Just when you thought it was safe to invest in Asia!

Just when you thought it was safe to invest in Asia!

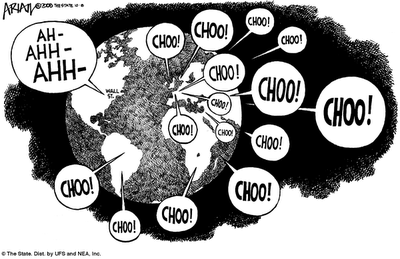

Today’s shocker came out of a World Health Organization meeting yesterday where officials estimate 20% to 30% of Asia’s population – or between 448 million and 672 million people will be infected by swine flu H1N1 this season. Hong Kong had their 15th death this weekend and eight more people are in critical condition. 492 new cases were confirmed over the weekend, bringing the official count in Hong Kong alone up to 22,054 infections. According to the WHO: "China may not be in a situation of what we call extensive local transmission, which Hong Kong is in now." Once it does happen, we can see a lot of severe cases."

It’s ironic that the G20s efforts to put lipstick on this pig of a global economy may all be derailed by a pig’s disease. Despite skipping testing and relaxing safety regulations (which will, of course lead to other problems) in order to get tens of millions of doses of vaccines out for mass-inoculation programs, the WHO estimates that China, at best, will be able to inoculate just 5% of the population (65M people). We went through our last major swine flu scare last April and, here at PSW, we turned it into a half-dozen very successful picks – so let’s look at a few more who should do well in this next round of the crisis:

- SVA is the primary vaccine maker in China and you can buy that stock for $8.88 and sell the Jan $7.50 puts and calls for $4.50, which is net $4.38 with a call away at $7.50 (up 71%) if they hold that level through Jan 15th and the break-even to the downside (where you would be assigned the puts) is $5.94, 33% lower than today’s price. I’m not one to jump on disaster plays usually but this one has pretty good odds.

- BCRX has Perimavir in late-stage trials and the FDA is considering a "pre-emergency use authorization review," of the drug, which would be great for BCRX if it goes through and bad if it doesn’t. As BCRX is already up a lot, the way I would play this one is buying the 2011 $10 calls for $4.10 and selling the 2011 $12.50 calls for $3.60, which is a net .50 entry with a 500% return if BCRX hits $12.50 in 15 months (now $10) and it shouldn’t cause too much damage (perhaps 30%) if things don’t work out and they fall back to the $7s.

- CAH is a mask maker and I love mask makers in a crisis where 6Bn people will be looking for protections. With a $10Bn market cap against $100Bn in sales and $1Bn in annual profits, I’m very happy with CAH as a long-term hold, especially with their 2.5% dividend. A conservative way to play is buying the stock at $27.89 and selling the 2011 $25 puts and calls for $7.80 for a net $20.09 entry, which is a 24% profit if called away and a 19% discount if additional stock is put to you at an average of $22.55. Meanwhile, over the course of 15 months, another .85 in dividend payments should come your way for another 4% gain.

- CAH is also a good enough opportunity to me to play the March $30 calls for $1.30, looking for a quick pop after Cramer reads this article and then pretends he thought of them on his own…

The Hang Seng erased it’s morning Ying with a large afternoon Yang that took 200 points off the market in the afternoon and that index finished down exactly 0.7% – the same exactly that the Nikkei finished down for the day an hour earlier. I’m not going to say anything about this and we can all pretend that the random trading of millions of individual investor decisions cause this to happen, as opposed to trading programs controlled by a dozen people because it’s Monday and we’re already worried about the flu so why add that to our usual concerns about the actions of the Gang of 12?

Speaking of the Gang of 12 however – last week I told you to read "The Creature from Jeckyll Island" to help understand why Ron Paul calls the Fed an evil, out-of-control creation that has undermined our nation. Today the Fed dropped the pretense that it answers to our Government as they rejected a request by U.S. Treasury Secretary Timothy Geithner for a public review of the central bank’s structure and governance. While the report requested by the Treasury hasn’t been formally scrapped, no work has been done on the project, which was due Oct. 1, the people said. Treasury spokesman Andrew Williams declined to comment, as did Fed spokeswoman Michelle Smith.

Europe is down about a point ahead of the US open (9am) but the really big news that no one is talking about is a major policy statement that is in the works for this week’s G-20 meeting that would commit the U.S., Europe and China to make big changes in national economic policies to produce lasting growth as the world recovers from the worst recession in decades. The focus is on a U.S. proposal, called the "Framework for Sustainable and Balanced Growth," whose details haven’t been previously disclosed. If implemented, the framework would involve measures such as the U.S. saving more and cutting its budget deficit, China relying less on exports, and Europe making structural changes to boost business investment.

Europe is down about a point ahead of the US open (9am) but the really big news that no one is talking about is a major policy statement that is in the works for this week’s G-20 meeting that would commit the U.S., Europe and China to make big changes in national economic policies to produce lasting growth as the world recovers from the worst recession in decades. The focus is on a U.S. proposal, called the "Framework for Sustainable and Balanced Growth," whose details haven’t been previously disclosed. If implemented, the framework would involve measures such as the U.S. saving more and cutting its budget deficit, China relying less on exports, and Europe making structural changes to boost business investment.

"As private and public saving rises," in the U.S. and other countries, "the world will face lower growth unless other G-20 countries undertake policies that support a shift towards greater domestic, demand-led growth," senior White House aide Michael Froman wrote to his G-20 colleagues in a letter dated Sept. 3. In the missive, which has not been made public, he called the framework "a pledge on the part of G-20 leaders" to press new policies. The G-20 countries have yet to decide how detailed to make their pledges to change. And the U.S. and Europe have different ideas on how to enforce them. "Implementation is always the issue," says Timothy Adams, a former senior Bush Treasury official. "If we wait even one more year, it may be too late." The sense of urgency will have faded, he says.

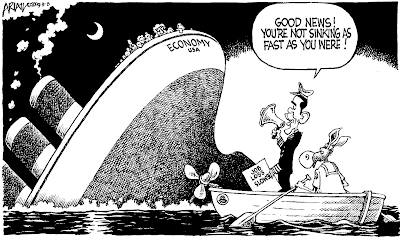

Gosh that sounds like a really big deal doesn’t it? Almost as big of a deal as the WHO’s flu warning, both of which are absent from 90% of the media I’m looking at and listening to this morning. You can bet though, that "THEY" are acting on this information and they will be SELLSELLSELLING, as they did on Friday afternoon even as the MSM pump-monkeys continue to tell you to BUYBUYBUY as if, not only has the economy fully recovered – but $70 oil, a global pandemic, massive unemployment, limited credit availability, record mortgage and credit card defaults and unsustainable levels of government stimulus and debt are nothing you should be concerned about either.

We all remember how the Dow climbed a "wall of worry" from 11,000 to 14,000 and how all the "experts" told you that was a good thing. Well guess what… Had you taken it off the table at 11,000, you’d still be 20% of where the market is now. Does that make sense to you or am I talking to a wall? I’m willing to tell you this, even though it’s bad for my "ratings."

We all remember how the Dow climbed a "wall of worry" from 11,000 to 14,000 and how all the "experts" told you that was a good thing. Well guess what… Had you taken it off the table at 11,000, you’d still be 20% of where the market is now. Does that make sense to you or am I talking to a wall? I’m willing to tell you this, even though it’s bad for my "ratings."

Subscriptions are down and hits are down since I’ve gotten more bearish last month and if I had a board of directors, I’m sure they’d be telling me to get more postive and stop all this negative talk because it’s turning people off. I’m sorry because I don’t like being bearish – I’m an optimistic guy usually but I can’t just sit here and tell people what they want to hear. It’s just too irresponsible not to be cautious here. We make plenty of bullish picks but I maintain a very wary outlook until we get some real fundamental improvements.

The Baltic Dry Index is down another 1.4% today and heading for a critical test of the 200 dma at 2,200, perhaps by the end of the week if things don’t turn up. As I’ve been saying for quite some time, if no one is shipping anything to the stores – what kind of Christmas season are we expecting? If we don’t have a good Christmas season what happens to the retailers and the REITs that rent them spaces? What happens to the people the retailers usually hire in Q4? What happens to the money that has been pouring into those sectors like Retailers and REITs are the new .com companies?

I don’t have all the answers, but I do have a lot of questions – too many to get comfortable buying at these levels.