Clearly there are people who will do anything for money.

Clearly there are people who will do anything for money.

In the classic movie, "The Good, the Bad and the Ugly," the characters all lie, cheat, steal and kill as they chase after a chache of government gold. They all kill, they all try to kill each other and the only character trait they all share is they will all do anything for money. We are lucky enough to have a modern version of that, with our own government supplying GOLDman Sachs and other bad market manipulators with TARP money, which they are using to, not to lend money to the good citizens of the US but rather to prop up the commodities market, stealing Billions of dollars from the very people they claimed they were going to help.

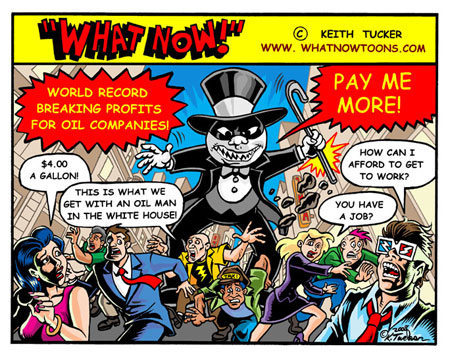

Since the November bail-out, consumer lending had gone down, home foreclosures have gone up, unemployment has gone up, housing has gone down yet the CRB has gone up 25%, led by oil, which is up 88% at $66 this morning. $66 oil is a noose around the neck of this economy as the it was cheaper oil that helped us begin to recover as it stayed around $40 from November through the beginning of March. On a per barrel basis alone, that was $500M a day LESS than we are paying now but, despite the fact that oil is still 54% in price from this time last year, gasoline has gone up so fast that it's only down 23% from the prices that knocked the wheels out from our economy. Including refined products, that extra $26 a barrel is costing US consumers $1Bn a day, $365Bn a year or 1/2 of the TARP money going straight out of our economy and back to the countries that fund terrorism through the very ugly hands of GS (who are partners in ICE) and other TARP recipients who have funded and coordinated this commodity "rally," screwing the American people over with our own tax dollars.

Aside from the very obvious upgrades by the TARP-sponsored Financial houses of anything and everything that even smells like oil and the GE-sponsored 24/7 pump-fest on CNBC, we now have Goldman Sachs this morning telling the sheeple specifically to: "sell Petrobras October $34 put options for $1.95 because a U.S. economic recovery and lower petrochemical supplies will limit declines in the price of oil." What Goldman does not mention is that they were one of the "large speculators" that increased their net long positions in commodities 300% since they got their TARP money. This is just BRILLIANT – take OUR money and invest it in commodities, then pull out all the stops to run oil up 88% where these leveraged investment can pay off 10:1 and then give us our money back early at virtually no cost while keeping the 900% gains for themselves – BRILLIANT!

Aside from the very obvious upgrades by the TARP-sponsored Financial houses of anything and everything that even smells like oil and the GE-sponsored 24/7 pump-fest on CNBC, we now have Goldman Sachs this morning telling the sheeple specifically to: "sell Petrobras October $34 put options for $1.95 because a U.S. economic recovery and lower petrochemical supplies will limit declines in the price of oil." What Goldman does not mention is that they were one of the "large speculators" that increased their net long positions in commodities 300% since they got their TARP money. This is just BRILLIANT – take OUR money and invest it in commodities, then pull out all the stops to run oil up 88% where these leveraged investment can pay off 10:1 and then give us our money back early at virtually no cost while keeping the 900% gains for themselves – BRILLIANT!

This is the exact same nonsense pulled by GS and company back when they were flush with cash and they drained the American public dry last year, as is documented here in "What Is Really Going On With The Price Of Crude Oil?" Of course this strategy blew up in their face and we had to bail them out when it collapsed, but not before the American people were forced to spend over $4Bn a day for petroleum products last summer – that's $800Bn we'll never see again – enough money to employ 16M US citizens with $50,000 jobs or enough to pay 12 Arab Sheiks and 1,000 Wall Street bonuses. Guess what they chose and guess what they are choosing again? It was also enough money to destabilize the balance of trade, throw this country into massive debt, crash the housing market and (in the one positive outcome) finally threw the Republicans out of power. Are the Democrats about to prove that they are no better? Can the same nonsense really go on less than one year after we "learned our lesson"?

Even the Libya's Oil Minister believes there is no fundamental support for these prices, saying: "Prices are moving because the speculators are back. Fundamentals do not tally with psychology." That is certainly backed up by this week's Petroleum Status Report, which had the very interesting statement: "Total products supplied over the last four-week period has averaged nearly 18.3 million barrels per day, down by 7.3 percent compared to the similar period last year." That's right, the US Oil Cartel produced 1.5M barrrels LESS per day than last year, creating a 10.5Mb product deficit on the busiest week of the year. Not only that but imports were down 650,000 barrels a day, shorting the US another 4.5Mb of oil for the week. This data is for the week that ended Friday, May 22nd – a week when massive amounts of fuel are transferred to retail gas stations who get ready for the biggest driving weekend of the year and despite having the head start of a 15Mb shortfall in supply, the total drawdown of product was just 5.4Mb for the week. Imagine how much oil we'd be swimming in if we didn't EXPORT over 1.8Mb PER DAY (12.6Mb/week):

And this nation is, in fact, swimming in oil, despite the fact that speculators like GS are paying to store oil in tankers offshore and around the world in order to create the impression there is more demand than there is in this slumping global economy. We discussed this obscene practice before but it has gotten so out of hand that it now threatens to destabilize the global oil markets and Iraqi Oil Minister (hey, wasn't that supposed to be OUR oil?), Hussain (no relation?) al-Shahristani said last week: "We don't think it's a wise economic decision to produce oil from secure underground fields and then pay to store it in floating tankers. Future generations can benefit from it better than we can, if we don't need it." The suppliers KNOW they are selling us more oil than we need and they KNOW the speculators are sitting on it, the only people who don't seem to know what's going on here is the Obama administration and the American people who are being conned out of 16M jobs worth of money again by the same bastards we had to bail out when their last con game got busted.

That is how, using our bail-out money, the price of oil has been driven up 88% in 6 months and it will go up another 88% if this Administration is going to act as deaf, dumb and blind as the last Administration while the American people are robbed blind with over $600Bn global consumer dollars being sucked out of the economy with every $10 increase in the price of crude. We are at a 25-year high in petroleum storage in the US and we have 139M barrels more in storage than last year – an average increase of nearly 3M barrels a WEEK despite OPEC's 29Mb/week production cut. Reuters reports that there is a "floating oil lake" that "is now so big that it is likely to keep a lid on prices for some time" as the volume of oil stored at sea has risen to record levels.

That is how, using our bail-out money, the price of oil has been driven up 88% in 6 months and it will go up another 88% if this Administration is going to act as deaf, dumb and blind as the last Administration while the American people are robbed blind with over $600Bn global consumer dollars being sucked out of the economy with every $10 increase in the price of crude. We are at a 25-year high in petroleum storage in the US and we have 139M barrels more in storage than last year – an average increase of nearly 3M barrels a WEEK despite OPEC's 29Mb/week production cut. Reuters reports that there is a "floating oil lake" that "is now so big that it is likely to keep a lid on prices for some time" as the volume of oil stored at sea has risen to record levels.

Reuters points out that the last time floating oil stock levels were anywhere near these levels was in the early 1990s after the first Gulf war. Tanks were drained then into a rising market and traders and analysts say only a rise in demand will clear the stocks now. But there is little chance of a quick recovery in oil use as the world faces its worst recession since World War Two, and the massive floating oil inventory is now haunting the market, an extra source of supply at a time when demand is extremely weak. "Out of the market and off balance sheet, everyone knows about this oil but is trying not to think about it," said Simon Wardell, director of oil research at IHS Global Insight. "It is deferred supply, an almost ethereal source of oil waiting offshore. As long as it is unused, it is effectively acting as a support for the market, but at some point it will reappear so it is acting as a ceiling on oil prices."

Of course, there are other players besides Goldman Sachs reaping huge cash rewards as they put the screws to the good people of the United States. BP's trading operations reported that Q1 "trading profit was about $500 million higher than what we would consider the normal range of quarterly volatility.” VLO reported $150M in "profits related to trading," RDS.A's CFO, Peter Voser was proud to report: "We have used some working capital actually to drive trading during the first quarter, and to a certain extent also into the second quarter" and HES said: "winning bets by its trading desk during the first quarter helped cushion the blow from $5 million in weekly losses on oil and natural-gas production, the company’s traders generated a $19 million profit in the January-to-March period." MRO, the fourth-largest U.S. oil company, also benefited from the trade: “A very small amount of crude was put in tankage for contango purposes,” said SVP, Garry Peiffer. In contrast, Chevron Corp., the second-largest U.S. oil company said a scale-back in trading contributed to a 99 percent drop in its U.S. oil and natural-gas profits. Chevron reduced its use of derivative contracts such as futures contracts and swaps to lock in margins by an undisclosed amount during the first quarter, spokesman Jim Aleveras said during a conference call with investors and analysts.

Of course, there are other players besides Goldman Sachs reaping huge cash rewards as they put the screws to the good people of the United States. BP's trading operations reported that Q1 "trading profit was about $500 million higher than what we would consider the normal range of quarterly volatility.” VLO reported $150M in "profits related to trading," RDS.A's CFO, Peter Voser was proud to report: "We have used some working capital actually to drive trading during the first quarter, and to a certain extent also into the second quarter" and HES said: "winning bets by its trading desk during the first quarter helped cushion the blow from $5 million in weekly losses on oil and natural-gas production, the company’s traders generated a $19 million profit in the January-to-March period." MRO, the fourth-largest U.S. oil company, also benefited from the trade: “A very small amount of crude was put in tankage for contango purposes,” said SVP, Garry Peiffer. In contrast, Chevron Corp., the second-largest U.S. oil company said a scale-back in trading contributed to a 99 percent drop in its U.S. oil and natural-gas profits. Chevron reduced its use of derivative contracts such as futures contracts and swaps to lock in margins by an undisclosed amount during the first quarter, spokesman Jim Aleveras said during a conference call with investors and analysts.

So Pete Rose is banned from baseball for life for betting on games but we not only reward the energy producers that bet the energy prices charged to US Citizens will go higher but we punish the ones who choose not to participate. This is a rigged system and only government action will ever change it. What's really sad here is that all of these bastards are just skimming profits off the barrels and those come in from overseas so it costs the citizens of the United States close to $1Tn of hard earned cash that literally goes up in smoke in order for the Big Oil/Big Broker Cartel to make $100Bn. It's not an efficient system – it would be much cheaper for us if we just hand them their money or perhaps start lobbying for real change to stop this madness. I am making this article free so feel free to send it to whoever you can – this is a serious issue that needs to be addressed before it's too late to save us.

We'll find out shortly to what extent the GDP supports any of the 88% rise in oil prices since Q4. I don't suppose we'll have an 88% rise in GDP – in fact, they are expecting a 5.5% decline but that would be a 0.6% improvement from the preliminary reading of -6.1% so the global markets are partying in anticipation of this blessed event. Oh here it is: Down 5.7%! That's a little disappointing but I think there has been such a massive effort to get the markets up this month that I can't imagine they'll let it go on the last day but there is NO WAY I would go into this weekend bullish. It is likely we zig-zag into a finish around 8,412 on the Dow and 908 on the S&P and I'm not expecting the kind of wild moves that we got yesterday.

As with yesterday though, absolutely anything can happen and we remain mainly in cash but I will be scaling into yesterday's oil shorts, painful though it may be. We expect a top at $70 (100% up from $35) and a 20% pullback to $63 so scaling in at $63 (yesterday), $66 (today) and $70 is the plan we are following. If we ultimately get blown out and take a 20-25% loss on this round (if oil flies through $70 and we stop out), then the plan is to wait for $100 and try again! Can the oil markets once again remain irrational longer than the nation can remain solvent? We will find out this summer for sure…

Meanwhile the dollar is being crushed, falling to $1.41.5 to the Euro and $161.5 to the Pound and back to 95.5 Yen in one horrible morning's trading. Of course currency speculation is not much different than commodity speculation and when you are a big investment bank and can control both at the same time – well that is just a home run play! Gold is flying up to $980 and oil is hitting our $66 target this morning. Just in case you thought your stocks were doing well, here is the performance of the S&P priced in barrels of oil. Depressing isn't it? In fact, if you are well indexed to the S&P, your holdings buy 33% less oil today than they did on Jan 1st. For many Arab nations, of course, they see the opposite as they have gained 33% against us in the first half of the year. Priced in gold, the S&P is only down 15% this year, but in a very ugly downtrend and in Euros we're only down 8% so yay, I guess…

Meanwhile the dollar is being crushed, falling to $1.41.5 to the Euro and $161.5 to the Pound and back to 95.5 Yen in one horrible morning's trading. Of course currency speculation is not much different than commodity speculation and when you are a big investment bank and can control both at the same time – well that is just a home run play! Gold is flying up to $980 and oil is hitting our $66 target this morning. Just in case you thought your stocks were doing well, here is the performance of the S&P priced in barrels of oil. Depressing isn't it? In fact, if you are well indexed to the S&P, your holdings buy 33% less oil today than they did on Jan 1st. For many Arab nations, of course, they see the opposite as they have gained 33% against us in the first half of the year. Priced in gold, the S&P is only down 15% this year, but in a very ugly downtrend and in Euros we're only down 8% so yay, I guess…

Asian markets were up about 1.5% this morning (China was still closed) led, of course, by commodity stocks as well as Japan enacting an EXTRA $143Bn stimulus plan. India's GDP came in at 5.8% vs. 5% expected and I'll be doing a global overview this weekend so we'll save that discussion. Europe is also up 1.5% ahead of our open but the DAX did not take our GDP well and turned sharply down off 5,000 (9am) so we'll have to see how things play out over there. Europe is also being led higher by energy stocks, which are also leading the US indexes with 12% gains on the month, accounting for 100% of the 3% gains the indexes have put up – it would be a real shame if they do sell off so please be careful out there!

Click here to sign up for a free subscription to Phil's Stock World Report. It's easy!