Well, we sure have come a long way in two weeks!

Here’s a great selection from our Chart School files that gives you a nice visual overview of the S&P from Larry at Ichimoku Charts:

As I mentioned in the

weekly wrap-up, having come to the very top of our predicted trading range, we had no choice but to grit our teeth and go short into the weekend, ratcheting up our DIA coverage to balance the overall virtual portfolio bearish over the weekend. There was nothing fundamental in the shift other than the overall fundamentals that WERE NOT being reflected in the (perhaps) overly exuberant rally of the past two weeks.

As I said in the post: "We have another heavy week of earnings ahead of us and we also have heavy data next week, including the Q2 GDP on Thursday. We have New Home Sales on Monday, Consumer Confidence and Case-Shiller on Tuesday. Wednesday is Durable Goods and the Beige Book all leading up to the GDP for April, May and June – which will be interesting to say the least. It’s going to be both exciting and informative but I’m sure sleeping better knowing we are well-covered over the weekend!"

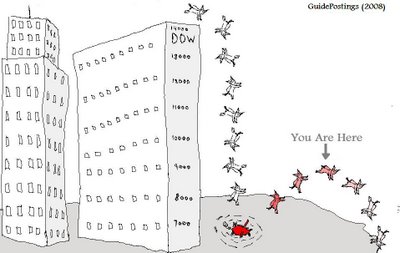

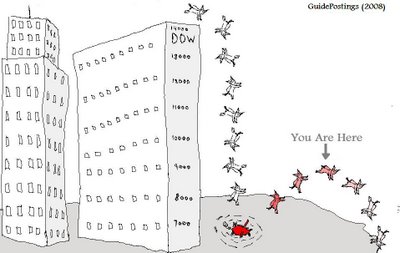

We did, in fact, have a nice, relaxing weekend as we were able to review our positions and discuss the pros and cons of the market. John Mauldin wrote an excellent piece called "The Statistical Recovery" and points out that, as Tim Knight did in "Legends of the Fall," seemingly spectacular rises off a deep bottom are not necessarily "evidence" of a recovery. In short – beware the dead cat bounce – something we had EXPECTED back on July 11th, when we first predicted this "rally." Has the cat exceeded our expectations? No, 9,100 was always our Dow target for this bounce – we just didn’t think we’d get there in just 10 days of trading!

We did, in fact, have a nice, relaxing weekend as we were able to review our positions and discuss the pros and cons of the market. John Mauldin wrote an excellent piece called "The Statistical Recovery" and points out that, as Tim Knight did in "Legends of the Fall," seemingly spectacular rises off a deep bottom are not necessarily "evidence" of a recovery. In short – beware the dead cat bounce – something we had EXPECTED back on July 11th, when we first predicted this "rally." Has the cat exceeded our expectations? No, 9,100 was always our Dow target for this bounce – we just didn’t think we’d get there in just 10 days of trading!

In that post at the bottom of the sell-off, I asked: "Is the current panic justified? What’s really changed in the last 30 days? Obviously, there were great attempts being made to push us up and over the top during the early part of June – the media pandering, the constant "stick saves," Cramer’s idiocy, Goldman Sach’s $85 oil call – all attempts to pull investor dollars off the sidelines and break out of our range. Failure to do so seems to have led to a sell-off, perhaps funds are giving up on the year or perhaps the sheeple who were herded in at the top have no appetite for a market that doesn’t go up and up and up."

Now I could ask the same thing as we are back at the top – What has changed in the last 2 weeks? When did everything get so good? Yes, we had better than expected earnings but we didn’t expect very much did we? What are we celebrating? That we "

only" are on a pace to drop 6M additional workers this year? That "

only" 4M more US homes are facing foreclosure? That "

only" 18% of the population is late on their credit card payments? In either direction, a few low-volume weeks is not going to be enough to fuel us out of either end of our trading range and we sure as hell need a better catalyst to the upside than the return of $70 oil (yes, I’m back to having a problem with that again).

So which way will the market go now? That all depends on sentiment at the moment and that brings us to my own contribution to Chart School – The Big Chart Review. It’s not pretty as we used statistical-based models to pick our levels but it works and, most importantly, it works consistently and we like things that work over at PSW! Right now, our focus is on the 33% off line, as the next "goal" area now that we’ve taken out some of our breakout levels (5% over our mid-points).

Things do look good, every single global index we track except the SOX, Transports and CAC are over the 40% off line we’ve been expecting to form a new global floor ever since the great crash. While we have spectacular performances in Asia, with China and India closing in on doubling off the lows – it pays to keep in mind that their lows were so spectacular, that 79% up from the low in Hong Kong is still 37% off the top!

| |

|

2 Week |

% Off |

40% |

33% |

March |

% From |

| Index |

Current |

Move |

High |

Down |

Down |

Low |

Low |

| Dow |

9,093 |

947 |

35% |

8,413 |

9,394 |

6,469 |

41% |

| Transports |

1,776 |

126 |

43% |

1,868 |

2,086 |

1,233 |

44% |

| S&P |

979 |

99 |

38% |

946 |

1,056 |

666 |

47% |

| NYSE |

6,337 |

737 |

39% |

6,232 |

6,959 |

4,181 |

52% |

| Nasdaq |

1,965 |

215 |

31% |

1,717 |

1,917 |

1,265 |

55% |

| SOX |

300 |

30 |

45% |

329 |

368 |

188 |

60% |

| Russell |

548 |

68 |

36% |

514 |

574 |

342 |

60% |

| Hang Seng |

20,251 |

2,751 |

37% |

19,200 |

21,440 |

11,344 |

79% |

| Shanghai |

383 |

23 |

35% |

353 |

394 |

234 |

64% |

| Nikkei |

10,088 |

888 |

45% |

10,980 |

12,261 |

7,021 |

44% |

| BSE (India) |

15,378 |

1,878 |

27% |

12,720 |

14,204 |

8,054 |

91% |

| DAX |

5,266 |

666 |

35% |

4,891 |

5,461 |

3,588 |

47% |

| CAC 40 |

3,512 |

512 |

43% |

3,701 |

4,133 |

2,465 |

42% |

| FTSE |

4,582 |

482 |

32% |

4,052 |

4,525 |

3,460 |

32% |

We’re seeing plenty of our indexes getting to that 50% gain mark off the March lows and we can ignore the FTSE’s relatively poor performance as they also didn’t fall as far as the rest. The Dow and the DAX are close enough to the 33% off line to merit close attention but we still have a long way to go on our other indexes so that’s going to be a tough line to cross and is our next critical goal. Of course, first we need to get those Transports, the SOX and the CAC over the 40% mark and a 10% move would do it there. We just don’t see that happening without a pullback of the others to regroup, so holding the 40% lines on a pullback is going to be our critical indicator for whether or not our cat is showing signs of life.

Asia had a great morning with 1% gains across the board and Europe is up about half a point ahead of the US open but nothing much matters until we get the Beige Book on Wednesday and the GDP on Thursday and, oh yes, another 1/3 of the S&P 500 reporting this week.

It’s going to be a wild ride – try to have some fun!

We did, in fact, have a nice, relaxing weekend as we were able to review our positions and discuss the pros and cons of the market. John Mauldin wrote an excellent piece called "The Statistical Recovery" and points out that, as Tim Knight did in "Legends of the Fall," seemingly spectacular rises off a deep bottom are not necessarily "evidence" of a recovery. In short – beware the dead cat bounce – something we had EXPECTED back on July 11th, when we first predicted this "rally." Has the cat exceeded our expectations? No, 9,100 was always our Dow target for this bounce – we just didn’t think we’d get there in just 10 days of trading!

We did, in fact, have a nice, relaxing weekend as we were able to review our positions and discuss the pros and cons of the market. John Mauldin wrote an excellent piece called "The Statistical Recovery" and points out that, as Tim Knight did in "Legends of the Fall," seemingly spectacular rises off a deep bottom are not necessarily "evidence" of a recovery. In short – beware the dead cat bounce – something we had EXPECTED back on July 11th, when we first predicted this "rally." Has the cat exceeded our expectations? No, 9,100 was always our Dow target for this bounce – we just didn’t think we’d get there in just 10 days of trading!  Now I could ask the same thing as we are back at the top – What has changed in the last 2 weeks? When did everything get so good? Yes, we had better than expected earnings but we didn’t expect very much did we? What are we celebrating? That we "only" are on a pace to drop 6M additional workers this year? That "only" 4M more US homes are facing foreclosure? That "only" 18% of the population is late on their credit card payments? In either direction, a few low-volume weeks is not going to be enough to fuel us out of either end of our trading range and we sure as hell need a better catalyst to the upside than the return of $70 oil (yes, I’m back to having a problem with that again).

Now I could ask the same thing as we are back at the top – What has changed in the last 2 weeks? When did everything get so good? Yes, we had better than expected earnings but we didn’t expect very much did we? What are we celebrating? That we "only" are on a pace to drop 6M additional workers this year? That "only" 4M more US homes are facing foreclosure? That "only" 18% of the population is late on their credit card payments? In either direction, a few low-volume weeks is not going to be enough to fuel us out of either end of our trading range and we sure as hell need a better catalyst to the upside than the return of $70 oil (yes, I’m back to having a problem with that again).