![[Growth and Deflation chart]](http://s.wsj.net/public/resources/images/NA-BC020B_JECON_NS_20091115220414.gif) Good morning!

Good morning!

Japan had a huge GDP beat (+1.2% for the Q, 4.8% annualized)) and they leaked it early (to oil executives!) but, strangely, deflation is accelerating at the same time. That’s great news for stimulus watchers as the government can continue to pump money into the economy, even while it’s growing and, of course, the carry trade can continue.

Despite the robust third-quarter report, Japanese officials said they were still concerned about the economy’s strength going forward, and didn’t intend to pull back plans for further spending to ensure continued growth.

"There is no change in the severe condition of the country’s economy," Naoto Kan, the deputy prime minister, told reporters after the report’s release. "We are concerned about whether the economy falls into a deflationary situation," he added.

The domestic demand deflator — a measure of changes in prices of goods and services, excluding exports and imports — plunged 2.6%, the fastest pace since 1958. It was the third straight quarter of falling prices.

Another sign of concern in the report: The contribution of private consumer spending to growth slipped in the third quarter, suggesting measures to convert Japan from export-led growth to domestic-demand-led growth were facing limits. In the third quarter, private consumer spending, rose 0.7%, compared with a revised 1% climb in the second quarter.

It’s all stimulus but there’s no sign stimulus is stopping so party on markets. Japan also got a huge benefit from the Chinese auto sales – more stimulus! The Nikkei itself isn’t thrilled and is up just 0.25%, barely hitting Friday’s high on a stick-save into the close but that didn't stopping the futures from jumping up more than half a point and gold from hitting $1,130. I sent out an Alert to Members at 2:24 this morning saying:

It’s all stimulus but there’s no sign stimulus is stopping so party on markets. Japan also got a huge benefit from the Chinese auto sales – more stimulus! The Nikkei itself isn’t thrilled and is up just 0.25%, barely hitting Friday’s high on a stick-save into the close but that didn't stopping the futures from jumping up more than half a point and gold from hitting $1,130. I sent out an Alert to Members at 2:24 this morning saying:

"Once the Nikkei closes (2am EST) the Hang Seng will have an hour to themselves and that should top out our futures (the Hang Seng is up at 22,900 (+1.5%). The shorting move on gold futures is to short them as they cross below $1,130 with zero tolerance for holding gold above that line. The same can be done with the S&P futures at 1,100, the Dow at 10,316 and the Nas at 1,800 and you can even use the 2 out of 4 rule to short one of the laggards only AFTER two others break down to be a little safer. We have Retail Sales at 8:30, which should be the next big market mover and keep in mind that Retail Sales were LOWER than expected in Japan for Q3.

So far that strategy has worked out fine for some pre-market fun, as we made our futures highs as predicted, but have steadliy bounced off those levels since – making for a series of small, successful futures wins so far this morning (8:20) while we wait for the big dip on Retail Sales.

Oil is $77.33 and we’re still watching that $77.50 mark. Copper is very excited about Japan and is back over $3 while silver hit $17.75. As usual, the dollar is the World’s whipping boy at $1.4975 to the Euro and $1.6725 to the Pound and still under 90 Yen at 89.59. That $1.50 line on the Euro is going to be critical, if that one breaks, the markets could break higher as the dollar heads to new lows.

There are some great charts this morning in our Chart School section from Fallond Stock Picks and Pragmatic Capitalist and it’s this Russell Chart we’ll be watching closely today as that’s the index that needs to turn (back over 600) for us to get more comfortable with our bull side.

Europe seems just thrilled this morning as well, with the FTSE well above the 5,250 danger zone at 5,358 (8:25am) but we still need the Dax to give us the go signal at the 8,750 mark, where it is right at the resistance line we predicted last week. Let us first keep in mind that we are pessing the break UP levels and we do have to respect those lines, not try to buck the trend if we get over them but I am STILL skeptical as I'm also reading in Europ that mega-retailer H&M had worse-than-expected October sales, especially in hard-hit unemployed nations like France, Spain and the United States. "There are large differences between markets," an analyst noted. "The U.S. was not good during [the third quarter], and it has continued in October."

What are the concerns that keep us from running with the bulls? We are concerned about Retail Sales and we are concerned about a bounce in the dollar dumping commodities and leading to a major market sell-off. The pain being caused by the weak dollar to foreign manufacturers is evident in EADS's report, where they swung to a net loss in the third quarter as it was hit by the strength of the Euro, cost increases and as the economic downturn and crisis in the airline industry forced its Airbus unit to lower prices for its jets. EADS said the drop largely extent reflected a €965 million ($1.47Bn) revaluation in contract provisions at the closing spot rate in the year-earlier period.

What are the concerns that keep us from running with the bulls? We are concerned about Retail Sales and we are concerned about a bounce in the dollar dumping commodities and leading to a major market sell-off. The pain being caused by the weak dollar to foreign manufacturers is evident in EADS's report, where they swung to a net loss in the third quarter as it was hit by the strength of the Euro, cost increases and as the economic downturn and crisis in the airline industry forced its Airbus unit to lower prices for its jets. EADS said the drop largely extent reflected a €965 million ($1.47Bn) revaluation in contract provisions at the closing spot rate in the year-earlier period.

Another concern out of Europe (sorry) is British Business Confidence falling again in October as access to credit remained tight, while house prices dipped in the first half of November. 33% of companies said it was more difficult to access bank finance in the three months to October, up from 20% in the three months to June. The Bank of England Wednesday said that while the U.K. economy has begun its recovery, activity won't return to its 2007 level until 2011 at the earliest. The Central Bank once again highlighted weak bank lending as a significant drag on growth.

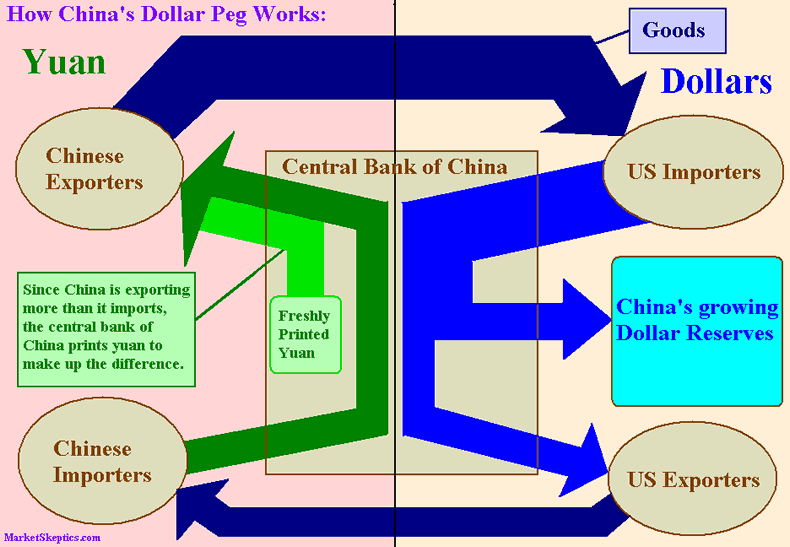

The decline of the dollar and decisions in the U.S. not to raise interest rates have caused “huge” speculation in foreign exchange trading and seriously affected global asset prices, said Liu Mingkang, chairman of the China Banking Regulatory Commission. “The continuous depreciation in the dollar, and the U.S. government’s indication, that in order to resume growth and maintain public confidence, it basically won’t raise interest rates for the coming 12 to 18 months, has led to massive dollar arbitrage speculation,” he told reporters in Beijing today at the International Finance Forum. Liu said this has “seriously affected global asset prices, fuelled speculation in stock and property markets, and created new, real and insurmountable risks to the recovery of the global economy, especially emerging-market economies.”

8:30 Update: Well, we got our Retail Sales and woo-hoo on our futures bets as they were a bit disappointing. The headline number was a strong 1.4%, double expectations of 0.7% but strip out autos and we fall to 0.2%, 1/2 the expected 0.4% move. Even worse, to those who are paying attention, is the 50% downward revision to September sales from -1.5% to -2.3% so, essentially, this whole monh's gain is due to shoving Sept Auto Sales forward into October. Worse than Retail Sales is the Empire State Manufacturing Survey, which fell from 34.57 in October to 23.51 in the November survey. Employment Index fell to 1.3 vs. 10.4 prior and new orders dove to 16.7 vs. 30.8 in October. Price dropped -2.6 but better than October's -5.2. More than 40% of manufacturers expect cash holdings to increase over the next year, vs. 24% expecting decline; a year ago more manufacturers had expected cash holdings to decline than to rise.

There is plenty of data in the week ahead including tomorrow's PPI and Industrial Production reports. Wednesday is CPI and Housing Starts and Thursday we get Jobless Claims, Leading Economic Indicators and the Philly Fed so lots of ways to yank the market around this options expiration week. We also have a lot of retail earnings from PSUN tonight, HD, SKS, TGT, TJX, and LZB tomorrow. BJ, CHS, PERY, GYMB, HOTT, JACK, LTD, PETM and PVH report on Wednesday. Thursday is huge with PLCE, DKS, GME, ROST, SHLD, SCVL, SI, SMRT, BKE, TWB, WSM, DEL, DBRN, FL, GPS, WTSLA and ZUMZ and Friday we get ANN and SJM as well as DHI with a peak at the housing market.

We're just watching our major breakouts today to see if we get any: Dow 10,300, S&P 1,100, Nasdaq 2,200, NYSE 7,200 and Russell 600. Anything less than that is going to be a disappointing week for the bulls, who must prove we're not topping out here ahead of the short holiday week next week.