a decline that started out rather gentle but led to where we are now.

So which is it to be this time?

It isn’t possible to know.

What I can tell you is that this rally has been led by the financials. That’s both good and bad – its good in that they’re the group that led us down, and its bad in that the underlying cause of the rot in the financials has not been fixed. Suspending mark-to-market will not "fix" them, but it sure will lead to lots of executives calling a bottom in their company’s fortunes, which will lead to a furious rally – for a while.

Balance sheet games, however, are just another unsustainable fraud. Eventually cash flow (or lack thereof) wins – always. So the real question becomes whether these firms, banks and other finance companies, can "earn their way out" by effectively getting people to take on more debt at higher interest rates but which they can actually pay, and therefore cover the losses with those earnings.

That’s a good question for the peanut gallery, and my suspicion is that the answer is "not a snowball’s chance in Hell."

If you remember back on March 3rd I warned about a sharp snapback rally that appeared imminent. Four days later……

How do you square that call, and what’s going on now, with my "worst case scenario" Ticker?

Simple: 1933.

The stock market doubled during A Depression!

Did that mean The Depression was over? Nope. In fact, some of the worst misery lay dead ahead. If you study The Depression you will find that there was actually a Depression within a Depression – that is, there was not one but two major steps downward in GDP.

Do not confuse economics with the stock market. They’re not the same thing. Further, do not confuse trading with investing – they are also not the same thing.

I will note again that the sidebar makes clear I’m not an investment adviser – just a guy who’s seen a lot, both in the markets and in business, who knows how to perform fairly basic mathematics, and writes on this stuff. I will also note that I have for more than a year now said that from my point of view there is no investing position that makes sense in a bear market except in Cash.

This doesn’t mean you can’t make money (or lose less) if you’re trading in a Bear Market – you most certainly can. But when I see posts on the forum or emails that talk about people investing in their 401ks and IRAs in a bear market, or whether people should "hide" now, more than a year into the maw of this mess, I cringe – investing and trading are simply not the same thing, and if you confuse one with the other you’re asking for trouble – perhaps a lot of trouble.

If I was caught in stocks in my 401k or IRA (I’m not) here and now, a year and change in, having listened to CNBC (or worse, my "investment adviser") for too long then I’d not be sleeping much these nights. I get these emails all the time – from people who a year ago demanded to be taken off my email list when I was sending out warnings to people I cared about telling them that I had a long-term "sell signal" and that if they weren’t in cash in those accounts they might want to think about it, as I saw the signs of a catastrophe dead ahead.

They told me I was a Cassandra and to take them off my email lists. Ok. I did. Some of them stopped speaking to me entirely. Now they’ve lost half of their retirement and are panicked.

Unfortunately there is no good answer here. Were I trapped I’d be looking for a good, solid and monstrous bear-market rally to reach for the cash – and this might be that opportunity. The problem of course is trying to catch the "corner" – that is, get as much back as possible without staying too long and catching another big plunge instead.

Consider that if you lose half in your retirement account you need a double to get back to even – that’s the math, and it sucks. Simply put the easy decisions were available more than a year ago – here, those same decisions are all both hard and dangerous.

The bottom line here is that stabilization of stock prices depends on stabilization of the credit markets. Stabilization of asset prices, such as houses, depends on those prices contracting to sustainable levels aligned with incomes that can be earned to support them.

We’re not there with houses yet; I think we’re about halfway there in that regard, maybe a bit more than half. Credit markets will stabilize when the game-playing and lying stop, and people trade these instruments not based on belief in some government machination (whether a bailout or destruction of value) but rather on their belief in the fundamentals in these instruments. For some of these instruments their true value is in fact zero – a HELOC behind a severely underwater first mortgage or some fully-synthetic debt instrument, for example. For others there is a value based on recovery and probability of default; even the worst subprime mortgage in California is likely not worth zero, although it might be worth a lot less than you’d think.

When – and only when – a consistent message comes from Washington DC and the market is allowed to figure these values out we will find stabilization in the credit markets, and from there stabilization of the stock market.

Our economy will ultimately stabilize at a lower level of consumption and a higher degree of saving. We’re going from a world where we had a negative savings rate, financing our consumption with debt, to one where we save perhaps as much as 10% of our incomes (it’s already up to 5% or so), which strongly implies a contraction in GDP of 10% or more. A 10% contraction of GDP from peak to trough is the definition of a Depression; as such those who believe we won’t experience one (I’d argue we’re already in the beginning phases of it!) are those who have their heads in the sand.

The sooner we recognize that corporations, people and the government must contract spending to sustainable levels the sooner we will get out of this mess.

We are in this mess due to spending at an unsustainable level and financing it through ever-increasing levels of debt, and the first rule of holes is "when in one, stop digging!"