I already stuck me neck out calling a bottom so now we’re just waiting patiently.

I already stuck me neck out calling a bottom so now we’re just waiting patiently.

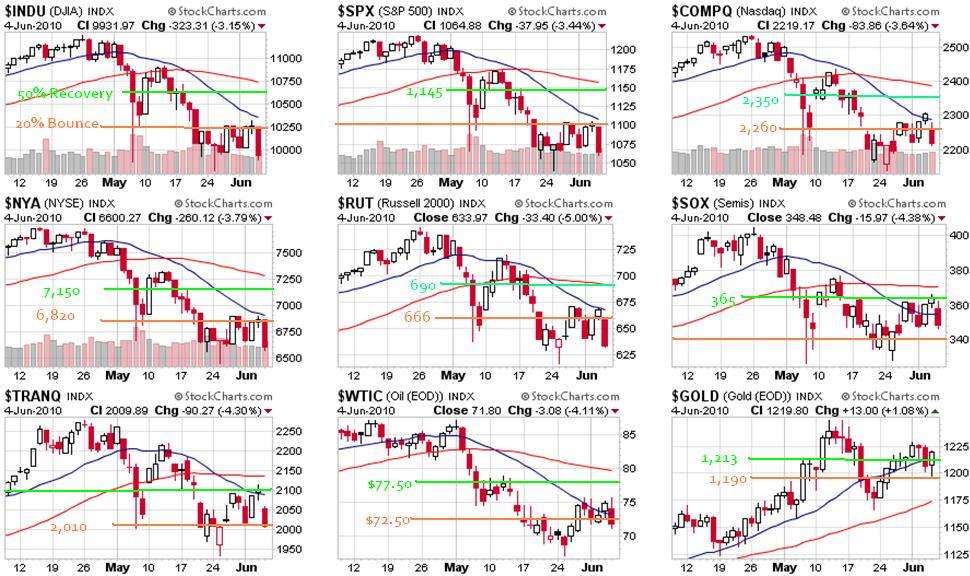

We are below the levels I hoped we would hold on Friday: Dow 10,020, S&P 1,070, Nas 2,220, NYSE 6,666, RUT 641 so we’ll be looking to see if we can retake those as a start today. Contrary to popular opinion in the MSM, the World did not end over the weekend and, as I said in this weekend’s special commentary: "The Worst-Case Scenario" anything short of that won’t keep us from buying down here, using our hedged entries. I’ve already put up 13 of my top 20 long-term trades in our new Buy List (Members Only) and I should have the rest up tonight.

We’re not expecting the markets to get away from us this morning but, as you can see from our Friday’s trade ideas in the Weekend Wrap-Up, we took 7 new bullish positions into the sell-off . We expect at least a short-covering bounce this morning as the super-bears sober up a little and perhaps rethink those S&P 800 puts or whatever it is super-bears bet on when they get into a frenzy like Friday.

It’s all about the Euro today as they are below that $1.20 mark and fell as low as $1.1876 in overnight trading and that’s boosting the dollar and killing commodities (other than gold, which people are still panicking into), which is driving down commodity stocks and pushing down the markets but, as I said to Members on Friday afternoon:

Keep in mind that your stocks are going down because they are priced in dollars and the dollar is up 1.5% today – we are very close to where we were in the Nov ‘08 and March ‘09 crashes on the dollar (89ish) yet, as Tusca points out, our markets are 70% higher than they were at the time. If the dollar devalues now – our markets will rocket and that’s all the G20 has to accomplish and it’s a win-win for everyone – save the Euro, boost US equities.

We were disappointed that there was no major announcement out of the G20 this weekend but the real meeting is at the end of the month (this was just the Finance Ministers), so plenty of time for something to happen. Before we go getting all bullish his morning, let’s talk about what constitutes a recovery and what constitutes a weak bounce in our indexes:

We’re not even really bullish until we get all those orange lines back and we’ll be keeping a close eye on the SOX and the Transports as they need to hold those lines before the Dow and the Nasdaq are likely to get back to their levels (Dow 10,250, Nas 2,260. Now, let’s look at the very bullish chart news – We were falling because the global markets were falling but, while US investors were freaking out and selling us their stocks at the lowest prices since February (thank you, by the way!) – the rest of the World was RECOVERING and are actually starting to take back their 20 dmas:

That’s right – these markets are right here on planet Earth! Not the planet Earth the MSM is telling you about but the planet Earth that is waking up every day and dealing with their issues and working on rebuilding their economies, whether we think they are doomed or not. Note that these charts are from Friday’s closes (curse you Stockcharts!) today Asia is just freaking out because we freaked out – not because of anything bad that actually happened this weekend.

The Hang Seng fell 2% (401 points) to 19,378, the Shanghai fell 1.6% (5 points) to 306.89, the BSE fell 2% back to the 20 dma at 16,781 and the Nikkei fell 3.8% (380 points) to 9,520 but held that 9,500 line we were watching in weekend chat (and we went long on oil and the Dow at crazy low futures prices last night!). Your key takeaway from all this is they (except for the Nikkei, who were freaking out as the Yen hit new highs) fell LESS than we did so the Asian markets felt our sell-off was an over-reaction too!

Workers of the World united as Chinese factory suicide prompted Hon Hai to double the minimum wage for the people who make IPhones and other fun toys all the way to 2,000 Yuan a month. Sure it’s still only $293 but hey – DOUBLE! Hon Hai employs 800,0000 people and are the World’s largest contract manufacturer and I want to thank all the writers who have taken up this cause recently as I am VERY HAPPY to pay .50 more per IPod to double the standard of living for the people who make them. Those 800,000 people will make $117M more per month and that $1.4Bn will flow back into the economy and boost the standard of living for another 4 or 5 Million people and THIS is how you improve an economy – TAKE CARE OF THE WORKING CLASS!

Workers of the World united as Chinese factory suicide prompted Hon Hai to double the minimum wage for the people who make IPhones and other fun toys all the way to 2,000 Yuan a month. Sure it’s still only $293 but hey – DOUBLE! Hon Hai employs 800,0000 people and are the World’s largest contract manufacturer and I want to thank all the writers who have taken up this cause recently as I am VERY HAPPY to pay .50 more per IPod to double the standard of living for the people who make them. Those 800,000 people will make $117M more per month and that $1.4Bn will flow back into the economy and boost the standard of living for another 4 or 5 Million people and THIS is how you improve an economy – TAKE CARE OF THE WORKING CLASS!

Of course, the evil Western Capitalists didn’t like this move one bit and BofA/Merrill Lynch Mob says: "Wage Increases in China to Damp Capital Spending." That’s right you greedy Chinese workers, if you won’t work for 91 cents an hour we’ll go find someone who will work for slave wages. Maybe Africa. Yeah, there’s an idea, let’s all go to Africa and capture employ some workers who are willing to work for less than the Chinese! Ah capitalism – you make the most even depraved acts of human cruelty sound like a business plan…

The WSJ has a great, scary presentation on the Chinese Housing market that I highly recommend but it’s only what we’ve been warning about on PSW all year so again, not NEWS – just the flavor of the moment for the MSM. Uncle Rupert must be short China housing because, just this morning, in additon to the main article on China, he is also running "More Chinese Expect Housing Prices to Decline, Survey Shows" as well as "China’s Property Market Freezes." I think, on the whole, I’d like to wait and see the ripple effect of doubling the wages of 800,000 people (and that may only be a start) before I go trying to short Chinese housing at the moment (Sorry Rupe).

Over in Europe, it’s all about the Euro and the markets there have recovered from a down 1% open to down half a point ahead of the US open. Trichet and Geithner went head to head at the G20 this weekend, with Trichet pushing for fiscal tightening as a solution to debt problems while Geithner thinks things will be fine if we can just get people to spend more money. It’s no wonder then, that the G20 also failed to agree on a global bank tax, because Geithner’s banking buddies are very much against that too.

![[Geithner's+world.jpg]](http://3.bp.blogspot.com/_O2JHv7M-9RE/SutmqsjTX9I/AAAAAAAAAOM/XE7LcvVgSSg/s1600/Geithner%27s%2Bworld.jpg)

It must make poor Trichet physically ill to have to deal with this BS while he’s trying to fix the global economy. It should make Americans sick as well. I have long since given up on expecting people to get involved in fighting this sham of a system that has been set up by bankers and their pet corporations to rape and pillage this great country of ours but I do still like to point it out every once in a while…

It’s going to be a very exciting week. Let’s keep an eye on our levels and be careful out there!