Oh, You Mean Like the Same Fed Audits We Already Have? Way to Go, Congress!

Courtesy of Jr. Deputy Accountant

Idiots. First of all, I take issue with the fact that WaPo titled this article "Lawmakers agree to expand audit of Federal Reserve" because basically all they did was decide to look deeper into emergency lending programs (most of those banks are probably kaput by now anyway) and make it appear as though GAO audits of the Fed are something new.

I remind dear reader that each regional Fed bank issues an annual report just like any other bank that is audited by the Big 87654. I also remind dear reader that we already know who got TARP money. And that the GAO has a handful of Fed audits going on AS WE SPEAK that will, like the audits before them, mean little since the Fed follows its own accounting rules and not GAAP. As any accountant will tell you, we perform audits each year to ensure the comparability of financial statements for the sake of investors. Since there is no comparing Fed statements and there are no investors (excluding the banks with mandated stock holdings in the Fed banks they are regulated by), basically all we’re doing is jerking off with our left hands pretending it is someone else doing the jerking.

You aren’t going to fall for this, are you?

WaPo:

Lawmakers on Wednesday reached a compromise to allow expanded audits of the Federal Reserve, part of an effort to shine light on the central bank’s emergency lending during the financial crisis while safeguarding its independence in setting monetary policy.

In another marathon session to hash out differences over sweeping new financial regulations, members of a House-Senate conference committee agreed to grant the Government Accountability Office broad authority to examine the operations of the Fed and to require additional disclosures from the central bank.

The compromise expands on language from the Senate bill that would grant the GAO authority to audit the Fed’s massive emergency lending programs and compel the agency to release details about the firms that benefited from those programs during the crisis.

The new language broadens those audits to include the Fed’s discount window and its purchases and sales of government securities, requiring the central bank to disclose details about such transactions within two years after they occur. "The Fed is going to be a lot more transparent," said Rep. Melvin Watt (D-N.C.).

The bottom line is that Congress doesn’t even know what the Fed is and if you tried to tell them, they’d run away scared and crying to Mommy.

You’re a joke, Congress. It took you two years to get the authority to look into emergency lending programs by the agency which is paid IN INTEREST every year to issue our worthless paper currency? Suckers. How many of the banks on that list have failed already?

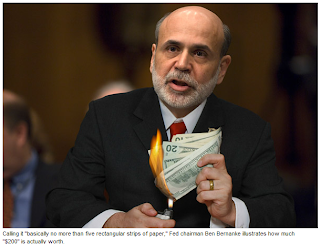

What you should REALLY be asking is why the Fed feels it is appropriate to loan money at nothing to the banks just so they can purchase Treasurys and not fuel growth by lending to business owners. But wait, that would make things really inconvenient in Washington since we’d have to figure out another way to pay our bills so scratch that, just keep letting Zimbabwe Ben ride ZIRP out as long as humanly possible, regardless of what impact this has on our overall economic health.

Maybe Congress is the left hand and ZB is the big swinging dick, who can say?