Here’s the long answer to a question regarding Phil’s thoughts on which way the market is going. – Ilene

Wonderland Market

By Phil at Phil’s Stock World (in comments)

Market direction – Interesting that this is what’s on your minds as it’s what’s on my mind too. What is real and what is not? Keep in mind that when the market was down 50% in March, that was not real either. You can go back and read all my posts back then, but the gist of my arguement was, short of annihilating a good portion of the global population, the global GDP is very unlikely to fall below $40Tn (down 20%) so anything beyond that is, by definition, an overreaction.

On the other hand, the run up to S&P 1,500 was itself overdone as we can’t just keep expanding insanely forever (outside of inflationary expansion). There’s an interesting article in Scientific American this week asking if current economic assumptions inherently violate the laws of physics, something I used to rant about back in ‘07 but got bored with as the market went up and up anyway – despite my efforts to talk sense to it… Oddly the chairman at Utah State is feeling my pain already, saying: ""Of course I’m trying to send a message – I just don’t expect there’s anyone out there to receive it."

So we have a low that was too low coming off a high that was too high. We have MASSIVE government stimulus and I not only don’t use the word MASSIVE lightly but MASSIVE is wholly inadequate to describe the level of stimulus in comparison to anything that has ever happened in the history of the world. We have a runaway global money supply, the worst global unemployment since the great depression (and that didn’t end in 12 months you know) and pretend shortages of commodities, which is usually something that ENDS expansion, not kicks it off. We have a dellusional population where 60% of the people surveyed believe their home prices have appreciated over the past 12 months while anyone who read this week’s housing reports can see that there is virtually not a single zip code in the united states that hasn’t lost 10%…

To say the media is uncritical is like saying my mom doesn’t think I suck. This is not surprising when you consider that the Media, as foretold by Mr. Beatty over 30 years ago, is controlled by the same corporations that require you to be a happy little consumer to buy their stuff. Do you know there is a show on TV where Frasier is a CEO who lost his company and now has to live in a small town in Virginia with "regular" people? He’s such a warm lovable guy and it’s not his fault that his shareholders were wiped out and hasn’t he suffered enough by losing his maid? Insert brain – wash, rinse, repeat. By the way, whoever does the laugh track on this show needs to die.

Speaking of the MSM. Check out this clip from Letterman (1987) where the guest tries to say something negative about GE (starts about 6 min in). They cut him off by playing music over him. The show is taped now so this can never happen again.

Anyway, where was I? Oh yes, the economy. So the media shouldn’t have anything to do with the economy but it sure does because they are, in large part, driving the economy by keeping consumer attitudes from getting depressed. There is good economic logic to avoiding a depression – as I said, the economy really can’t fall more than 20%, anything else is just attitude adjustments. But the economy CAN fall 20% and pretty much has and failing to grasp the reality of that situation is dangerous.

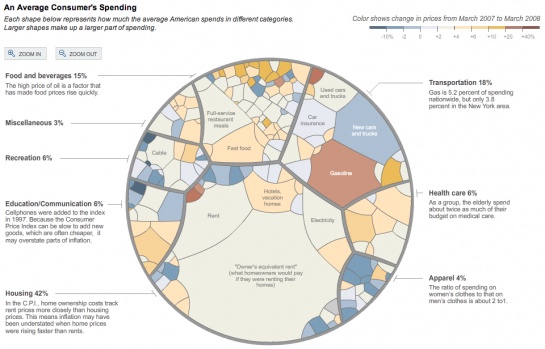

In a normal correction, food, energy and housing costs would come down to the point where people earning 10% less money can afford them but that is not what’s happening. By pretending everything is great and getting better, we pump up the commodity prices and people go 10% further in debt to support those prices as they aren’t being supported out of rising wages. That is physics – 300M people had $100 last year and they spent $42 on Housing, $15 on Food and $5 on gas and another $13 on Transportation and $6 on Health Care.

That’s $81 out of every $100 GONE before the consumer even gets to make a decision on whether or not to get a new pair of sneakers or an IPod. Another 2% goes on Communications, that’s kind of mandatory and 4% goes on education, also kind of mandatory, and 2% goes to Cable and Home Electronics, which I think you’d have a pretty hard time telling most Americans isn’t mandatory. So now we’re up to $89 out of every $100 out the door on non-discretionary spending.

It’s easy for us (the investor class) to forget how limited the choices of average people are because, for a person earning $50,000 a year and taking home about $35,000, that 11% of their income that they get to "choose" to spend is just $3,850 over 52 weeks or just over $74 a week. That’s why it’s ridiculous to pretend that it doesn’t matter if health care goes up $400 a year or a tank of gas goes from $30 back to $60 – These people are being boxed into their homes with no ability to go out and no ability to do anything other than sit in front of those TVs and decide WHICH food they will spend 15% of their income on and WHICH car to buy.

I pointed out this week that consumer spending on food was down 5% – that right there is a sign of how close to the bottom people are scraping as it’s the only place they can really cut (outside of giving up cable). THAT’s the American economy at the moment and just because GE/CNBC and DIS/ABC and Bilderburg Billionaires like Murdoch (Fox) and Redstone (CBS) tell us that everything is great and it’s OK to go to the mall and sign up for a new washing machine or whatever – doesn’t mean it is.

YOU are CUSTOMERS – Corporations, including media corporations and including GS and the Gang of 12 have meetings every day thinking of ways to advertise to you and issue press releases and go on media junkets — whatever it takes to get you to BUYBUYBUY what they are selling and the most powerful companies in this world right now: GS, JPM, MS, BLK, CS, DB, BCS…. They are in the business of selling you stocks. They don’t give a rat’s ass whether the stocks go up or down because, as Eddie Murphy pointed out in Trading Places, those guys are just bookies. They make money every time you get in and every time you get out. What they make on their own manipulative trading is just a bonus.