I’m going to be quick today as I got caught up doing a new Buy List for Members.

I’m going to be quick today as I got caught up doing a new Buy List for Members.

This is my new favorite picture and I used it in this morning’s Alert to lead our Members in prayer and warn them: Dear Lloyd, lead us not into temptation…

I was VERY worried yesterday that I might have to send CNBC a box of chocolates and apologize for calling them a pack of dangerous fear-mongering morons who would trade their viewers souls for ad dollars but, it turns out I was right after all, as we quickly recovered from the 2nd CNBC-inspired market meltdown in one week and held my bottom targets on both the S&P and the Russell.

That was good enough for us to bring cash off the sideline and we went 100% against Jim Cramer’s (who began the panic with his Dow 9,500 call on Monday night) advice and sold not one but 3 naked puts to the panicking crowds in my 9:47 Alert to Members yesterday morning:

- USO June $30 puts sold for $1, now .70 – up 30%

- SSO June $30 puts sold for $1.60, now .80 – up 50%

- FAS June $17 puts sold for $1.45, now .77 – up 50%

Pretty good one-day profits, aren’t they? I explained why Cramer was totally wrong in the Weekly Wrap-Up, so no sense in going back over it here. I’m sure he’ll say something else that I can correct any minute now… By the way, I don’t have it "IN" for Cramer. He can press all the buttons he wants and bark buy and sell orders at his viewers but DON’T, Mr. Cramer, start giving out bad advice on options, especially advice that is so bad that it can really hurt people – that’s when I get pissed. Telling people that selling naked puts is dangerous is simply ignorant or misleading – you can decide which Jim is.

If I REALLY want to own USO long-term at net $29, then why shouldn’t I sell the June $30 puts for $1? USO barely touched $31 briefly yesterday yet we were able to score either a $29 net entry on the stock (if USO finishes below $30, the stock will be assigned to us for $30 a share) or, if USO remains above $30 through June expiration, we keep the $1 and that’s our profit for the month. Do that 12 times a year and you are getting paid $12 for NOT owning the stock (37% of the current $32 price). This is what Cramer’s hedge fund buddies do every day – WHY IS HE TRYING TO STOP YOU FROM HAVING THE SAME ADVANTAGE?

Here’s a fairly well-balanced article on options from Bloomberg. I particularly liked what Tom Sosnoff from ThinkorSwim said about people who try to scare retail investors out of options: "I’m not a fan of people who say you shouldn’t be doing this. Imagine you walked into the casino and people said to you, ‘You look stupid so you can only play the slots.’” We talk about a casino model often at PSW and what Tom and I both like to teach people is that you can use options to BE THE HOUSE. I point out to HNW clients that a million people a month may walk through the doors of a casino but it’s VERY unlikely that ANY of those people will be richer than the guy who owns it. Why is that? Because he’s SELLING risk, not buying it. That’s what we do with options like the example above, we sell risk and get paid a premium for doing it.

Rather than swing for the fences, we can take well-hedged positions that pay us small amounts over and over and over again. While the pump monkeys tell the sheeple to BUYBUYBUY and SELLSELLSELL the same stocks over and over and over again. If you ever feel like your investing life feels a bit like being a hamster on a wheel – it’s because you are paying to take risks with your own money. Why do that when you can GET PAID for taking risks? Cramer’s buddies don’t want you to know this the same way Steve Wynn doesn’t want all of his clients opening up their own casinos. The difference is, to sell options you don’t need to be a Billionaire, you just need to take some time to learn a new skill.

Options are contracts that grant their buyers the right, without the obligation, to buy or sell a security, a commodity or an index’s cash value at a set price by a specific date. Call options give the right to call a security away from another owner if the security reaches its strike price on or before the contract’s expiration date. Put options give the right to sell. If you want to learn the basics of options trading, I highly recommend our partners at Market Tamer. When you are ready to open your own casino, come over to our house and we’ll show you how it’s done!

As I often explain to new members, I am NOT an "options trader" I am a fundamental analyst who uses options for leverage and hedging. Once you learn how to use options to your advantage, it makes little sense to just trade stocks so almost all of our trades involve some use of options but this morning our Buy List has over 50 STOCK posiitons we like at this market bottom. Well we hope it’s a bottom but that’s where options come in. Purchasing the stock AND selling the options gives us (at this VIX level) AT LEAST a 20% discount so we are covered all the way to Dow 8,000. If you think the Dow will fall below 8,000 then DON’T buy stock here at 10,000 but, if you think we might survive and move higher – why wouldn’t you take a little cash off the side to test the waters using our Discount Stock Buying Strategy.

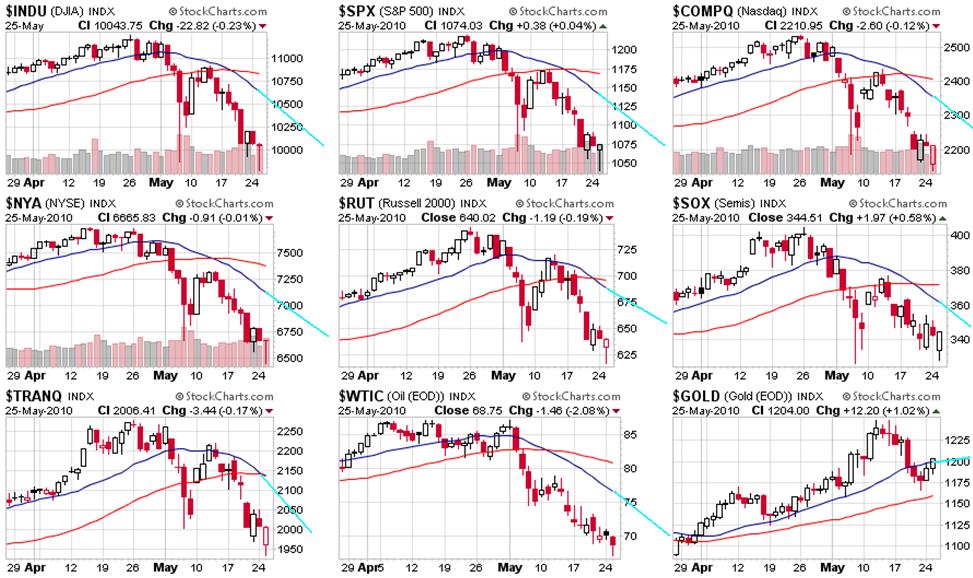

So it is in THAT context that we are bullish here. We are scaling in from our mainly cash positions and looking for bargains but not so confident yet that the market will get back into our comfort zone, which is the range I predicted we’d fall to when we cashed out at the end of April:

- Dow 10,200 to 10,650

- S&P 1,100 to 1,155

- Nasdaq 2,225 to 2,350

- NYSE 7,000 to 7,250

- Russell 620 to 660

We want to be above 3 of 5 of those levels (and see my 5% Rules Review for more on our trading range) in order to get more bullish (currenly about 20% invested bullish here with hedges for a 40% drop) and we’d LOVE to take cash off the sidelines if the market shows us something but any move that doesn’t take us above our Dow, Nas and S&P levels TODAY is not going to be very impressive coming off such steep declines – we need to break back over the "death crossed" 50 dmas before we even consider thinking of this as anything more than a weak bounce.

So screw the fundamentals today, it’s all about retaking those blue lines (20 dmas) by the end of the week or we are in a serious technical downturn that will start bending those red lines (50 dmas) lower, which will in turn begin to bend the 200 dmas lower etc., etc. There, now you know everything you need to know about charting…

The OECD raised the Global Growth forecast so rah rah globe, I guess. Durable Goods Orders were a BTE 2.9% (2.2% expected) but up only 1% outside of Transportation so yay for our BA play but boo to pretty much everything else as non-defense capital goods orders fell 2.4%. The S&P said they are not going to downgrade Banks – YET so yay for prevarication. Spain is bailing out their banks and Italy is tightening their belts so all is well in the world this morning – at least until the next "shocking" bit of news freaks everyone out again.

We will have itchy trigger fingers to take profits on our unhedged bullish plays from yesterday (and our oil futures already stopped out after a nice run to $70.75) and we don’t need to flip bearish (but we are addding a TZA play here) as our short-term disaster hedges are still active so simply taking the bullish plays off the table flips us bearish – isn’t that clever? Let’s have some fun out there, it’s likely to be a wild day!