Our broken markets… Allan, who was watching his positions shoot up and down yesterday during the big price collapse, wrote this about the trading action of TYP. For a list of stocks that had trades canceled, including TYP, see: 296 ‘funked up’ stocks — trades canceled. – Ilene

Shameful

Courtesy of Allan

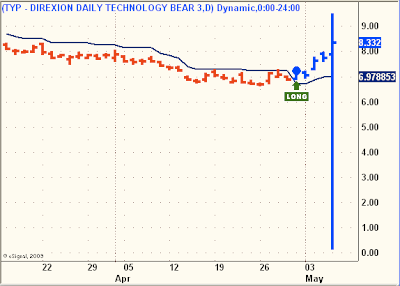

Just one example of how the markets broke down yesterday. Below, a daily chart of TYP, the 3X inverse ETF for the Russell 1000 Technology Index. I’ve owned TYP since it’s Buy Signal on April 30th @ $7.31. Yesterday, while the market was down over 900 points, TYP traded as high as $9.50 and as low as $0.15.

Since it’s in my portfolio and on my screen all day, I watched with equal emotional highs and lows. When it broke below $1.50, my hand hovered above the "Buy" button. But I knew it was erroneous, would be canceled, perhaps tying up my account and generally be a real mess to deal with. So I passed on "averaging down."

Speaks loudly to shameful failure of the system, as well as avoiding hard stops and instead, using mental stops, or better yet, options to hedge and protect.

Emphasis on shameful.

Allan’s newly launched newsletter, “Trend Following Trading Model,” goes with his trend-following trading system. Most trades last for weeks to months. Allan’s offering PSW readers a special 25% discount. Click here. For a more detailed introduction to the Trend Following Trading Model newsletter and trading system, read this introductory article.