Mish predicts a poor outcome to this grand experiment; recommends buying gold.

Bernanke’s Grand Experiment Continues

Courtesy of Mish

We are in the middle of a grand experiment. Bernanke upped the ante today in his foolish quest to beat deflation. Please consider the FOMC Press Release.

Information received since the Federal Open Market Committee met in January indicates that the economy continues to contract. Job losses, declining equity and housing wealth, and tight credit conditions have weighed on consumer sentiment and spending. Weaker sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories and fixed investment. U.S. exports have slumped as a number of major trading partners have also fallen into recession. Although the near-term economic outlook is weak, the Committee anticipates that policy actions to stabilize financial markets and institutions, together with fiscal and monetary stimulus, will contribute to a gradual resumption of sustainable economic growth.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months. The Federal Reserve has launched the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses and anticipates that the range of eligible collateral for this facility is likely to be expanded to include other financial assets. The Committee will continue to carefully monitor the size and composition of the Federal Reserve’s balance sheet in light of evolving financial and economic developments.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

Bernanke Carries Out Threat

Ben Bernanke has now carried out the threat infamously made in Deflation: Making Sure "It" Doesn’t Happen Here.

Deflation great enough to bring the nominal interest rate close to zero poses special problems for the economy and for policy. First, when the nominal interest rate has been reduced to zero, the real interest rate paid by borrowers equals the expected rate of deflation, however large that may be.

Because central banks conventionally conduct monetary policy by manipulating the short-term nominal interest rate, some observers have concluded that when that key rate stands at or near zero, the central bank has "run out of ammunition"–that is, it no longer has the power to expand aggregate demand and hence economic activity. It is true that once the policy rate has been driven down to zero, a central bank can no longer use its traditional means of stimulating aggregate demand and thus will be operating in less familiar territory.

Curing Deflation

Let me start with some general observations about monetary policy at the zero bound, sweeping under the rug for the moment some technical and operational issues.As I have mentioned, some observers have concluded that when the central bank’s policy rate falls to zero–its practical minimum–monetary policy loses its ability to further stimulate aggregate demand and the economy. At a broad conceptual level, and in my view in practice as well, this conclusion is clearly mistaken. Indeed, under a fiat (that is, paper) money system, a government (in practice, the central bank in cooperation with other agencies) should always be able to generate increased nominal spending and inflation, even when the short-term nominal interest rate is at zero.

Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

So what then might the Fed do if its target interest rate, the overnight federal funds rate, fell to zero? One relatively straightforward extension of current procedures would be to try to stimulate spending by lowering rates further out along the Treasury term structure–that is, rates on government bonds of longer maturities.

One approach, similar to an action taken in the past couple of years by the Bank of Japan, would be for the Fed to commit to holding the overnight rate at zero for some specified period. Because long-term interest rates represent averages of current and expected future short-term rates, plus a term premium, a commitment to keep short-term rates at zero for some time–if it were credible–would induce a decline in longer-term rates. A more direct method, which I personally prefer, would be for the Fed to begin announcing explicit ceilings for yields on longer-maturity Treasury debt (say, bonds maturing within the next two years). The Fed could enforce these interest-rate ceilings by committing to make unlimited purchases of securities up to two years from maturity at prices consistent with the targeted yields. If this program were successful, not only would yields on medium-term Treasury securities fall, but (because of links operating through expectations of future interest rates) yields on longer-term public and private debt (such as mortgages) would likely fall as well.

A second policy option, complementary to operating in the markets for Treasury and agency debt, would be for the Fed to offer fixed-term loans to banks at low or zero interest, with a wide range of private assets (including, among others, corporate bonds, commercial paper, bank loans, and mortgages) deemed eligible as collateral.

Bernanke Has Failed

Bernanke Has Failed

Please note that Bernanke has already failed. "It" (deflation) has arrived. And deflation has arrived in spite of the fact that Bernanke has slashed rates to 0%, instituted numerous lending facilities that have all failed, squandered $trillions in taxpayer money, and has already implemented phase II (or do I mean phases 2 through 20) of his plan, that being the "offer fixed-term loans to banks at low or zero interest, with a wide range of private assets as collateral."

Debt Deflation Confirmation

Today Eric Janszen offered his take on deflation in Flow of Funds Q4 2008: Debt Deflation confirmation.

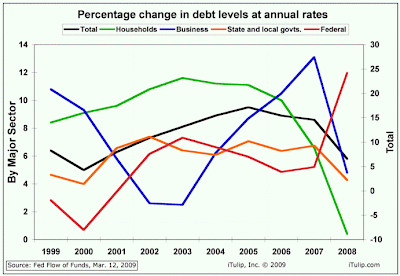

Buried in the details of yesterday’s quarterly Fed Flow of Funds report is the collapse of the private credit market in Q4 2008 and attempts by the Federal Reserve and Treasury Department to compensate for the loss with government credit as the world’s largest lender of last resort.

click on chart for sharper image

Debt growth levels declined in all sectors except US Federal. Household debt turned negative.

Please take a look at the rest of the article for an excellent series of charts on securitization.

I am often in what is best described a "violent agreement" with much of what he has to say. Eric speaks of "Debt Deflation"; to me it is simply deflation, a net destruction of money and credit (marked to market). See Humpty Dumpty On Inflation for details.

However, I do not subscribe to Eric’s "Ka-Poom" thesis in that I do not think inflation is coming back any time soon, nor do I think a bubble in stocks will be reached again for a decade if not longer, in spite of this monumental effort by the Fed.

Right now, credit (marked to market) is imploding so fast that they are going to change the accounting rules regarding it. And while $300 billion is a lot of money to throw at treasuries, even $1 trillion pales in relation to the consumer and corporate debt on the books that cannot be paid back.

My alternative to "Ka-Poom" is Fiat World Mathematical Model.

That aside, Eric made a tremendous call way back in 2002 when he said "Buy gold and hold on to it". What made the call great was Eric went out of his way to specifically say "gold" not miners, not copper, not oil, not foreign stocks or hundreds of other things whose price has since crashed.

Today with Bernanke’s announcement, treasuries are soaring, the stock market is continuing its rally, and gold reversed from down $25 to +30. Enjoy the stock market and treasury rally while they last.

Gold 30 Minute Chart

Attitudes Key To Deflation

Note the losing battle Benanke is fighting: attitudes. The Fed has become the lender of only resort as opposed to the lender of last resort. Bernanke cannot force banks to lend nor can he force companies to hire or if they do hire the wages that will be paid.

Wage destruction continues unabated, and if Bernanke does succeed in driving prices higher, he just might ask himself, how anyone is going to pay the bills.

Deflation is a Benefit, Not a Curse

Deflation is a benefit, not a curse. It only appears to be a curse through the myopic eyes of Bernanke who is worried about the destruction of debt on the balance sheets of financial institutions. However the time to worry about balance sheets is not now. The time to worry about balance sheets was in 2002 when something could have been done about it.

Now the best thing to do is let things play out. The economy will bottom on its own once prices fall far enough.

Now the best thing to do is let things play out. The economy will bottom on its own once prices fall far enough.

The End of Bretton Woods II

Bretton Woods II is on its last legs and cannot possibly survive. The only thing we do not know is the timeframe. The global monetary system could collapse next month, next year, or central bankers might manage to keep it together for another five years.

Meanwhile the Grand Experiment Continues. And as central bankers worldwide continue their coordinated competitive currency debasement silliness, one beneficiary is likely to be gold.