Finally we break out!

Last Friday we had our charts that indicated it was possible but we played 55% bearish into the weekend thank goodness and, as I predicted in the weekend wrap-up, our broken clock (going into each weekend 55% bearish) was right twice as we had a harsh sell-off on Monday that did not get us off to a good start. After last week's action, which I called "a big, ugly W," where 8,130 capped our gains on the Dow, we got a very nice 2.5% rule move for the week on a breakout where we held 8,130 to the downside. While we still went into the weekend just a little bearish – it's getting harder to believe it as the relentless rally continues but better safe than sorry over the weekends as our rallies are still coming on very low volume and, other than Friday, we sold off into every close this week.

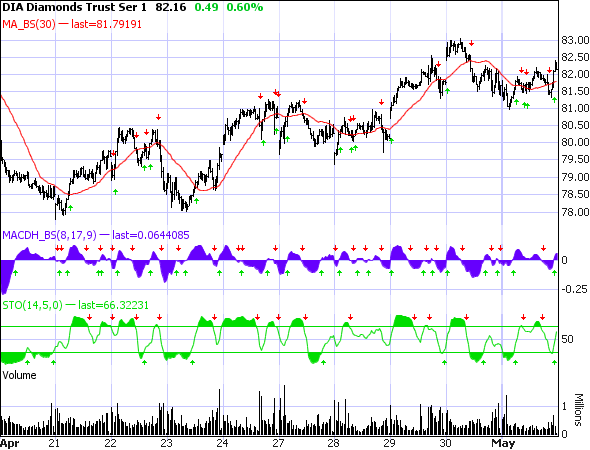

We finished the week right at the 8,200 mark that I predicted weeks ago would be the top of this rally. In fact, the breakout levels we've been using since we first broke out over 7,632 in late March were DIA 8,130, S&P 870, Nas 1,700, NYSE 5,500 and RUT 480 – these were our break DOWN levels of January (and pretty much where we closed for the week) so, on the whole, we are nicely confirming that our "V" bottom of March 9th was an aberration and will NOT be revisited. We do still expect a retest of 7,900 but 7,632 may now be off the table and our 8,650 target (the mid-point of what we've considered "fair value" since October) is just as likely to be hit before we see another pullback.

We finished the week right at the 8,200 mark that I predicted weeks ago would be the top of this rally. In fact, the breakout levels we've been using since we first broke out over 7,632 in late March were DIA 8,130, S&P 870, Nas 1,700, NYSE 5,500 and RUT 480 – these were our break DOWN levels of January (and pretty much where we closed for the week) so, on the whole, we are nicely confirming that our "V" bottom of March 9th was an aberration and will NOT be revisited. We do still expect a retest of 7,900 but 7,632 may now be off the table and our 8,650 target (the mid-point of what we've considered "fair value" since October) is just as likely to be hit before we see another pullback.

What we're looking for is a new range that confirms the 5% levels around 8,650, which is, as a floor, 8,200 (8,217 to be exact) and, at the top of the range, 9,100 (9,082). The closer we get to 9,100 before pulling back, the more likely 8,200 firms up as a floor. Volatility is certainly washing out of the market slowly but surely as the VIX finishes the week at 35.30, down 20% for the month against an 8% gain in the S&P – a complacency that indicates that up, as we like to say, is the new down.

We had an absolutely fantastic week as we learned to stop worrying and love the rally. After being cautious last Friday, my comment in last week's wrap up was a wishy-washy "Earnings last week were way better than expected overall and guidance was not too depressing so we’ll have to see what kind of follow-through we can now get on that and if there is any gas left in the market to finally punch through that 8,200 mark." Despite my misgiving about Monday, we still were pretty gung-ho bullish (or as bullish as we can be) in our $100,000 Hedged Virtual Portfolio and we'll be doing a full review with new trades for members but, suffice to say – EVERY SINGLE TRADE WAS A WINNER! That's right, I went 10 for 10 in Saturday's post and it was even better than it looks because we got a nice, low open on Monday to buy into. Members may want to use this tibit as this is the last weekend to get a double credit for our "Refer A Friend" discount and, don't forget, you must refer at least one member to our free (for now) Email report to lock in your own 20% discount by this weekend.

This was one crazy week (as usual) and Monday started out with a bang as the flu scare hit the markets. In my morning post we discussed how crisis = danger + opportunity and we took the opportunity to sell GSK June $30 puts, which opened at $1.60 and dropped to $1.10 the same day (up 31%) but finished the week back at $1.35, still up 15%. Our buy/write entry of $27.17/27.35 is looking good too with the stock up at $30.61 while the 2011 $25s opened way up at $7.25 but stayed there and the 1/2 sell of the June $30s went as planned with $2.60 being Monday's high and those calls have already fallen to $1.90. So we REALLY liked GSK as they were a good deal anyway and this was just a good excuse to get in… As we expected, HRL was a great buy on the dip and NVAX was a great short on the pop with NVAX giving up 50% of it's Monday open by Friday's close and HRL going back to $31.31 from its $29.50 open on Monday. MMM did not disappoint either and that spread is doing very well. It pays to review these trades while they are still fresh as you don't get that many chances to "practice" in actual panic situations but it always helps to get you ready for the next whatever.

We called gold right on the nose Monday morning and Tuesday gave us a quick $25 drop back to our $875 target zone and we are cautiously bullish at this spot. The FXP we had followed from under $20 on Friday didn't finish topping out until Tuesday morning at $22.50 with huge gains on those calls (up 12.5% on the straight ETF!). Those were just the plays from the morning post on Monday. It only took until 9:42 for me to send out an alert to members listing the levels that we held and saying: "If the bears can’t take these out today, their case is going to look pretty sad."

We took advantage of the volatility (which gives us nice premiums to sell) to do a buy/write on UAUA at $3.30/3.65 (now $5.18) and we began a play on BIDU puts that were great the next day as BIDU fell from $235 to $215. We scaled into our UNG plays and they are looking great now with UNG up $1 for the week (7.5%) but by noon on Monday I had soured on the "rally" and warned members: "All the advance/decline numbers are very red, this is a highly selective rally and we just tested the top again and failed." That caused us to adjust to a 60% bearish posture with the Dow at 8,106, ahead of the drop that finished the next morning at 7.930. In that same Alert I reminded members to play FAZ up and FAS down, both easy money with our standard plays.

Tuesday morning was going according to our plan, with a nice follow-trough down at the open but we were getting bullish before the bell and my play of the morning was CAL which gave us a better entry than we had hoped on a hedged $6.50/8.25 with CAL now back at $10.94, better than 50% if we are called away at our $10 target! FAZ was another morning hedge with nice premium as we got an entry of $4.70/5.85, looking to get called away at $7 (+50%) with FAZ now at $8.53. I had said in the morning that XLF must hold $10 for us to stay bullish and they did and the Yen held 95 and the Baltic Dry index held 1,800 – all the signs we were looking for to turn Asia back up.

SPWRA was a gift that morning and was our first pick of the day, selling the naked June $20 puts for $2, now $.88 (up 56%) as the stock jumped 20% from that buy-in. We also went full covered (60% bullish) in our 10:00 Alert to Members, selling the DIA $81 puts at $3, now $1.46 (up 51%) and I liked the YRCW $2.50s at .65 as well and they topped out at .80 (up 23%) where we called them off – not a bad set for a single Alert! We sold FAZ $9 puts but that was a day trade that went nowhere and some of us really lucked out as we had a DNDN play which involved first selling the 2011 $20s for $12.75 (now $9.78) and waiting to sell the 2011 $15s (now $11.75) as some caught the spectacular dip DNDN had just before the stock was halted but, even if not, the play allowed us to have a long-term $5 spread free of charge – Now THAT'S hedging!

SPWRA was a gift that morning and was our first pick of the day, selling the naked June $20 puts for $2, now $.88 (up 56%) as the stock jumped 20% from that buy-in. We also went full covered (60% bullish) in our 10:00 Alert to Members, selling the DIA $81 puts at $3, now $1.46 (up 51%) and I liked the YRCW $2.50s at .65 as well and they topped out at .80 (up 23%) where we called them off – not a bad set for a single Alert! We sold FAZ $9 puts but that was a day trade that went nowhere and some of us really lucked out as we had a DNDN play which involved first selling the 2011 $20s for $12.75 (now $9.78) and waiting to sell the 2011 $15s (now $11.75) as some caught the spectacular dip DNDN had just before the stock was halted but, even if not, the play allowed us to have a long-term $5 spread free of charge – Now THAT'S hedging!

Also in that same 11:34 comment I said to members: "Pattern holding but a much lower high at 11. Some money is coming out of bonds and that didn’t happen yesterday so we may get a better push this afternoon off some fresh money but that’s really brave ahead of the Fed and the GDP. We’ll see if 8,000 holds on this dip but, if it does, we may get another 100-point move up from there at which point I’d probably want to uncover the puts again." Well you could have plugged that into your trading system and gone home for the day as that's exactly what happened…

ELN was a good pick-up mid day with a hedged $4.21/4.61 entry and the stock leaped up 5% the next day and held $5.89 for the week so looking good for our $5 target. We went back to the well on UAUA with a $3.39/3.70 entry, also looking good with the stock at $5.15. As I mentioned above we flipped bearish into the close, calling the top in the 2:49 Alert, just ahead of a 100 point drop into the close. Being bearish did not stop us from taking a nice HOV vertical leap, the $5s and $7.50s for net .30, still a good long-term play at .33.

We expected a wild day on Wednesday and we were not disappointed but we were surprised as we went up and up and up following a horrific GDP report. At 2:15 we had more quantitative easing from the Fed and, despite the afternoon sell-off, I had already said in the morning I would be impressed by ANYTHING that finally took out our breakout levels. I did jump the gun by looking to take the profits on the DIA $81 puts at 10:06, but flipping to the half cover of the $83 puts over 8,130 worked out well. We played for a turn and got burned on a couple: Shorting oil futures didn't work out so well and we killed that even and selling naked USO $27 calls at $2.25 stopped us out at $2.50 (down 10%). Buying DIA puts didn't work at first but did later and selling FAZ $7.50 puts for $1 and buying them back for .65 (up 35%) was the usual win, as was selling June $6 puts for $1, now .75 (up 25%).

We got a huge win out of a DIA spread into the Fed which couldn't have gone better as we strangled at .95 on each side and collected $1.25 on the up side (up 31%) and got out even on the down as the Dow went up 50 and down 100 after the 2:15 statement was released. Those plays are worth reviewing as we have plenty of Fed statements left to play this year and they are a good way to play any market moving event when you don't know which way the market will move. On reviewing the actual Fed statement in our 2:25 Alert, I concluded: "In a real, logical world, there is nothing here that is worth busting 8,200" and that kept us skeptical into the short rally we were having.

FAZ $6 calls at $2.65 gave us a quick gain and we flipped short on DNDN at $22.50 and they bottomed out $1 lower the next morning. Despite the sell-off we finally went bullish into a close and I said to members ahead of the bell: "Tomorrow is last day of the month so you would think they hold it up for one more day at least…Don’t forget 8,130 was our breakout level and where are we? 8,130. Holding that for the day is still a breakout." That night, in chat, I put forth my premise that it may be possible for the markets to rise much farther on thin trading as we may have moved into a market no longer dominated by speculators but by a content group of investors who bought $20Tn worth of stocks at levels as much as 30% lower than they are now who may be content to hold on for quite some time, leaving very few shares for the sideline money to compete for.

Thursday morning the pre-markets were going crazy and I was very much against it, taking time to point out why we SHOULDN'T be over 8,200 at the open. My play of the day in the morning post was an SKF spread that took advantage of the low open and is working very well already. It only took 19 minutes of trading for me to call a top at 8,300 adding DIA $80 puts at $1.15 to our naked long puts, which ran up to $1.50 on Thursday (up 30%) and $1.70 on Friday (up 45%). SPWRA went so high on the spike that we flipped bearish, selling June $27 calls naked for $4 now $2.83 (up 29%) and we're now ready to enter stage 2 (the bullish side) of that trade right on target.

I guess we were really bearish because the very next trade idea, at 10:23, was selling the BXP $50s naked for $3.20, now $1.30 (up 59%) and, of course, selling the FAZ $7.50 puts for $1 yet again, back to .65 (up 35%) yet again. FSLR was our next victim as we sold the naked $200 calls for $5.50, now $2.12 (up 61%) and this, by the way, is why virtual portfolio margins are a good thing as you can make these very effective plays without tying up too much margin (we had that discussion in member chat with Peter this week). To be fair to the rally, we did get slammed with the fact of the Chrysler bankruptcy on Thursday and that was enough to take the steam out of any bull run.

We added QID $34s at $3 and they topped out at $3.90, now $3.50 (ip 16%) and, at 12:51, FSLR was going our way so we added the $175 puts at $5.30, which topped out Friday at $7.50 (up 41%) where we wisely took the money and ran as they are now back to $5.50 (we only do out of the money front-month contracts as quick trades, every day you hang on in a huge premium penalty otherwise). MA $180 puts for $7.50 are now $10.45 but we took $9 and ran on Thursday. We sold naked BMY puts and those are on track and Peter had a great MA earnings ratio spread, buying 5 June $195s at $8.50 and selling 10 $200s at $7 for a net credit of $2,750, now $875 to buy back (up $1,875 with no money laid out) – very nice!

Friday morning we expected a quiet day and we got one. We went for USO June $32 puts at our $29.50 target and those are still $2.70. Also at the open we liked the FAS June $6 puts for $1, still $1 and we added USO $30 puts at $1.10 and they are down 10% at .97 but it was a scale-in so we'll see if we do get a drop on Monday. We began an RZ buy/write by selling naked June $5s for .55 – working well so far and we once again went for selling the FAS and FAZ June $8 puts for $2 each that we've been playing for 2 weeks. USB gave us another buy/write entry at $12.71/13.85 as they dipped down and we sure hope they are one of the banks that passes the test.

I did call a short on the oil futures at $53.50 as it ran up to silly levels but they only closed .30 lower so a nervous weekend hold! MS had such a good run we decided to sell the naked June $25 calls at $3.15, but that's an entry on a complex spread so I won't get into it here. Taking the OIH May $85 puts for .95 was not complicated and those are even into the weekend. As it was a stick save close to the day we once again found ourselves heading into the weekend 55% bearish after a week of very bullish betting in general.

With 2/3 of the S&P 500 weighing in, earnings have been 70% positive. I had warned earlier in the week that we are only beating a very low bar but we are beating nonetheless. As you can see from the above chart, even if we do keep moving up, we are heading into some very serious overhead resistance that may not prove futile this time. With the added pressure of the old "sell in May, go away" adage – there will be a lot of obstacles to overcome this week and next so we will remain on guard but we have also trained ourselves not to think and simply go with the flow, letting our levels guide us and, so far, our levels keep saying yes – despite our common sense saying no.