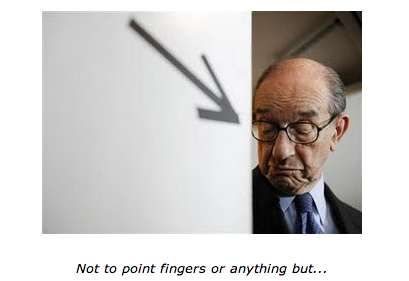

ALAN GREENSPAN SOUNDS THE BOND VIGILANTE SIREN CALL

Courtesy of The Pragmatic Capitalist

The lead story at the Wall Street Journal is an absurd diatbribe from none other than the U.S. central banker who has been wrong about just about everything over the last 25 years. Alan Greenspan has officially joined the legion of deficit terrorists and flat earth economists who believe the U.S. is on the verge of imminent collapse at the hands of the bond vigilantes.

Alan Greenspan has been more than discredited over the course of the last 10 years. This is a man who helped deregulate the financial sector while also believing that he controls every twist and turn in the U.S. economy via his interest rate press releases. Of course, the last 18 months have proven the monetarists terribly wrong. The Enron banking system has also proven that deregulation substantially contributed to our current predicament. But don’t take it from me. The man himself admitted in 2008 that his models were “flawed”:

“I discovered a flaw in the model that I perceived is the critical functioning structure that defines how the world works. I had been going for 40 years with considerable evidence that it was working exceptionally well.”

Nonetheless, he remains a reliable and important adviser on monetary and fiscal policy in the United States. Now he is helping rally the troops in an attempt to implement 1930’s style austerity.

Don’t be fooled by today’s low interest rates. The government could very quickly discover the limits of its borrowing capacity.

An urgency to rein in budget deficits seems to be gaining some traction among American lawmakers. If so, it is none too soon. Perceptions of a large U.S. borrowing capacity are misleading.

Borrowing? What borrowing? The United States budget deficit is not “borrowed money”. We fund our own spending internally. We do not borrow one penny from abroad. China is not our banker. Japan is not our banker.

Despite the surge in federal debt to the public during the past 18 months—to $8.6 trillion from $5.5 trillion—inflation and long-term interest rates, the typical symptoms of fiscal excess, have remained remarkably subdued. This is regrettable, because it is fostering a sense of complacency that can have dire consequences.

Inflation has remained remarkably subdued? Yes, this has surprised only those who fail to understand how the monetary system works. The inflationists and monetarist hyperventilators have failed to understand that excess reserves do not necessarily result in inflation. Mr. Greenspan (like Mr. Bernanke) honestly believes he can sell more apples if he stocks the shelves with more of them.

The roots of the apparent debt market calm are clear enough. The financial crisis, triggered by the unexpected default of Lehman Brothers in September 2008, created a collapse in global demand that engendered a high degree of deflationary slack in our economy. The very large contraction of private financing demand freed private saving to finance the explosion of federal debt. Although our financial institutions have recovered perceptibly and returned to a degree of solvency, banks, pending a significant increase in capital, remain reluctant to lend.

This is unbelievable. Mr. Greenspan still believes this is a banking problem. The banks have largely recovered. We’ve seen a v-shaped recovery in banking profits yet they won’t lend. Why? Because there is no private sector demand for loans. Mr. Greenspan utterly fails to grasp this concept. Like Mr. Bernanke, he thought he could implement the ultimate form of trickle down economics by fixing the banking system. Of course, this strategy has failed spectacularly as the U.S. consumer remains very weak, consumers continue to deleverage and DEMAND for loans remains weak.

Beneath the calm, there are market signals that do not bode well for the future. For generations there had been a large buffer between the borrowing capacity of the U.S.

government and the level of its debt to the public. But in the aftermath of the Lehman Brothers collapse, that gap began to narrow rapidly. Federal debt to the public rose to 59% of GDP by mid-June 2010 from 38% in September 2008. How much borrowing leeway at current interest rates remains for U.S. Treasury financing is highly uncertain.The U.S. government can create dollars at will to meet any obligation, and it will doubtless continue to do so. U.S. Treasurys are thus free of credit risk. But they are not free of interest rate risk. If Treasury net debt issuance were to double overnight, for example, newly issued Treasury securities would continue free of credit risk, but the Treasury would have to pay much higher interest rates to market its newly issued securities.

So he seems to at least grasp the fact that the United States has ZERO solvency risk. But he seems to fail in understanding why our borrowing costs might increase. Mr. Greenspan doesn’t seem to connect the dots between the lack of solvency risk and what might actually cause higher interest rates – inflation. But as he admitted above, Mr. Greenspan can’t understand why there is no inflation (just like he can’t understand why stocking the the shelves with more apples doesn’t result in higher sales).

I grant that low long-term interest rates could continue for months, or even well into next year. But just as easily, long-term rate increases can emerge with unexpected suddenness. Between early October 1979 and late February 1980, for example, the yield on the 10-year note rose almost four percentage points.

Mr. Greenspan entirely fails to understand that this is a balance sheet recession. The private sector is deleveraging which is resulting in deflationary pressures and general economic weakness. Rates will remain low as long as there is low demand for debt in the private sector. This is a direct result of a lack of velocity of money in the economy. The Fed can “print” as much money as they please, but if it doesn’t actually get into the economy it might as well be sitting on a dark wet floor at the NY Fed (which is exactly what most of it is doing effectively).

In the 1950s, as I remember them, U.S. federal budget deficits were no more politically acceptable than households

spending beyond their means. Regrettably, that now quaint notion gave way over the decades, such that today it is the rare politician who doesn’t run on seemingly costless spending increases or tax cuts with borrowed money. A low tax burden is essential to maintain America’s global competitiveness. But tax cuts need to be funded by permanent outlay reductions.

The U.S. government is NOT a household. The comparison is not remotely accurate. The federal government does not fund its spending like a household or state must. Much like an alchemist, the Federal government simply walks into the basement and presses a button that results in money. This might sound like semantics, but it is of vital importance in understanding the monetary system and what our future economic risks are and how we should respond to them.

The current federal debt explosion is being driven by an inability to stem new spending initiatives. Having appropriated hundreds of billions of dollars on new programs in the last year and a half, it is very difficult for Congress to deny an additional one or two billion dollars for programs that significant constituencies perceive as urgent. The federal government is currently saddled with commitments for the next three decades that it will be unable to meet in real terms. This is not new. For at least a quarter century analysts have been aware of the pending surge in baby boomer retirees.

Spending has been very poorly allocated in the last few years. We have allocated billions in funding to bailout bankers, prop up housing prices and stimulate loan growth via absurd programs like “cash for clunkers”. In the meantime, the Federal government has failed to stimulate the private sector via job growth and/or reduced tax burden while also promoting loser capitalism and substantially increasing moral hazard.

We cannot grow out of these fiscal pressures. The modest-sized post-baby-boom labor force, if history is any guide, will not be able to consistently increase output per hour by more than 3% annually. The product of a slowly growing labor force and limited productivity growth will not provide the real resources necessary to meet existing commitments. (We must avoid persistent borrowing from abroad. We cannot count on foreigners to finance our current account deficit indefinitely.)

Borrowing from abroad? Mr. Greenspan – you should be ashamed of such comments.

Only politically toxic cuts or rationing of medical care, a marked rise in the eligible age for health and retirement benefits, or significant inflation, can close the deficit. I rule out large tax increases that would sap economic growth (and the tax base) and accordingly achieve little added revenues.

Now we can’t afford Medicare? No, greater government spending might result in higher taxes down the road (to offset potentially higher inflation), but the United States will never not be able to afford it Medicare or Social Security payments. It is operationally impossible for the United States to be unable to fund its spending.

With huge deficits currently having no evident effect on either inflation or long-term interest rates, the budget constraints of the past are missing. It is little comfort that the dollar is still the least worst of the major fiat currencies. But the inexorable rise in the price of gold indicates a large number of investors are seeking a safe haven beyond fiat currencies.

I disagree. Inflationist hyperventilators (all of whom have been wrong for years) and fear mongering is driving the price of gold higher. In addition, the worries in Europe (which is ironically, a single currency system like the gold standard) has resulted in mass worries over fiat currency. Such thinking is entirely misguided and will ultimately be proven wrong when gold never becomes a reserve currency and fear mongerers around the world are crushed under the continued shocking trust in fiat money.

The United States, and most of the rest of the developed world, is in need of a tectonic shift in fiscal policy. Incremental change will not be adequate. In the past decade the U.S. has been unable to cut any federal spending programs of significance.

I believe the fears of budget contraction inducing a renewed decline of economic activity are misplaced. The current spending momentum is so pressing that it is highly unlikely that any politically feasible fiscal constraint will unleash new deflationary forces. I do not believe that our lawmakers or others are aware of the degree of impairment of our fiscal brakes. If we contained the amount of issuance of Treasury securities, pressures on private capital markets would be eased.

No new deflationary forces? If that is the case then why do we continue to see deflationary price action in the markets? The Fed is pushing on a string. They have been unable to increase lending. Our fiscal operations have been largely targeted on the same markets – the lending markets. Unfortunately, the crux of this problem does not reside at the banking level, but rather the consumer level. Thus far, fiscal policy has done little to alleviate pressures on Main Street. We continue to funnel money into banker’s pockets while ignoring the real crux of this issue – the U.S. consumer.

Fortunately, the very severity of the pending crisis and growing analogies to Greece set the stage for a serious response. That response needs to recognize that the range of error of long-term U.S. budget forecasts (especially of Medicare) is, in historic perspective, exceptionally wide. Our economy cannot afford a major mistake in underestimating the corrosive momentum of this fiscal crisis. Our policy focus must therefore err significantly on the side of restraint.

We are not Greece. We do not have an even remotely similar currency system or economy. The comparison is not remotely fair.

History has not been kind to Mr. Greenspan. This article effectively puts the cherry on top of his remarkable career of being wrong. Unfortunately, his plane is crashing and burning and he’s trying to take us all down with him.

****

See also Barry Ritholtz’s Greenspan Says “Deficit Reduction A Priority” — Hence, You Know its Not