"California tumbles into the sea."

"California tumbles into the sea."

Yes, Steely Dan predicted it in 1973, when Ronald Reagan was still Governor but we thought they were talking about earthquakes at the time. This year it’s clearly California’s 49.3% budget gap and 16.2% drop in state revenue that has them leading a list of lemming states to their doom. Over 1M state and municipal employees may be getting their last checks this Christmas as 9 states face budget issues on par with California.

According to The Atlantic: Nine more states are "barreling toward an economic disaster" according to a new Pew poll that sees deep service cuts and temporary tax hikes to avoid fiscal calamity. Some of these states will be familiar to Atlantic Business readers. I’ve been leading the funeral cry for the united states of MichiCaliFlAriVada (that’s Michigan, California, Florida, Arizona and Nevada), and all five states are on Pew’s list. Rounding out the ten are Illinois, New Jersey, Oregon, Rhode Island and Wisconsin. Here’s the graph from the Pew Center on the States:

| Six Factors | Revenue change | Budget gap | Unemployment rate change | Foreclosure rate | Need supermajority? | GPP "money" grade | Score | ||||||||

| United States | -11.70% | 17.7%5 | 4.4 | 1.37% | 17 yes, 33 no | B- 5 | 17 | ||||||||

| California | -16.20% | 49.30% | 4.6 | 2.02% | Yes | D+ | 30 | ||||||||

| Arizona | -16.50% | 41.10% | 3 | 2.42% | Yes | C+ | 28 | ||||||||

| Rhode Island | -12.50% | 19.20% | 4.5 | 1.50% | Yes | D+ | 28 | ||||||||

| Michigan | -16.50% | 12.00% | 6 | 1.47% | Yes | C+ | 27 | ||||||||

| Oregon | -19.00% | 14.50% | 6.4 | 0.86% | Yes | C+ | 26 | ||||||||

| Nevada | 1.50% | 37.80% | 5.2 | 3.12% | Yes | C+ | 26 | ||||||||

| Florida | -11.50% | 22.80% | 4.4 | 2.72% | Yes | B- | 25 | ||||||||

| New Jersey | -15.80% | 29.90% | 3.7 | 1.18% | No | C- | 23 | ||||||||

| Illinois | -10.90% | 47.30% | 3.5 | 1.44% | No | C- | 22 | ||||||||

| Wisconsin | -11.20% | 23.20% | 4.4 | 0.96% | No | C+ | 22 |

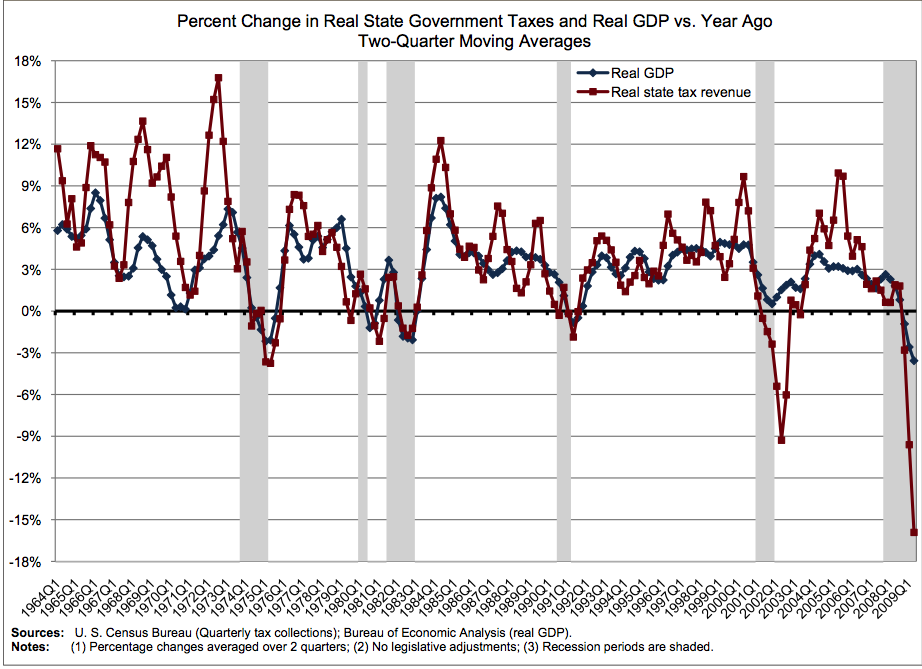

This horrible news only underscores the fact that even though 70% of stimulus spending has gone to fill in Medicaid and state budget holes, our states are still in dire straits because state tax revenue is collapsing across the country. Unlike the federal government, states cannot run deficits, which means cascading revenue becomes cascading services and many, many cut state jobs. For those who resist another state bailout-type stimulus bill, they must recognize what that entails: hundreds of thousands of state employees joining the ranks of unemployment, and unemployment benefits. Q3 was great, but this thing isn’t close to being over. The Center on Budget and Policy Priorities reports that states could cut almost a Million jobs without US aid because of budget shortfalls.

A Million jobs!?! That can’t be good, right? Of course, as Jim Cramer told us on Friday: "The bears were right, unemployment is awful but no one seems to care." So far this week, Jim is right and I am wrong – we’ve gone up another 100 points since I made my top of the market call on Monday night so I tip my cap to Jim, who seems to be able to switch off his brain and go with the flow a lot better than I can. My call yesterday morning, was to take advantage of the futures pop at the open and go short – that kind of worked out but nothing impressive so far but today is the day we thought the market would get real, not yesterday’s pathetically low volume holiday. After all, I did call yesterday’s post "Veteran Scammers on the Loose" to describe what I thought was a blow-off top, although Jim strongly disagrees, of course.

A Million jobs!?! That can’t be good, right? Of course, as Jim Cramer told us on Friday: "The bears were right, unemployment is awful but no one seems to care." So far this week, Jim is right and I am wrong – we’ve gone up another 100 points since I made my top of the market call on Monday night so I tip my cap to Jim, who seems to be able to switch off his brain and go with the flow a lot better than I can. My call yesterday morning, was to take advantage of the futures pop at the open and go short – that kind of worked out but nothing impressive so far but today is the day we thought the market would get real, not yesterday’s pathetically low volume holiday. After all, I did call yesterday’s post "Veteran Scammers on the Loose" to describe what I thought was a blow-off top, although Jim strongly disagrees, of course.

When I need to switch my brain off, I go to the charts. In Monday morning’s post, we expected to test our 25% lines (up from July consolidation) of: Dow 10,250, S&P 1,100, Nasdaq 2,187, NYSE 7,000 and Russell 600 and I said at the time that we needed to watch the FTSE at 5,250 as that would be the key breakout level that would signal a possible next leg up for the global economy and we did get it yesterday and we’re getting a re-test this morning, which is holding so far (6 am). What I didn’t mention, because I left the wrong color on our chart, was the DAX, which also needed to prove out the 25% line at 5,750 and Germany has, so far, been uncooperative in it’s move up. Still, if you compare the chart to Monday, you’ll see that we are getting closer to a chart that we will have to call bullish – but we’re not quite ready to jump in and party with the mad man just yet:

| Dow | S&P | Nasdaq | NYSE | Russell | Trans | HSI | Nikkei | FTSE | DAX | |

| Wed Close | 10,291 | 1,098 | 2,166 | 7,155 | 592 | 1,882 | 22,397 | 9,804 | 5,284 | 5,679 |

| 2.5% Up | 10,273 | 1,095 | 2,164 | 7,131 | 594 | 1,855 | 22,374 | 10,053 | 5,342 | 5,714 |

| Sept High | 10,119 | 1,101 | 2,190 | 7,241 | 624 | 2,045 | 22,600 | 10,397 | 5,299 | 5,888 |

| 2.5% Down | 9,772 | 1,042 | 2,059 | 6,784 | 565 | 1,764 | 21,283 | 9,562 | 4,917 | 5,435 |

| July Base | 8,200 | 880 | 1,750 | 5,600 | 480 | 1,650 | 17,500 | 9,200 | 4,200 | 4,600 |

| 25% Up | 10,250 | 1,100 | 2,187 | 7,000 | 600 | 2,062 | 21,875 | 11,500 | 5,250 | 5,750 |

| Retrace | 9,840 | 1,056 | 2,100 | 6,720 | 576 | 1,980 | 21,000 | 11,040 | 5,040 | 5,520 |

The 2.5% Up and down lines are from Monday’s open, we’re leaving those as is and they need to provide support once they are crossed (as the Hang Seng did this morning). So far, only the Dow is above the September high, which means if you have a stock that is over it’s September high, it may be ahead of itself and you may want to consider caution until we see a few other indexes agreeing with the Dow, which is up on backs of TRV and CSCO since September, with the two new components contributing 80 of those added points with another 120 points coming from XOM and CVX. While $80 oil may be great for them, is it really good for the rest of the economy?

The Hang Seng closed right at the 22,600 mark yesterday morning and we expected at least some pullback so we played the FXP (ultra-short China) Dec $8 calls yesterday, which seemed cheap at .50 as well as the FCX Dec $85 puts at $5.55 (now $6.05) on the morning spike (based on Tuesday’s logic). We were looking for a pullback to the 50 dma at 22,200 but it’s no surprise that the index stopped dropping at almost exactly the 2.5% mark, falling over 300 points from the open but officially down "just" 229 for the day. The Nikkei dropped 150 points from their gapped up open, falling back to Monday’s close at 9,804 as the dollar failed to hold 90 Yen during the session. 22,200 was Monday’s close on the Hang Seng…

“The challenge is growth,” U.S. Treasury Secretary Timothy Geithner said at the Asia-Pacific Economic Cooperation Group meeting in Singapore today, where he said the US supports a strong dollar (always lead off with a joke). Most countries see a need for more government support to bolster the economic recovery, while there are “early signs” that the world is addressing imbalances in spending and saving. Geithner said Thursday that the U.S. government’s borrowing needs will be substantially less than anticipated and that banks will make "significant repayments" from borrowings made during the economic crisis.

“The challenge is growth,” U.S. Treasury Secretary Timothy Geithner said at the Asia-Pacific Economic Cooperation Group meeting in Singapore today, where he said the US supports a strong dollar (always lead off with a joke). Most countries see a need for more government support to bolster the economic recovery, while there are “early signs” that the world is addressing imbalances in spending and saving. Geithner said Thursday that the U.S. government’s borrowing needs will be substantially less than anticipated and that banks will make "significant repayments" from borrowings made during the economic crisis.

Despite Geithner’s irrational exuberance, emerging markets took a general hit this morning as Chinese Premier Wen Jiabao (who is WAY more credible than Timmy) said the world economy faces a gradual and uneven recovery from the recession. The MSCI Emerging Markets Index dropped 0.8 percent, ending the steepest rally since July. Governments around the world are funding stimulus programs with record bond sales. Issuance of coupon-bearing Treasuries will increase to $2.38 trillion in the fiscal year that began Oct. 1, from $1.81 trillion in the prior 12 months, Goldman Sachs Group Inc. said in a report Oct. 20. The U.S. is scheduled to auction $16 billion of 30-year bonds today, following $40 billion of three-year notes and $25 billion of 10-year debt earlier in the week, all record amounts.

Nothing could be worse for the current US market rally than a recovery as we are bubbaliciously full of weak dollars that have been driving up commodities and overseas earnings of the S&P. The rest of the world doesn’t give a damn about popping the commodity bubble as it’s only a bubble to us and our weak currency. The actual commodity producers will still get the same currency-adjusted amount for their product, only speculators will be hurt if the dollar floats. This is, of course, why you are seeing the speculators rushing on TV every 5 minutes to tell you how much further the commodity rally has to go.

Nothing could be worse for the current US market rally than a recovery as we are bubbaliciously full of weak dollars that have been driving up commodities and overseas earnings of the S&P. The rest of the world doesn’t give a damn about popping the commodity bubble as it’s only a bubble to us and our weak currency. The actual commodity producers will still get the same currency-adjusted amount for their product, only speculators will be hurt if the dollar floats. This is, of course, why you are seeing the speculators rushing on TV every 5 minutes to tell you how much further the commodity rally has to go.

In reality, foreign governments are already very uncomfortable with where the dollar is and, according to the WSJ, Thailand, South Korea, Russia and the Philippines have been snapping up dollars this week in order to hold down the value of their currencies. In Latin America, Brazil’s finance minister said the country’s currency remained too strong, sparking speculation that the government would intensify recent efforts to curb the real’s ascent. On Tuesday, Taiwan banned foreign investors from parking time deposits in the country in an effort to ease upward pressure on the local currency.

On Wednesday, China’s central bank made a nod to concerns about the declining dollar and yuan by issuing a rare change to the official language of its exchange-rate policy. The central bank said it would take major currency trends into account in setting policy, though it wasn’t clear what impact that may have on the yuan’s future value. Experts estimate that some of the largest emerging economies may have spent as much as $150 billion on currency intervention over the past two months, judging from the growth of their international reserves, according to data from Brown Brothers Harriman. While that’s not a huge amount in the currency markets, which have turnover of more than $3 trillion a day, traders pay keen attention to what the authorities are doing and where they are likely to intervene.

As I mentioned above we’ll be looking for either the FTSE to fail the 25% line at 5,250 or have the DAX join them above it at 5,750. EU markets are trading generally flat ahead of our open. “European stocks have had a good run higher so people at the moment aren’t willing to stick their neck out too far,” said Stephen Pope, chief global equity strategist at Cantor Fitzgerald in London. “We are going to see increased volatility, particularly towards year end, but any dip is just a good opportunity to return to the market.”

As I mentioned above we’ll be looking for either the FTSE to fail the 25% line at 5,250 or have the DAX join them above it at 5,750. EU markets are trading generally flat ahead of our open. “European stocks have had a good run higher so people at the moment aren’t willing to stick their neck out too far,” said Stephen Pope, chief global equity strategist at Cantor Fitzgerald in London. “We are going to see increased volatility, particularly towards year end, but any dip is just a good opportunity to return to the market.”

Our Initial Jobless Claims came in at 502,000 for the week, down 12,000 from last week and the lowest level since January – which lets you know how awful the year has been more than anything else. Firings may slow as the loss of 7.3 million jobs since the recession began in December 2007 probably means many companies have already cut staff to bare minimums. That may not stop the jobless rate from climbing further after reaching a 26-year high in October as the shortest workweek on record gives employers room to increase hours before taking on staff. The drop in claims is “reassuring, but these levels are still consistent with job losses,” said Jonathan Basile, an economist at Credit Suisse in New York. “We’re not getting a strong enough vote of confidence yet from claims to say companies have stepped up their hiring and greatly reduced their pace of layoffs.”

We are just going to be watching our levels today. It’s been a pretty dull week with very few picks made as we wait to see how the top of our range plays out. We’ll see oil inventories at 10:30 and if those don’t support $77.50 we could get a sell-off in that sector and gold has to prove they can hold $1,112, which is considered a technical there. If this rally is real we’ll expect copper to actually close above $3 and silver is STILL $17.50, not really following gold up to the sky either (we are short on gold after cashing out the bullish leg of a spread with a nice profit).

We expected the market to hold up today ahead of the Bill Gates and Warren Buffett show this evening and President Obama will be announcing a "Jobs Summit" this morning so it’s been stimulus, spin and more stimulus all week – pretty sad if the bulls can’t make something out of that! Tomorrow we get Trade Data and the Michigan Sentiment Report but Monday is more interesting as we get October Retail Sales (just 41 days until Christmas!) along with Business Inventories and Empire Manufacturing.

We’ve already had an inkling of what Retail Sales will be as MasterCard’s SpendingPulse "showed further signs of stabilization in October, but they’re not posting the kind of gains that would significantly boost the economy." Sales excluding autos were flat compared to September, according to SpendingPulse, which compiles spending data based on credit card purchases as well as estimates for cash and checks. On a year-over-year basis, sales excluding autos and gas were up 1.5%.

We’ve already had an inkling of what Retail Sales will be as MasterCard’s SpendingPulse "showed further signs of stabilization in October, but they’re not posting the kind of gains that would significantly boost the economy." Sales excluding autos were flat compared to September, according to SpendingPulse, which compiles spending data based on credit card purchases as well as estimates for cash and checks. On a year-over-year basis, sales excluding autos and gas were up 1.5%.

"Consumers aren’t pulling back, but aren’t necessarily going out and spending a lot either,” said Kamalesh Rao, director of economic research at SpendingPulse. “We’ve rescued ourselves from lurches downward, but we’re seeing a consumer that is really plateauing into a phase where we’re not talking about great growth or acceleration of spending.”

Hey, don’t worry! I’m sure Cramer would point out that Retail Spending is only 70% of the GDP and 70% is not 100% so the markets can go up 30% so BUYBUYBUY everything that is already up 70% because it’s going to 100% – or something like that. Me, I’ll remain cautious for now, I’d rather remain cautious for 41 more days to see if there really is a Santa Clause than make cash bets on him despite much data to the contrary. If we get over our levels, I can become a believer (mostly because then there will be an easy to identify floor that tells us when to get back out) but, until then, "You’d better watch out…"