Being a fib fan does not mean that you are a member of the Fibonacci fan club. Here’s what it is. – Ilene

Week-end Outlook!!!

Courtesy of Michael at EW trends and charts

Fibonacci Fans

Since I have been posting a Fibonacci fan (Fib fan) chart in my blog everyday, interest has really been picking up among people on what a Fib fan is, and how to use one, so I will try to explain.

Fibonacci fans are very similar in concept to the Fibonacci retracements and in many ways they are used the same way. Both are effective tools for identifying support and resistance levels, determining trend, identifying areas to enter and exit, and providing levels to set stops.

Fibonacci fans go one step further than Fibonacci retracements by adding time to the equation. Fibonacci fans use the same primary ratios of 38.2%, 50% and 61.8% that form the "Golden Ratio."

Fibonacci Fans use these ratios based on time and price to provide support and resistance trendlines. They are used to measure the speed of a trend’s movement, higher or lower. In a bullish Fib fan, the higher the fan that the price is in, the stronger the movements. As price starts to deteriorate and weaken, the price will challenge the first fan, where at first it provides support. When price breaks through the first fan line, it usually keeps going.

If the price moves below a Fib Fan trendline, then the price is usually expected to fall further until the next Fib Fan trendline is reached. When the final fan has been broke and the price is no longer within the fan, it signals that the trend has changed. Used along with Elliott wave counts, is a great tool for confirming a trend change has taken place but I wouldn’t rely on Fib fans alone. Use them with other technical analysis tools.

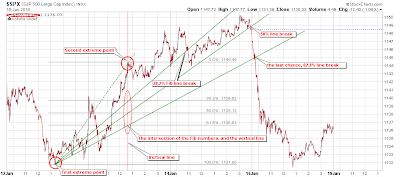

The chart above is the SPX for the last three days [click on charts to enlarge]. I applied the high and low extreme points after there was enough data to establish the trend. The diagonal fan lines are then based on an imaginary vertical line drawn from the top to the bottom price levels of the trend. The fan lines are drawn from the bottom of the trend through the vertical line at its 38.2, 50 and 61.8% points. Determining the extreme points of the tops and bottoms of the trend is somewhat subjective, especially when the trend is in its earliest stages. However, Fib fans, like retracements, can tolerate a fair amount of variation.

This (above) is the chart I post everyday. It is a very good example of how the fans can be used as another important trading tool.

The green fans, are the bullish fans, and the blue ones are the bearish fans. An important event occurred yesterday with respect to both of the bullish fans. A solid break happened, now the bullish fans have turned to resistance, and a new short-term trend has developed.

When new trends developed, the initial move can be extreme, as evidenced by the angle of the blue fan, making the first set of fans short-lived. Until enough price data becomes available to set a longer term trend, I treat these extreme movements with caution.

This is a chart of the SPX that goes back three months with no short-term Fib fan support, notice how all the lines of the fans are now above the price of the SPX, resistance, not supportive.

This chart shows the whole rally of the SPX from 666, with four sets of Fib fans. The first set, blue, was the first reliable set as the rally progressed, and if one were to have used this chart, you would of caught the sell-off from 956, and would of seen that the SPX recaptured the fan at 869, when it turned bullish again. The 2nd set, the green fans were established after 956 become the most important high, and now is the longest-term fan that the SPX is still respecting, with final support in the 1120-1125 area. The 3rd set, gray, is a shorter term fan that also is still being respected, with its final support in the 1110-1115 area. The final set of fans are the purple ones, and I just set them there speculating, what if a top was put in last week at 1150. If that was a top, the purple fans would be useful to set areas of support as a sell-off commences. If the SPX were to break through all of its fans, it would further signal that the rally from 666 was over.

This is a project being worked on with Anchak and myself about using a previous trend to help predict how a new trend could play out by using the strength of the older trend. Combined with the Fib fans we can lay-out some support/resistance levels for the new trend while still in its infancy. The blue dashed lines on the chart are just trend lines from the high/low extremes of the wave, then by calculating the angle of that trend we can measure its strength, then imposing the exact angle onto the new trend, we set the second point of the median line so we can draw a new set of Fib fans, even before any price data becomes available.

The above chart shows the back testing that I have done on the longer-term chart of the SPX, please note, all those Fib fans are set using only the previous waves trend strength.

We believe the best use of this technique might be to bridge that gap between the start of a new trend, where there is yet not enough price action to set a normal Fib fan, while we wait for a reliable spot to place the second of the two points required for the fan.