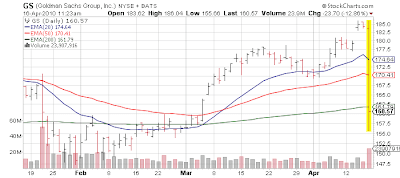

So, GS is down 13% – Mark wonders the obvious, did the GS traders get short in time? (See also Zero Hedge’s Did Goldman Short Itself, Reuters Reports Goldman Was Told In Advance It Faced SEC Action) – Ilene

Goldman Sachs (GS) Charged with Fraud by SEC; Firm Immediately Lashes Out at Stock Market Sending it down 1.5%

Courtesy of Trader Mark

Well since 70% of the trades nowadays are controlled by a handful of firms, the last thing you want to do is upset Goldman Sachs "the market". I am selling my SPY calls for a loss because the last thing I want to do is get in front of the most powerful firm on Earth when they are throwing a temper tantrum. How dare the SEC!

I’m sure once the back channel negotiations are complete nothing will come of this, but it makes for good populism for the peasantry.

Via WSJ:

- The Securities and Exchange Commission charged Goldman Sachs Group Inc. and one of its vice presidents for defrauding investors by misstating and omitting key facts about a financial product tied to subprime mortgages.

- The SEC said Goldman Sachs structured and marketed a synthetic collateralized-debt obligation, or CDO, that hinged on the performance of subprime residential mortgage-backed securities.

- According to the SEC, Goldman Sachs failed to disclose to investors vital information about the CDO, in particular the role that a major hedge fund played in the portfolio selection process and the fact that the hedge fund had taken a short position against the CDO.

- "The product was new and complex but the deception and conflicts are old and simple," said Robert Khuzami, Director of the Division of Enforcement. (snake oil really never changes its complexion does it?)

- "Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio, while telling other investors that the securities were selected by an independent, objective third party," Mr. Khuzami said.

- According to the SEC, Goldman Sachs failed to disclose to investors vital information about the CDO, in particular the role that a major hedge fund played in the portfolio selection process and the fact that the hedge fund had taken a short position against the CDO. "Undisclosed in the marketing materials and unbeknownst to investors, a large hedge fund, Paulson & Co. Inc. ["Paulson"], with economic interests directly adverse to investors in the [CDO], played a significant role in the portfolio selection process," the complaint said.

I wonder if Goldman made money today shorting its own stock, as it certainly had the news before the rest of us (allegedly) with all it’s "access to information". Anyone want to check the trades of who bought puts this AM? SEC?

EDIT 11:30 AM – Obama approval rating surges 32% in the last hour (ok I made that up)

EDIT 11:32 AM – Jim Cramer in frantic phone call with Lloyd Blankfein on how to put lipstick on pig during next CNBC appearance (ok I made that one up too)

Edit 11:42 AM – for your amusement follow this link for the comments section on this story in the New York Times. As I said, the populism quotient of this move is off the charts. Somehow I think Goldman will recover from the $1.8 million fine and "no contest" judgement. But it’s still fun.

No position