Welcome to Adam Sharp at the Bearish News blog!

Adam writes on the non-existence of a free market economy. Agreed – we don’t have free markets. About half-way through, Adam clarified another point – free markets cannot operate outside the framework of effective laws and a legal and regulatory system that will enforce them. He differentiates between deregulation and decriminalization – a semantic issue perhaps? Law enforcement and regulations (Adam might just say laws) have been m.i.a., and consequently, blaming laissez-faire capitalism for our economic woes ignores a vital part of the problem. – Ilene

Don’t Blame Free Markets, They Never Existed

Courtesy of Adam Sharp

A rhetorical question for free-market critics: Do the following policies reflect a laissez-faire economy?

#1 – Artificially cheap money – America’s central bank regularly provides heaps of cash to their member banks, especially when unsustainable rallies stall and sputter. Liquidity is the cause and the cure. This is anything but laissez-faire. Keeping interest rates low mangles the free-market, rewarding reckless borrowers and lenders, and punishing savers.

#2 – Bailouts – Banks feel safe taking huge risks, and for good reason. The taxpayer will surely bail them out. The absolute worst-case scenario for an executive who loses billions is getting fired. But when you only need a few months to make millions, who cares about getting canned?

#3 – Meddling in Housing; Freddie, Fannie & More – The housing market has been propped-up too long. The stated goal of GSEs like Fannie and Freddie are to facilitate affordable housing. Problem is, they’re become a significant part of the problem. They contributed to the housing bubble, and shifted debt from private to public hands. Further bailouts seem inevitable. In short, they are anything-but free-market.

Laissez-Faire Still Takes The Blame

Despite all this, free-markets remain the favored scapegoat of this crisis. David Leonhardt’s NYT piece titled Greenspan’s Mea Culpa captured wrong-headed use of laissez-faire perfectly:

Over the last 30 years or so years, the world has been deeply influenced by a laissez-faire economic philosophy, which has shifted the world toward an embrace of markets… But it certainly seems as if this country, at least, went too far toward laissez-faire economics.

Leonhardt goes on to blame the housing bubble on a lack of regulation from Greenspan and the Fed. We agree on where the fault lies. The Fed certainly did blow their regulatory duties. But his argument, like most made by free-market critics, ignores the real causes. The root of the problem lies in gross government intervention, primarily in two forms:

- Bailouts – As long as bankers can count on taxpayer-funded rescues, any mention of a “free-market” is laughable. As Elizabeth Warren recently stated, “Until we have a credible liquidation threat, we don’t have capitalism in America“. Such a shame that Mrs. Warren has no teeth in her current post. I suppose she’s too honest and sharp to be appointed to a position where she could have some impact.

- Loose money – How can we expect banks/lenders to act responsibly when the Fed shovels money to them at below-market rates? We can’t. Profiting from this spread is irresistible. It is inevitable that they will churn out bad loans. No amount of regulation can create artifically-stimulated, yet responsible lending.

This belief that a lack of regulation is solely to blame for this crash is becoming dangerously widespread. This Telegraph piece is another example. The author blames laissez-faire philosophies for the collapse of Lehman Brothers (LEHMQ.PK) and its aftershocks. What is it about moral hazards that these bank-apologists can’t understand? When you make risky loans, you should expect to take some losses. Yes, even if that means money-market funds are forced to break the buck. Spreading losses around only makes things worse, and basically stabs Adam Smith’s invisible hand with a rusty screwdriver.

Deregulation, or Decriminalization?

Like any good myth, there is some truth in the anti-free-market crowd’s argument – deregulation. But that word, deregulation, doesn’t describe what took place. Decriminalization is more accurate. Repealing Glass-Steagall, lowering bank reserve requirements to zero, increasing leverage, loose money, revolving doors.

Regulation hawks make many valid points. Clearly we need laws that outlaw reckless greed and fraud. Those who profited should have everything clawed back. But unless we stem the flow of cheap money and allow companies to fail, such regulation is pointless. Our first priority should be restoring some version of a free market.

Easy Money and Bailouts

Prior to the Great Depression, banks were forced to borrow money at above-market rates. Now we shovel it to them freely. Under the status quo, banks are practically ensured profitability, and bankers fat bonuses. This should come as no surprise, as bankers largely control the Federal Reserve.

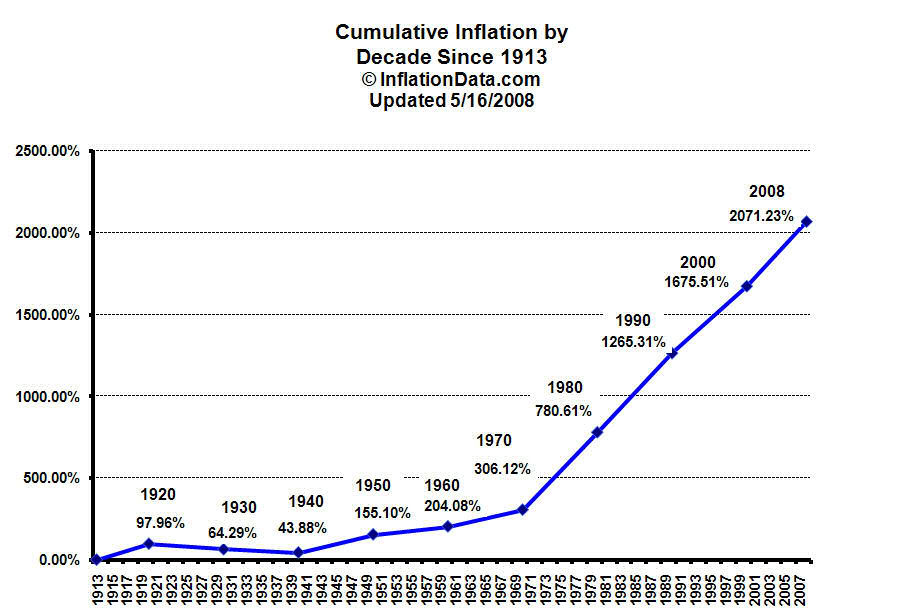

It is critical that Americans realize the role our Central Bank plays in bubbles. Without Fed-provided liquidity, bubbles would be tame or non-existent. Growth would be smoother. Instead of dramatic cycles of boom/bust, we would see small fluctuations and stable growth. Deflation, the Fed’s worst nightmare, might even occur. But that would be a result of increased productivity, and wages would not necessarily follow. We would also escape rampant dollar destruction shown in the chart below.

These issues are nothing new. Thomas Jefferson fought against central banks and their loose-money policies almost 200 years ago.

No one has a natural right to the trade of a money lender, but he who has the money to lend. Let those then among us who have a moneyed capital and who prefer employing it in loans rather than otherwise, set up banks and give cash or national bills for the notes they discount.

Blame the Fed

While a responsible Fed is theoretically possible, we haven’t seen anything close since Paul Volcker left. For now, it is imperative that we stop blaming laissez-faire policies for our problems, and recognize the real causes of this crisis. Our economy is artificially stimulated, power-biased, corrupt, and manipulated. Almost nothing about it resembles true free-market capitalism. Spread the word. Until this is widely accepted, necessary economic change will never happen.

Disclosure: No positions in any companies mentioned.