10 Winners and 5 losers but our loser is a doozy!

Despite being down $7,170 on our FAZ hedge, we are at net $99,079.64 in the virtual portfolio after two weeks, which is fine as we still have plenty of premium to collect and we still have $92,884.64 in cash with $163,661.13 in available buying power. Now comes the hard part – where (if anywhere) do we need to make some adjustments? I was a little too skeptical of the rally, we could have grabbed some more bargains but I thought we'd at least try to make our adjustments to this well-balanced set first and THEN worry about adding more complexity – kind of like this video on balance.

We closed our first position on Friday, buying back the FAZ Apr $17 calls for .95, a $1.68 gain off our $2.63 short entry (up 64%) for a $2,860 gain. As we expected, our other positions did very well as FAZ went down but it does look like we could do with a few more of them, especially if this continues. Don't forget we were supposed to fill the FAZ spread at $2.20 and it filled at $2.53, which is a $990 difference on 30 contracts and that is the entirety of our loss. If you have a broker that does "little things" like this to you – THEY ARE KILLING YOUR PROFITS! Don't let them get away with it… Our other positions are all open and as follows:

How are our trading plans holding up?

BAC – 10 Apr $15 puts sold for .46, now .23. – up 50% (margin $1,730). $1,730 in margin is a lot to try to make $230 but not if you're not using it for anything else. Also, it's $230 in 6 weeks on $1,730, which is 13% or 112% a year so don't sell these little victories short! We are 50% ahead and way ahead of our goal for 2 weeks on this trade but the real questions are: 1) Do we have any better use for the margin? No, we do not as we are still early in our scales and we anticipate having lots of cash around for a few months. 2) Are we worried about losing the 50% ($230) we already made? Ah, that's an interesting question. Let's define "worry," shall we?

BAC has a rising 200 dma AND a rising 50 dma that don't look like they want to cross each other. The have just had a huge run off $14.50 but we knew that when we bought them and we weren't "worried" about $15 then. Why were we not worried? Because we WANTED to own BAC for $14.50. In this case, our consolation prize for NOT getting to own BAC at $14.50 is $460 and no BAC stock. So I am not "worried" BAC will fall back to $14.50 – I am worried that it won't and I'll have to wait for another chance to get a good deal on a bank stock.

BAC has a rising 200 dma AND a rising 50 dma that don't look like they want to cross each other. The have just had a huge run off $14.50 but we knew that when we bought them and we weren't "worried" about $15 then. Why were we not worried? Because we WANTED to own BAC for $14.50. In this case, our consolation prize for NOT getting to own BAC at $14.50 is $460 and no BAC stock. So I am not "worried" BAC will fall back to $14.50 – I am worried that it won't and I'll have to wait for another chance to get a good deal on a bank stock.

Meanwhile, how can I be worried that BAC will drop 10% when I'm holding 30 uncovered FAZ calls? I would be THRILLED, at the moment, to give that $230 back, if I can get my $7,000 back on FAZ, right? So the answer to this one – so far – is no, I am not worried about my BAC puts so I don't really have any intention of taking them off the table BUT – that should not stop me from offering to buy them back for .15, a price at which it would be silly not to clear the decks with 5 weeks remaining to expiration. So that's the adjustment – offer to buy back the puts for .15.

Don't forget that this is a very low-touch virtual portfolio so I'm making decisions for the week on the weekend, assuming I'm going to be busy at work at some sort of real job where I don't have time to watch the markets all day… Also, I hope my stream-of-consciousness typing isn't too confusting but I'm trying to narrate my thought process on these trades while I look at them.

FAZ – 30 Apr $15 calls at $4.10, now $1.71 – down 58% (no margin). As I mentioned, we made $1.68 on the $17s so our net basis on this play is now $2.42 and we are down a tolerable 29%. The naked FAZ calls are very powerful protectors against a downturn in the financials and I just paid .95 to nakify these (my internal monolog has many made-up words!) as they have a .65 delta and they are already .85 in the money (50%). What are our options?

1) Sell more puts on financials. We have a lot of margin we're not using and we can sell puts LIKE (and example only) UYG $6s for .11, which have a net $100 per $11 margin so I can raise $3,300 for $30K in margin over the next two weeks and for UYG to get to $5.89 (causing me to pay back the putter in full) from $6.16 would be a 5% move on this 2x ETF so we figure that would raise FAZ 7.5% back to $17, which would add about .80 to the calls or $2,400 before I lose a penny on the trade. So, if the market keeps going up, that's the likely play as it's simple and should be rollable to the Apr $5 puts, where FAZ would be up aother $3 to $20 for $15,000 back on that position. Again, not necessarily selling 300 UYG puts but that's the concept and focusing on what you can do with an ETF allows you to benchmark possible bank entries.

2) Offset them. I don't want to lose more so I could do something like buy an FAS July $80/84 bull call spread for $2. That makes $4 if FAZ goes any lower and I could potentially lose $5K more so buying $5K worth of this spread caps my losses. Since they are out in July, if FAZ rebounds I can assume I'll retain good value as my net delta is just .06 but FAS is 5x FAZ so it's more like a .30 delta to my .65 delta on FAZ. That means if I get my $7,500 back on FAZ I'm sacrificing about $3K of it here so not too appealing.

3) Roll 'em! I'm in the FAZ Apr $15 calls at net $2.42 and I can sell the Apr $16 calls for $1.30 and adding .80 more will roll us to the July $13s, now $3.80. That puts us in the July $13s at net $3.12 that are $2.85 in the money with Apr $16 callers. This would no longer be covering anything (important note) as there's not much to be gained but we have an excellent chance of getting even over time. So this is going to be the plan if the markets refuse to turn down.

GE – Complex 2011 spread – on target (margin $1,810). Ah, do you see how nice it is to have part of your virtual portfolio taken up with things you are not worried about?

KEY – 5 Apr $7 puts sold for .45, now .35 – up 22% (margin $594). Ah HA! See, I knew if I didn't worry about what to sell more puts on something would come to me! Good old KEY! We liked the entry when they were at $6.85, now they are at $7.24 and we can still get 78% of our original sale price with a pretty good margin ratio ($594:175 = 3.3:1) – that's much better than the 10:1 on UYG but this one is for 6 weeks, of course. So this will be high on our list to possibly add to if we keep going up next week. We WANTED $3,150 worth if they were put to us – are we willing to risk having $9,900 worth (1,500 shares at net $6.60) put to us in exchange for $700? Have to think about it but probably acceptable.

SIRI – 50 Apr $1 puts sold for .15, still .15 (margin $1,457). This is great margin bang for the buck if nothing else! We REALLY want to own SIRI long-term and we're not worried about owning 5,000 shares at net .85 so nothing to do here but watch what happens.

SPWRA – 5 Apr $19 puts sod for $2, now $1.15 – up 42% (margin $1,525). Hey, remember when these were way underwater and we didn't worry because we REALLY wanted to own SPWRA for net $17 so we patiently waited and now we're up 42%? Yeah, good times… Selling puts because you REALLY want to own a stock at the net entry and selling calls because you REALLY want to be short the stock at the net entry makes your life much more relaxing!

SRS – 10 Apr $7 puts sold at .39, now .57 – down 46% (margin $1,588). This is another hedge so we're not too worried with SRS at $6.79 and our net entry at $6.61. Do we REALLY want to own SRS at $6.61? Well, we can sell the Apr $6s (6 weeks out) for .83 so we'll figure we can sell the July $6s (12 weeks from Apr exiration) for at least $1, which would drop out basis to $5.61 with a call-away at $6 for a 7% profit – disappointing but livable if we have to. The July $6 puts are .45 and if we do drop lower, I would consider a sale at .75 as a July Double Down at net $5.25, which would effectively create a buy/write with my theoretically put to me April $7 puts and the July $6 calls I intend on selling and that buy/write would net out at $4.61/5.31 so that's 22% lower than today's price with a 30% profit if called away. See – I've talked myself into totally not worrying about this position!

SRS – 10 Apr $7 puts sold at .39, now .57 – down 46% (margin $1,588). This is another hedge so we're not too worried with SRS at $6.79 and our net entry at $6.61. Do we REALLY want to own SRS at $6.61? Well, we can sell the Apr $6s (6 weeks out) for .83 so we'll figure we can sell the July $6s (12 weeks from Apr exiration) for at least $1, which would drop out basis to $5.61 with a call-away at $6 for a 7% profit – disappointing but livable if we have to. The July $6 puts are .45 and if we do drop lower, I would consider a sale at .75 as a July Double Down at net $5.25, which would effectively create a buy/write with my theoretically put to me April $7 puts and the July $6 calls I intend on selling and that buy/write would net out at $4.61/5.31 so that's 22% lower than today's price with a 30% profit if called away. See – I've talked myself into totally not worrying about this position!

UNG – 500 shares at $8.77, now $8.35 – down 5% (no margin). The blew past our $8.50 cover target and, of course, I had said in the last post: "We have now filled everything but the short calls on UNG, which is dangerous as I really don’t trust UNG at all but it’s an October play so way to early to worry." Not worrying does not mean not being annoyed, and I am! I'm distrustful of nat gas anyway and they burned me. The plan was to sell 1/2 the Jan $8s for $1.60 and they are now $1.50 so no major damage and we'll have to give next week a day or two to play out before deciding.

UNG – 5 Oct $8 puts sold for .80, now .90 – down 12.5% (margin $901). Will nat gas stay below $5 through hurricane season? I don't think so. Should be an easy roll to the next year anyway.

UYG – 20 Apr $5 puts sold for .16, now .06 – up 62% (margin $1,120). OK, holding $1,120 in margin for 6 weeks to collect $120 just kind of goes against my grain and I actually put in an order to buy them back for .05, but I'm cancelling it as $5 is 20% out of the money and we don't mind owning UYG at net $4.84 at all and why throw away $100 just because the nickel put is going to annoy me for a month?

UYG – 20 Apr $5 puts sold for .16, now .06 – up 62% (margin $1,120). OK, holding $1,120 in margin for 6 weeks to collect $120 just kind of goes against my grain and I actually put in an order to buy them back for .05, but I'm cancelling it as $5 is 20% out of the money and we don't mind owning UYG at net $4.84 at all and why throw away $100 just because the nickel put is going to annoy me for a month?

VLO – 5 Apr $18 puts sold for $1.10, now .27 – up 75% (margin $1,035). Similar to UYG with just $135 left to win. Since we REALLY, REALLY wish we could buy VLO for net $16.90 and we really don't need the margin, we can let this one slide. At .10 I'll probably change my mind but I'm not paying .27 for puts that are almost 10% out of the money.

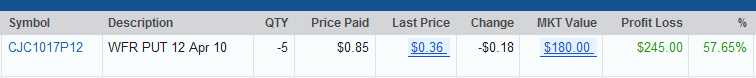

WFR – 5 Apr $12 puts sold for .85, now .36 – up 57% (margin $780). Another winner from the "I told you not to worry" collection of fine beaten-down stocks.

This goes for all our naked puts that we're riding out – I am much braver with our naked FAZ plays than I would be if we decide to roll them. My plan is to see what happens Monday and Tuesday and hopefully by Tuesday night I'll have some idea of where I want to go next with this group. Iceland rejected the bank bailout and China looks like they are going to let local governments default on bonds too – If we shake all that off and keep moving higer, there may be nothing else to do but climb on board but until we see a move with more volume conviction than last week – cash remains the king of our virtual portfolio!