Our favorite bond pimp is in some mood this month!

Our favorite bond pimp is in some mood this month!

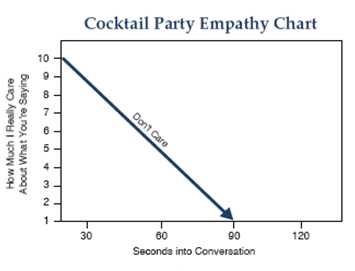

Maybe it's because, despite PimpCo's best efforts, they failed to tank the markets last week but Gross starts his March newsletter off with this harsh chart but his words are even harsher – saying of cocktail parties:

I suppose the parties wouldn’t be so bad if there was something original to be said, or if “you” had a genuine interest in “me” as opposed to “you,” but let’s face it folks, no one does. The only reason any of us really cares about cocktail conversations is to quickly redirect someone else’s stories into autobiographies that we assume to be instant bestsellers if only in print. If not, if the doe-eyed listener seems simply fascinated by what you’re saying, you can bet there’s a requested personal favor coming when you finally shut up. “Say Bill, I was wondering if you knew somebody at…that could…” Yeah right! But, as my chart shows, 90 seconds into a typical conversation, no one gives a damn about you and your problems – maybe those shoes and that dreadful eye shadow you’re wearing, but not anything audible coming out of your mouth.

Yow Bill! Tell us how you really feel… After telling us how appalling he finds it to endure 90 seconds of our time at a party, Bill then asks for his own 90 seconds to teach us about economics. I'm not going to edit as it is about 90 seconds worth but after that opening – don't you find it kind of hard to read what he has to say without looking for a place to throw a virtual punch?

To begin with, let’s get reacquainted with the fundamental economic problem of our age – lack of global aggregate demand – and how we got to where we are today:

(1) Twenty years of accelerated globalization incrementally undermined the real incomes of most developed countries’ workers/citizens, forcing governments to promote leverage and asset price appreciation in order to fill in what is known as an “aggregate demand” gap – making sure that consumers keep buying things. When the private sector assumed too much debt and asset prices bubbled (think subprimes and houses, or dotcoms/NASDAQ 5000), American-style capitalism with its leverage, deregulation, and religious belief in lower and lower taxes reached a dead end. There was a willingness to keep on consuming, there just wasn’t the wallet. Vigilantes – bond market or otherwise – took away the credit card like parents do with a mall-crazed teenager.

(2) The cancellation of credit cards led to the Great Recession and private sector deleveraging, the beginning of government policy reregulation, and gradual deglobalization – a reversal of over 20 years of trade policies and free market orthodoxy. In order to get us out of the sinkhole and avoid another Great Depression, the visible fist of government stepped in to replace the invisible hand of Adam Smith. Short-term interest rates headed to 0% and monetary policies of central banks incorporated new measures labeled “quantitative easing,” which essentially involved the writing of trillions of dollars of checks to replace the trillions of dollars of credit that disappeared after Lehman Brothers. In addition, government fiscal policies, in combination with declining revenues, led to double-digit deficits as a percentage of GDP in many countries, a condition unheard of since the Great Depression.

(3) For awhile it seemed that all was well, that the government’s checkbook could replace the private market’s wallet and credit cards. Risk markets returned to normal P/Es as did interest rate spreads, and GDP growth resumed; it was only a matter of time before job growth would assure the world that we could believe in the tooth fairy again. Capitalism based on asset price appreciation was back. It would only be a matter of time before home prices followed stock prices higher and those refis and second mortgages would stuff our wallets once again.

(4) Ah, but Dubai, Iceland, Ireland and recently Greece pointed to a potential flaw in the model. Shaking hands with the government was a brilliant strategy in 2009 when it was assumed that governments had an infinite capacity to leverage themselves.

But what if they didn’t? What if, as Carmen Reinhart and Kenneth Rogoff have pointed out in their book, “This Time is Different,” our modern era was similar to history over the past several centuries when financial crises led to sovereign defaults or at least uncomfortable economic growth environments where real GDP was subpar based on onerous debt levels – sovereign and private market alike. What if – to put it simply – you couldn’t get out of a debt crisis by creating more debt?

You know, for a pompous jackass – the man makes a good point… Gross goes on to say that while emergency deficit spending may work over the short-run – "Based on existing deficit trends and the expectation that not much progress will be made in reducing them, markets are raising interest rates on sovereign debt issuance either in anticipation of higher future inflation, increased levels of credit risk, or both. This places a potential “cap” on the “debt” that supposedly can be created to get out of the “debt crisis.” Clearly Mr. Gross has not met the White Rabbit nor has he read my October rant on the Wonderland Market (probably because it's longer than 90 seconds), nor did he read today's FT article titled "How Reagan Ruined Conservatism," which clearly points out that he is talking to the proverbial wall.

Gross makes an excellent point about the global homogenization of debt we are seeing, saying: "Government bailouts and guarantees such as those evidenced and envisioned in Dubai and Greece, as well as those for the last 18 months with banks and large industrial corporations across the globe, suggest a more homogeneous “unicredit” type of bond market. If core sovereigns such as the U.S., Germany, U.K., and Japan “absorb” more and more credit risk, then the credit spreads and yields of these sovereigns should look more and more like the markets that they guarantee. The Kings, in other words, in the process of increasingly shedding their clothes, begin to look more and more like their subjects. Kings and serfs begin to share the same castle."

Gross makes an excellent point about the global homogenization of debt we are seeing, saying: "Government bailouts and guarantees such as those evidenced and envisioned in Dubai and Greece, as well as those for the last 18 months with banks and large industrial corporations across the globe, suggest a more homogeneous “unicredit” type of bond market. If core sovereigns such as the U.S., Germany, U.K., and Japan “absorb” more and more credit risk, then the credit spreads and yields of these sovereigns should look more and more like the markets that they guarantee. The Kings, in other words, in the process of increasingly shedding their clothes, begin to look more and more like their subjects. Kings and serfs begin to share the same castle."

While this may, in the short-term, be a "good thing" as we save Greece from having to pay a logical 10% interest to borrow their next Drachma, what we have really done is have Europe as as a co-signer to Greece's refinancing. This is no longer about Greece learning how to restrain themselves or suffering the consequences but about Greece learning to restrain themselves or we ALL suffer the consequences. The same obviously goes for the US, who has now directly guaranteed what Whitney and Roubini estimated to be $6Tn of potentially bad bank debts as well as stepping in behind AIG, FRE and FNM to guarantee tens of Trillions more in MBS and CDS securities. As anyone who has done a relative favor and co-signed for a home loan knows – it's all well and good as long as they make their payments but, as soon as there is a slip – it becomes very much your problem!

Today our Wonderland Market is climbing back to test the top of our bounce zone using what Douglas Adams called "The SEP Effect" or "Somebody Else's Problem." This allows the market to ignore Gross's logic as well as all the bad news and just climb along an uptrend on a broken wing and a muttered curse. As Adams puts it: "An SEP is something we can't see, or don't see, or our brain doesn't let us see, because we think that it's somebody else's problem…. The brain just edits it out, it's like a blind spot. If you look at it directly you won't see it unless you know precisely what it is. This is because it relies on people's natural predisposition not to see anything they don't want to, weren't expecting, or can't explain."

Today our Wonderland Market is climbing back to test the top of our bounce zone using what Douglas Adams called "The SEP Effect" or "Somebody Else's Problem." This allows the market to ignore Gross's logic as well as all the bad news and just climb along an uptrend on a broken wing and a muttered curse. As Adams puts it: "An SEP is something we can't see, or don't see, or our brain doesn't let us see, because we think that it's somebody else's problem…. The brain just edits it out, it's like a blind spot. If you look at it directly you won't see it unless you know precisely what it is. This is because it relies on people's natural predisposition not to see anything they don't want to, weren't expecting, or can't explain."

Using that simple logic, the market is able to shake of CDS, MBS, Trillion Dollar deficits, double digit unemployment, foreclosures, credit card defaults, inflation and hosts of other concerns and JUST GO UP – because – it's nicer than down isn't it?

We do sort of kind of think something will be done about Greece by Friday as Merkel is meeting with Papaconstantinou in Germany where he promises not to ask for WWII reparations and she promises to give him money just for the hell of it. If we do not get a resolution on Greece by Monday, I imagine the markets will be very disappointed. The British Pound is on the edge of the $1.50 cliff and there is a lot of futures betting that they will fall to $1.35 – on par with the Euro by the end of March – clearly that is not our problem but that homogenization of debt that Gross points to may make it our problem very soon. Australia rasied their benchmark rate to 4%, 3.5% higher than ours as we vie with Japan to be the new source of carry-trade funding for the next decade.

China had a little pullback this morning as the Hang Seng dropped 150 points (0.75%) and the Shanghai fell half a percent (15 points) but the Nikkei rose 0.5% and broke over our 10,200 bounce level to 10,221 while the BSE racked up a 2% gain to 16,772. China was hit by New Home Sales in Shanghai falling 54% in February to the lowest monthly volume registers since tracking began in 2005. That's down an ADDITIONAL 54% from January's 51% drop. "Policies implemented by the government to curb speculation in the overheated real estate market, traditional slack momentum during the Spring Festival as well as growing wait-and-see sentiment among buyers dragged the city's monthly volume to a record low although they didn't impact the housing prices," said Lu Qilin, a researcher at Uwin. Clearly this is somebody else's problem…

Also not our problem is the urban/rural income gap in China hitting a new record (we discussed causes for this in yesterday's post and in Member Chat over the weekend re. the NY Times article) as city wages have pushed to a whopping per capita of $2,525 a year vs. just $757 a year earned by the average Chinese country mouse (and there's about 1.1Bn of them). I guess we can raise the standard of living of 1.1Bn farmers by 10% ($83Bn) by redistributing it from the top 30% (in true communist fashion) as the top 300M only earn a collective $757Bn so it works out to just a little 10% taken from the "rich" and given to the poor to bring the ratio back to an just an appalling 3:1 (now 3.3 to 1).

None of this is Europe's problem and they are having another nice day with 1% gains across the board. The Dax finally got over our 5,750 target so this is going to be the US's race to lose today as we closed with all 5 of our indices over our bounce lines yesterday. Euro-zone deflation – oops, I mean inflation – remained low, at 0.9% in February, despite a 10% rise in fuel prices because the Eurostat data, just like our own beloved CPI, doesn't include prices for energy, food, alcohol and tobacco. That way, we can show increases in consumer spending by squeezing them on essentials and forcing them to go into debt while at the same time claiming inflation is under control so we can continue to make rates artificially low which allows the bankers to keep raping the consumers on the lending spreads while disincentifying savings with ridiculously artificially low rates since the consumers have to compete as lenders with a government who simply prints money and gives it to the bank.

Oh sorry, forget I said that – it's not our problem…

We took our short oil profits and ran yesterday – getting a little more cashy in order to take advantage of this morning's run-up to do a little more shorting. We have Auto Sales throughout the day and if they come in positive, I'll be getting more neutral but tomorrow we get a lot of employment data and ISM services and the Beige Book so I'm willing to stay short into that data if need be as this very low-volume attempt to shove us back into an uptrend is a very dangerous game and we can slip back surprisingly fast if sentiment turns.