What a freakin’ recovery!

What a freakin’ recovery!

As I said on Monday: "It’s a paper tiger of a straw man we’re building for $1Tn but you HAVE to respect $1,000,000,000,000 – you just have to… Our 5% Rule series for the S&P over the 1,155 breakdown line is the very critical 1,170, followed by 1,185, 1,200 (critical), 1,215 and 1,230 and THEN we are on the way to recovery." Wow, that guy is AMAZING! Anyway, so here we are at 1,170, after two days of testing the 1,155 line as a bottom so now it’s onwards and upwards to 1,185 hopefully. I also said on Monday: "Below that, we’re not too impressed but it also won’t be very surprising if all $1Tn buys us these days is some moderate lift that isn’t strong enough to break our major technicals."

We have been casting a wide and bullish net since the crash, finally pulling some of our sideline cash for long plays on ABX, APPY, BAC, BIDU, BRK/B, BSX, C, CAT, DIA (3), DF, ERX, GOOG, LIZ, LVS, MEE, MON (3), RIG, T (2), TBT (2), TZA (shorting it), UNG and WFR. We’re hedging heavily, of course, but it feels good to have longs again after being in cash for a while. Our short-term bearish plays (mostly DIA and TZA) have been crushing us so far, which is good in a rally but yesterday was a bit much for us and we got a little more bearish but it looks like the G7 has adopted the "Better Red Than Dead" mantra as the World racks up astounding deficits to put off admitting that this little debt problem is not isolated to the PIIGS nations.

Nonetheless, the global markets are rallying in unison – even while the Pound ($1.47) and the Euro ($1.26) collapse and even the Yen jumped back up last night, falling off the very BS 93.63 to the dollar it hit at 3am to psych up the Nikkei exporters back down to 92.75 this morning. I noted weeks ago how the Yen knocked down for Japan’s open and then drifts lower into the US open virtually every night – it’s what currency traders call the "Goldman Trade" because you can bet it every single day and have a perfect quarter. Sure it’s blatant manipulation designed to fool an entire nation of investors but, what else is new – Fuggedaboutit…

So, a TRILLION Dollars down the rabbit hole in Europe – Fuggedaboutit! I pointed out to Members in yesterday’s chat that, as savvy as we think we are, it’s still hard to wrap our heads around $1Tn. $1,000,000,000,000 is $1,000,000,000 in additional revenues for 1,000 companies. Think that doesn’t prop up the Global GDP? Fuggedaboutit!

The US has already spent $3.6Tn bailing out the economy and that’s not even counting the $300Bn a year of bailouts to military contractors in the form of a war (or whatever they are calling it now) that’s off budget and never ends but at least keeps 250,000 soldiers and contractors occupied and wastes a lot of fuel and ammo because the LAST thing the US needs right now is 250,000 more jobless people who know how to use a gun coming home to a country they may not even recognize if they left in 2007.

Remember how "outraged" we were when we were told Saddam had taken $1Bn out of the country and his palace had over $100M hidden in it. Imagine the soldier in charge of that investigation being told about Madoff, Goldman Sachs and JPM – at least in Iraq we got to torture people! Remember how outraged we were when Saddam spilled oil into the Persian Gulf? Let’s put the guy who prosecuted that in charge of what BP did to the Gulf of Mexico! Remember when politicians spoke out against the "oil for food" scandal? Exxon and Chevron have yet to deal with 100,000 old wells in Texas alone that are an environmental disaster and threatening the food supply but not a peep from politicians, who recieved $35M from oil companies in the last election cycle (2008) and $11M already in 2010! We’ve gone to war over far less my friends…

How much is $35M? Well there are about 600 Senators and Representatives so that’s $58,000 EACH, almost 1/2 of their annual salaries! But that’s just the Oil and Gas industry, not including King Coal, pipelines, miners, etc – who all have their own categories. Of course all these guys put together are NOTHING compared to the WHOPPING $476,000,000 spent by the Finance Sector. That’s almost $1M per politician! No taxation without representation? Well that’s very interesting as not only did $1M bribes (what else are you going to call them) give the financial industry TRILLIONS in bailouts but in the "turnaround" year of 2009, our government collected the LEAST amount of taxes since 1950.

Federal, state and local income taxes consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8.% of income before rising slightly in the first three months of 2010. Taxes paid have fallen much faster than income in this recession. Personal income fell 2% last year. Taxes paid dropped 23%. This tax drop has boosted consumer spending and the economy, which grew at a 3.2% annual rate in the first quarter. It also has contributed to the federal debt growing to $8.4 trillion.

Federal, state and local income taxes consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8.% of income before rising slightly in the first three months of 2010. Taxes paid have fallen much faster than income in this recession. Personal income fell 2% last year. Taxes paid dropped 23%. This tax drop has boosted consumer spending and the economy, which grew at a 3.2% annual rate in the first quarter. It also has contributed to the federal debt growing to $8.4 trillion.

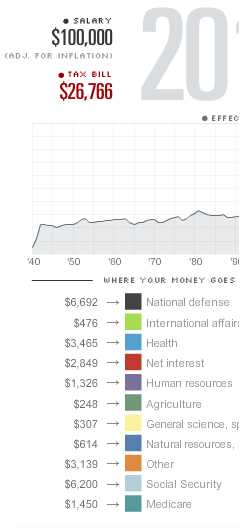

If you are one of those suckers that pays more than 9.2% of your income in taxes, after you fire your accountant you can check out this chart on where your money is being spent. A whopping 25% of the money goes to National Defense with Social Security eating up another 23% (right, like you’ll ever see that money again!) and 11% goes just to paying interest on the debt we ran up through last year. This year we will increase that debt by 20% and the government kicked Q2 off with a big bang by announcing a RECORD $82.69Bn budget shortfall in April. This is the 19th consecutive month we’ve run a deficit – also a record!

Karl Denninger says the real number is actually $175.6Bn if you count the money that is being shifted from FICA and Medicare to mask over the real shortfall in the Federal Budget. You see, the government treats the 23% of your tax money that goes to Social Security and the 5.4% that goes to Medicare as "profits" because you didn’t ask for them back yet.

So, like any insurance company that ends up in jail, the Government spends that money on other things and make their books look pretty(er) in a gigantic ponzi scheme that all falls apart when something bad happens – like perhaps Baby Boomers hitting retirement age. Then the whole thing falls apart as fast as Madoff and there will be lots of investigations and finger pointing about who should have seen this coming but didn’t and how come regulators didn’t notice that our Government stole $5Tn out of our retirement accounts, etc…

I wouldn’t mind so much if the government was spending our Trillions to build infrastructure (things we will use for many years) or to create jobs but that’s not happening. The only "shovel ready" project I’ve seen it the shovels full of BS that have come out of Washington for the past two years. Why has $3,600,000,000,000 been given to the banks to pay off loans they shouldn’t have made and unload assets they shouldn’t have backed while less than $200,000,000,000 (5%) has gone to create jobs for the people who paid for the bailout? Well, the people who got the bailout contributed $1M to each and every person in Congress and unemployed people don’t contribute crap – that’s why!

Sorry, not much fundamentals today because I’m so pissed…. Much as I joke about it, we are heading towards a Financial disaster of biblical proportions. You CAN’T pay off debt with more debt forever. You can for a surprisingly long time but not forever so one day this party will come to a horrifying, crashing end. It could happen in 2 years (2012!) or it could happen this afternoon if we have another "fat finger" incident that doesn’t magically turn around like the last one. Idiot commentators sit in their nice leather chairs on TV and tell you that what the PIIGS need is austerity but those little piggies are 10% of the global GDP and that’s not counting the UK, Germany, Japan and the US – who are pretty much the rest of it. Cut those economies 10% and you’ll REALLY have a catastrophe!

Let’s bring the boys back home so we can start the damned revolution!!!