"The New Bubble Is In Stimulants….." Rosenberg

Courtesy of Jan-Martin Feddersen at Immobilienblasen

I want to add that the bubble is also in outright & hidden bailouts…..Nothing really new but hours/days away from the next mega bailout ( FHA ) a sober summary how wasteful the resources are "squandered"..…..

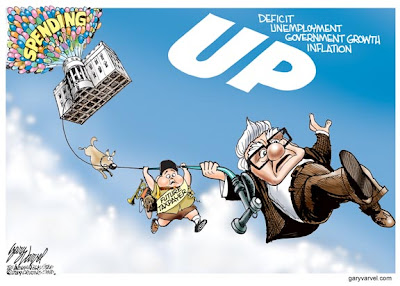

H/T Gary Varvel

So the U.S. economy is growing again. But how can it not be growing with all the dramatic stimulus? The question should be “why only 3.5%”?

> If you can stand more details you can read "A Sham GDP For A Sham Economy"……

> Für einen teiferen Einblick was die USA veranstalten müssen um überhaupt ein positives GDP Ergebnis auf die Beine zu stellen kann das in "A Sham GDP For A Sham Economy"…… nachlesen….

Now the U.S. government is going to not just extend but indeed expand the tax credits for homeownership. This is happening at a time when the fiscal deficit is 10% of GDP. Simply amazing. The sector already receives more in the way of government support than any other area, and it adds zero to the capital stock or productivity growth. Oh, but it makes us better citizens. Renting must be for losers.

And then we see that the Fed’s TALF (Term Asset-Backed Securities Loan Facility) program that began in March just broke the $90 billion mark. This has basically supported 75% of the growth in the asset-backed market, almost evenly split between auto credit and credit cards because at over a 130% household liability-to-disposable income ratio, the government seems to believe we don’t have enough debt on our balance sheets. Honestly — you can’t make this stuff up.

But here is the real kicker. The Federal Housing Authority (FHA). If you’re wondering how it is that the U.S. housing market has managed to rise from the ashes, well, consider that the government-insured FHA program moved into high gear this year and has basically filled the gap vacated by the private sector. (where default rates are really becoming a problem) should not go unnoticed (and they weren’t by the staff at the WSJ that uncovered the growing problems in yesterday’s edition — FHA Digging Out After Loans Sour on page A2).

The efforts to allow practically anyone to secure a mortgage not just for a new purchase but for refinancing purposes

![[Bigger Burden chart]](http://s.wsj.net/public/resources/images/NA-BB672_FHA_NS_20091103192816.gif)

The efforts to stimulate were so profound that the damn-the-torpedoes-full-steam-ahead policy has resulted in an expected 24% default rate on loans originated in 2007, and 20% for 2008. So, what has happened is that the taxpayer has taken over the bad lending decisions that were Wall Street’s domain three, four and five years ago.

>The following chart is from the must read Quote Of The Day….. "The Defaults Are Worth It " Guess who said this…..

Indeed, the FHA began its aggressive moves to support the housing market in 2007 and has since spread its tentacles

According to the WSJ, the FHA is going to publish a report acknowledging that it may need to tap into general tax revenues for the first time in its 75 year history. Oh, but don’t worry, FHA officials say the agency has enough capital to withstand any expected losses.

> I think David missed the "surprising" news that the FHA Delays Fiscal Report . The only question is now how "shocking" & "surprising" the multibillion $ bailout will be…… Cannot wait to hear Barney Frank´s "outrage" ( "The Defaults Are Worth It " ) ………

The FHA began its aggressive moves to support the housing market in 2007 and has since spread its tentacles. The FHA actions, foreclosure moratorium and tax credit have all given a false impression that we have seen a bottom in residential real estate.

But all that’s happened here is the risks have been transferred to the public sector balance sheet. The share of FHA-insured borrowers with a sub-600 FICO score has rapidly approached the 40% mark. So, we have stimulated a recovery by inducing more bad debt accumulation, which got us into trouble to begin with. But it’s not Wall Street taking on the risks now, its Capitol Hill.

This is an effective way to fight a credit collapse? No wonder global central banks are diversifying into gold. The U.S. is hardly going to pay for this by raising taxes (the newly emboldened GOP will see to that) nor by cutting spending (the union lobby groups won’t stand for that). Moreover, we’ll have to assume that global central banks are not stupid and can see the future supply of dollars that will be printed to fund all these initiatives.

All this must be part of the famous "strong $ policy"…….. 😉 Good to be a GOLDBUG……

UPDATE:

$45 Billion Boondoggle of Which $33 Billion Goes To Homebuilders Mish

It would loosen tax rules for homebuilders and other money-losing companies to let them claim an estimated $33 billion in tax refunds this year, according to Joint Committee on Taxation estimates.

The most galling thing about it is $33 billion of the $45 billion is not going to do anything but pad the pockets of those who helped create this mess. A mere $2.4 billion was given to extend unemployment benefits.

If Goldman Sachs is correct (and I believe they are), then most of the $10 billion in tax credits is a waste as well. Moreover, we have a huge inventory of homes already and we are creating incentives to build more.

The whole thing reeks and the Senate knows it. Note that Senator Christopher Bond called it a waste of money but there was not a single "No Vote". The bill passed 98-0 undoubtedly because the homebuilders padded the pockets of those voting for it with campaign contributions. This is the way Congress "works."

You cannot make this up…… This explain why i have the "Banana Republic Watch" label tagged to this post…. 😉

Erklärt warum ich diesem Post das Prädikat "Banana Republic Watch" zugeteilt habe……;-)

![[No Easy Exit for Government as Housing Market's Savior]](http://s.wsj.net/public/resources/images/P1-AR590_EXIT_NS_20090914191413.gif)