Wow, crazy morning already (6 am)!

Wow, crazy morning already (6 am)!

Pre-markets fell off a cliff and the big thing freaking everyone out is a Bloomberg report that insiders are selling, something we’ve been reporting over at the Insider Zone for a couple of months so no surprise to us. The World Bank cut their global forecast 15%, sending commodities down and the dollar up – also what we expected and oil fell off 2% to $68.74, but down 6% from Sunday night’s manipulated joke of a spike to $73. The World Bank said that, while a global recovery may begin this year, impoverished economies will lag behind rich nations. Global growth will be 2 percent next year, down from a 2.3 percent prediction in March, the bank said.

“The green-shoots story is largely priced in,” Lena Komileva, an economist in London at Tullett Prebon Plc, wrote in a note today. “Judging by the general commentary in recent days focus has started to shift from the overall positive direction of the economic surveys,” she said. That’s “consistent with weak demand, pressured producer profit margins, high unemployment and weaker labor wages.”

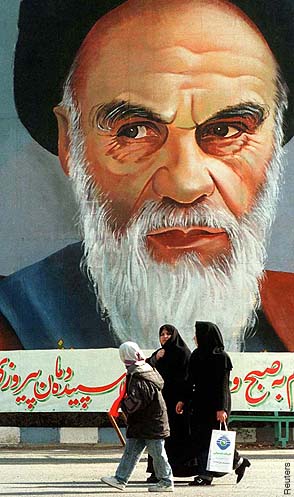

Energy stocks are leading Europe lower as investors are "shocked" that demand isn’t what they thought it was. This is why we were 100% bearish in our bets on Friday, a weak, stick-save rally led by the energy sector was bound to end in tears… Also "surprising" is Iran’s Guardian Council finding "some irregularities" in the polls. Meanwhile, the police arrested former President Ali Akbar Hashemi Rafsanjani, as well as his family. Just to keep you up to speed, Rafsanjani is now one of the "good guys," even though he was a principal organizer of the revolution and was Khomeini’s right-hand man but is now considered a "moderate" and supports Mousavi. Looks like we may have Revolution Part II brewing – either that or a very brutal crackdown coming.

Energy stocks are leading Europe lower as investors are "shocked" that demand isn’t what they thought it was. This is why we were 100% bearish in our bets on Friday, a weak, stick-save rally led by the energy sector was bound to end in tears… Also "surprising" is Iran’s Guardian Council finding "some irregularities" in the polls. Meanwhile, the police arrested former President Ali Akbar Hashemi Rafsanjani, as well as his family. Just to keep you up to speed, Rafsanjani is now one of the "good guys," even though he was a principal organizer of the revolution and was Khomeini’s right-hand man but is now considered a "moderate" and supports Mousavi. Looks like we may have Revolution Part II brewing – either that or a very brutal crackdown coming.

That makes the 6% drop in oil since 7pm last night all the more disconcerting for energy bulls as chaos in Iran is just the sort of thing they wish for. Europe is down about 1.5% going into lunch, led down by the energy and commodity sector. We had such a party on Friday with 20%, 30% and 70% gains on various short day-trades (we love option expiration day and even had a 50% winning long into the attempted stick close!) that we were mainly back to cash over the weekend. Congrats to those who took advantage of Friday’s 4 Free plays from the morning post as both the DIA and QQQQ puts were big winners as were the two QID plays.

We did carry RTH short plays into the weekend but still mainly in cash other than our very well-hedged $107K Virtual Portfolio and we’ll see how on-target our repositioning was in that one this week. We are still market neutral, not hugely bearish until we see levels falling, just like we’re not bullish uniess we see upside levels breaking but we have got a very nice channel to trade off between 8,433 (-2.5%) and 8,866 (up 2.5%) until we get a serious move. We have Existing Home Sales tomorrow, Durable Goods and New Home Sales on Wednesday along with crude inventories and an FOMC rate decision at 2:15. Thursday we wave goodbye to another 600.000 jobs and get the final Q1 GDP numbers and Friday is a big data day with Personal Income & Spending, the PCE and the Michigan Consumer Sentiment report. Several Builders and Retailers report this week as well, more on that later in the week.

Speaking of sentiment, German Business Confidence is up again, increasing from 84.3 in May to 85.9 for June. Just like the consumer confidence numbers we’ve been seeing, our concern is that all this indicates is that 3 months of media brainwashing is working, not necessarily that things are really getting better or that green shoots are sprouting up all over. To some extent the economy has been taken from a "crisis of confidence" that we had at the March lows to a crisis of overconfidence as we race into what is very likely over-valued territory into the reality of Q2 earnings and guidance.

Speaking of sentiment, German Business Confidence is up again, increasing from 84.3 in May to 85.9 for June. Just like the consumer confidence numbers we’ve been seeing, our concern is that all this indicates is that 3 months of media brainwashing is working, not necessarily that things are really getting better or that green shoots are sprouting up all over. To some extent the economy has been taken from a "crisis of confidence" that we had at the March lows to a crisis of overconfidence as we race into what is very likely over-valued territory into the reality of Q2 earnings and guidance.

Last Saturday, we did an extensive review of our 5% rule for members in the article I titles "Weak Weekly Wrap-Up, Is Cramer Still Wrong? (turns out he was…)" We made NONE of the breakout targets we were looking for last week. Our 40% (off the top) levels are: Dow 8,413, S&P 946, Nas 1,717 (notice support is above that line), NYSE 6,232, Russell 514, Sox 329 and Transports 1,868. As we open this week, only the Nasdaq is in "safe" territory but that’s why we shorted them last week as it’s a bit more likely the rest of the market drags them down than the reverse occurs. Our points of key concern this week will be S&P 928 and Russell 515 as they should be our ealy indicators if we turn back up. If the Nasdaq, on the other hand, fails 1,717 – look out below!

We have some nice Asian headlines this morning like the Hang Seng is up 138 points and the Nikkei up 40 points but that does not mention how the Hang Seng actually FELL 350 points after lunch and were saved by the bell at 18,059 and still down 1,000 from June 12th. The Nikkei made a similar closing move, falling from 9,881 to 9,826 in the last 30 minutes of trading and were gapping down when the bell rang. There is a report out of Japan that consumer spending is trailing off rapidly as the government stimulus runs dry. According to the WSJ:

This is a fragile recovery, and odds are high that it won’t continue for long. Incentives to spend will lose their steam, and unemployment, which lags behind falling production, continues to rise. Barclays Capital forecasts the jobless rate to hit 5.8% next year, above the record of 5.5% reached in April 2003. Wages, meanwhile, are stagnating. Having been through this before, Japan’s taxpayers and pensioners also know that the bill will come due for the latest government borrowing and spending spree, in the form of higher taxes and slashed benefits. Those pocketbooks won’t stay open for long.

While our own Fed plays a starring role in this week’s market-moving items, something the Fed already did is looking disturbing as California’s unemployment rate hits 11.5% in May. That is 10% worse than the "worst-case" scenario for 2009 used in the famouns bank "stress tests." This is close to double last year’s 6.8% rate in May and is the highest rate since national record-keeping began in 1976. Recent forecasts from the UCLA Anderson School of Management, Chapman University and Beacon Economics, a Los Angeles consulting firm, predict that unemployment in the state will peak between 12.1% and 12.8%, possibly as early as year’s end. California has 11% of the country’s workforce.

Our green shoot for the day is a nice article where David Ellison of FBR agrees with our heavy financial weighting in our conservative virtual portfolio. We are on a lookout for financial bargains and Sage and I just selected GE this weekend and we have a couple of fine financial hedges in my "Long Shots" article. Do be careful out there though – I read a good "White Paper" from Themis Trading entitled "Toxic Equity Trading Order Flow on Wall Street – The Real Force Behind the Explosion In Volume and Volatility," which sadly confirms many of my pet conspiracy theories. Themist has a whole blog full of cool stuff and it makes a good, but depressing, read.

I’ve been ranting for quite some time about how the moves are fake-looking and the volume doesn’t support the chart painting, Themis puts it well saying:

I’ve been ranting for quite some time about how the moves are fake-looking and the volume doesn’t support the chart painting, Themis puts it well saying:

Our way of analyzing market internals, and predicting future moves, is dependent on this simple assumption in many ways. We assume that buying takes place to make a profit, or limit a loss, based on the price of the stock. But what if all the volume we are seeing no longer is volume with that motive, or backdrop? What if the players/traders/automated traders in the market are making money, not on price moves, but by just simply creating phantom volume. What if the money is being made by designing systems to garnish liquidity rebates as close to risklessly as possible? What if money is being made by creating instances of trades on the tape on specific venues in order to garnish “tape revenue”? If this is so, then is the volume we are all seeing, and the corresponding price action that goes with it, relevant?