Well we sure ended Q2 with a bang.

Just because we're in cash doesn't mean we don't have some fun and our final index play of the quarter was a nice 70% gainer on the DIA $86 puts. Other than a TNK spread and some quick GS puts (up a quick 20% and out), that was our only play of the week so far so we're really picking our spots for that sidelined cash. Now that Q2 is finally fading into the sunset, it is time to see what's real and what isn't and we're really looking forward to earnings season, where we hope to separate the haves from the have-nots.

As David Fry pointed out regarding yesterday's action: "Stock price declines today were milder than expected given the news. But, silly me, I forget that this is the quarter and mid-year end—there are bonuses to be had and bullish headlines to be written. Why did the market rise this quarter? An overwhelming amount of liquidity plus an equal amount of BS." It has indeed been a very frustrating quarter to be a bear, mainly because you have an administration that turns a blind eye towards bullish market manipulation because it's "good" for the economy. Unfortunately, it's only good for the economy the same way rigging baseball so the Yankees would play the Mets in a subway series would be "good" for New York sports – it may be good in the short run but, if people begin to distrust the validity of the games, then they may lose interest altogether…

As David Fry pointed out regarding yesterday's action: "Stock price declines today were milder than expected given the news. But, silly me, I forget that this is the quarter and mid-year end—there are bonuses to be had and bullish headlines to be written. Why did the market rise this quarter? An overwhelming amount of liquidity plus an equal amount of BS." It has indeed been a very frustrating quarter to be a bear, mainly because you have an administration that turns a blind eye towards bullish market manipulation because it's "good" for the economy. Unfortunately, it's only good for the economy the same way rigging baseball so the Yankees would play the Mets in a subway series would be "good" for New York sports – it may be good in the short run but, if people begin to distrust the validity of the games, then they may lose interest altogether…

Professional traders like the market to make some sense. We like to see X data have Y effect in a fairly reliable curve. Consumer confidence fell 10% yesterday and consumer spending is 70% of the GDP so you would think it would affect the market by more than 1% right? Not this market – nothing seems to matter and that's OK, we're getting used to the scam but we're now playing the scam – not the market itself and that's never a good thing and it's certainly no reason for us to commit our long-term capital and that's the only way this market will ever get healthy again.

Meanwhile, over in reality, steel prices in the US fell 3.1% in June – the 11th consecutive monthly decline as the only green shoots we see there are the ones growing through the rust of the abandoned steel mills. Steel prices have fallen 64% from their highs and have not had the miraculous turnaround of other commodities, perhaps because there is no active futures market to manipulate. “The steel market continues to be sluggish, despite protestations by some analysts that recovery has begun,” Purchasing Magazine said. “U.S. end-user purchasing is expected to remain weak for remainder of 2009,” the magazine said. “The steel makers admit very little marketplace impact from the government’s fiscal stimulus package is expected this year.”

Over in Japan, where they also use steel when the economy is going well, the BOJ's Tankan Manufacturing Survey remained at minus 48 for June, up from -58 in March but below the -43 expected. Big companies surveyed plan to cut spending at a faster rate than they predicted three months ago as profits decline and factories lie idle amid weak global demand. The report provides the latest indication that Japan’s likely expansion last quarter was short lived after figures over the past week showed a revival in industrial production may wane, job prospects worsened and deflation returned. “The improvement is good news but this Tankan makes me very skeptical about the sustainability of the recovery,” said Takahide Kiuchi, chief economist at Nomura Securities Co. in Tokyo, who correctly forecast the survey result. “Japan’s economy may start to deteriorate after the third quarter because demand hasn’t rebounded.”

I don't want to be gloomy but this is the world's second-largest economy people! And their interest rates are 0.1% – they are trying REAL HARD to boost demand and it just isn't working… Even with the improvement in Tankan sentiment, the first in more than two years, large manufacturers and service companies remain more pessimistic than they were at any time during the previous recession, which ended in 2002. Large businesses plan to slash capital spending by 9.4 percent in the current business year, more than the 6.6 percent predicted three months ago and the worst-ever projection for a June Tankan. They said profits will tumble 19.8 percent, more than the 11 percent predicted in March, the report showed. Exports and output have fallen by about a third from last year’s levels. While production has increased month-on-month since March, manufacturers plan to slow the pace of gains in June and July, the Trade Ministry said this week. Gosh, it must be time to buy commodities again…

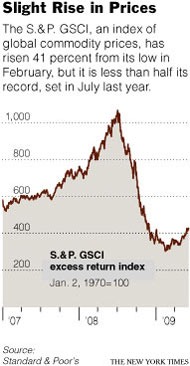

I'm not going to get into commodity prices here, Pragmatic Capitalist has an excellent article titled "Will Commodities Kill the Stock Rally" and I suggest reading that. My real concern is that, with commodities up 40% in Q2, they have accounted for almost half the new money that came back into the market between March and June. Should we have another commodity melt-down like we did last fall, there is no doubt that it will take the entire market down with it – this is a very scary base upon which to build a recovery isn't it?

I'm not going to get into commodity prices here, Pragmatic Capitalist has an excellent article titled "Will Commodities Kill the Stock Rally" and I suggest reading that. My real concern is that, with commodities up 40% in Q2, they have accounted for almost half the new money that came back into the market between March and June. Should we have another commodity melt-down like we did last fall, there is no doubt that it will take the entire market down with it – this is a very scary base upon which to build a recovery isn't it?

We get our own ISM data this morning, along with Construction Spending at 10 am. A measure of 45 is expected on ISM with any number below 50 indicating contraction and our inventory of Durable Goods to to shipments ratio is 1.9 vs. 1.3 when the economy is "healthy" so it's going to take a lot more than a 1.2 move up in ISM to begin to repair that 50% gap.

We also get crude inventories at 10:30 and a large draw is now expected as all but 21M barrels scheduled for June delivery were canceled last month, a feat that was matched for July and 11.5M barrels a week less than last year are being delivered to the US, creating artificial shortages that are allowing Goldman Sachs and the den of thieves at the NYMEX to overcharge the American people over $18Bn dollars a month for oil and another $18Bn a month for refined products. It's like Bernie Madoff is set loose once a month to destroy people's savings but, because Goldman Sachs and Co. commit their crime by stealing just $100 from every household in America rather than millions from a select few – there is no outrage – just the quiet destruction of the buying power of the American consumer.

The ADP report showed we lost 473,000 jobs in June, 20% higher than the 400,000 job losses expected but our markets seem undeterred. We get the Non-Farm Payrolls tomorrow and they are also expected to show "just" 400,000 new job losses. In another Wednesday job report, TrimTabs Investment Research estimated that job losses accelerated last month, with 472,000 jobs lost in June. TrimTabs uses daily income-tax withholdings to the U.S. Treasury to estimate changes in employment. "Job losses slowed temporarily in May as consumers benefited from income tax refunds, President Obama's tax credit, low interest rates, and low energy costs," said Charles Biderman, chief executive of TrimTabs. "With the exception of the tax credit, all of those factors have disappeared or reversed."

The ADP report showed we lost 473,000 jobs in June, 20% higher than the 400,000 job losses expected but our markets seem undeterred. We get the Non-Farm Payrolls tomorrow and they are also expected to show "just" 400,000 new job losses. In another Wednesday job report, TrimTabs Investment Research estimated that job losses accelerated last month, with 472,000 jobs lost in June. TrimTabs uses daily income-tax withholdings to the U.S. Treasury to estimate changes in employment. "Job losses slowed temporarily in May as consumers benefited from income tax refunds, President Obama's tax credit, low interest rates, and low energy costs," said Charles Biderman, chief executive of TrimTabs. "With the exception of the tax credit, all of those factors have disappeared or reversed."

Hong Kong was closed this morning for a holiday and the rest of was up slightly with Japan having a very strange session in which they gave up all of 150 points worth of early gains to finish the day down 18 points at 9,939. If we didn't know better, you could look at this chart and conclude that the entire move over 10,000 in the afternoon was forced and faked. It's a good thing we know stuff like that would never happen… Except in Europe of course, where the FTSE gapped open 1% over yesterday's close but has flatlined since the open as real traders take the opportunity to lighten up into what is essentially a commodity rally spurred on by the $2 rise in oil in overnight trading (back to $71.70). The DAX and the CAC have very similar charts – just a coincidence I'm sure…

We're still mainly sidelined ahead of the holiday weekend. The window dressing has been accomplished for Q2 and now we'll see if all the lipstick they put on this pig will attract any buyers as we begin Q3. We'd love to see earnings reports catch up to the massive increases in valuations but please, show us the money first – we've had enough happy talk for now.