Wheeeee, this is fun!

It's only been a week since I called for "Turnaround Tuesday" and asked the question "Will CNBC Apologize to America" for their ridiculous, sickening parade of negativity that chased their poor viewers out of the market (now 600 points ago) by completely misrepresenting the economic outlook in order to protect the TERRIBLE advice given by Jim Cramer, the Fast Money Crew, their sponsors etc. etc. – it was all one national frenzy of media negativity designed to shove retail investors entirely out of the market while the cognoscenti went shopping.

It's not just CNBC, of course, it's a problem with the whole MSM but I ranted about corporate (top 0.01%) control of the media last week so let's move on as we wave bye-bye to all the beautiful sheeple who were kind enough to sell us their stocks at the bottom, despite my warnings. Our 500% upside plays are now well on their way to making 500% for us and our "9 Fabulous Dow Plays Plus a Chip Shot" are also looking good already. Even the trade ideas I mentioned right in last Tuesday's post are well on track as I said last week:

On Friday, I had said to Members right at 9:38, in the Morning Alert: "If we run up, then it will be prudent to get more neutral into the weekend but if we stay down and hold our levels, then saying a little bullish will be fine. Out of short-term short trades if you haven’t already. Keep in mind we have some great 500% upside plays you can still grab here if you think you are too short."

The latter was a reference to our 500% upside plays. We also went with EEM July $38 calls at .99, and a QLD $50/53 bull call spread for $1.30 (selling puts as well for more profits) as well as long plays on RIMM, AA, HOV, VLO and TASR. My optimism was based on the considered TA analysis I shared with Members at 2:39:

.jpg)

After completing last month’s "Omega III" market pattern on the Trade Bots, it’s now time to spring the bear trap and run the "Apha II" into options expiration on July 16th. Maybe there will be as little logic to the rise as there was to the fall – who really cares – it’s just our jobs to try to catch these waves when they come and ride them out for as long as they last (until the cheerleaders are back on CNBC and we know it’s time to bail!).

So far, so good – right? Of course, now that we are up 60 S&P points in 4 days, we have to consider taking on some new downside protection. We'll be looking at that today in Member Chat this morning as I have to see how we handle our upside targets for this week (set last week), which are: Dow 10,290, S&P 1,102, Nas 2,257, NYSE 6,930 and RUT 651 – the 5% rule off our (also predicted) bottoms. I don't think we're ready for a breakout today but a good run on the Dow could give us a look at 10,300, which would be exciting.

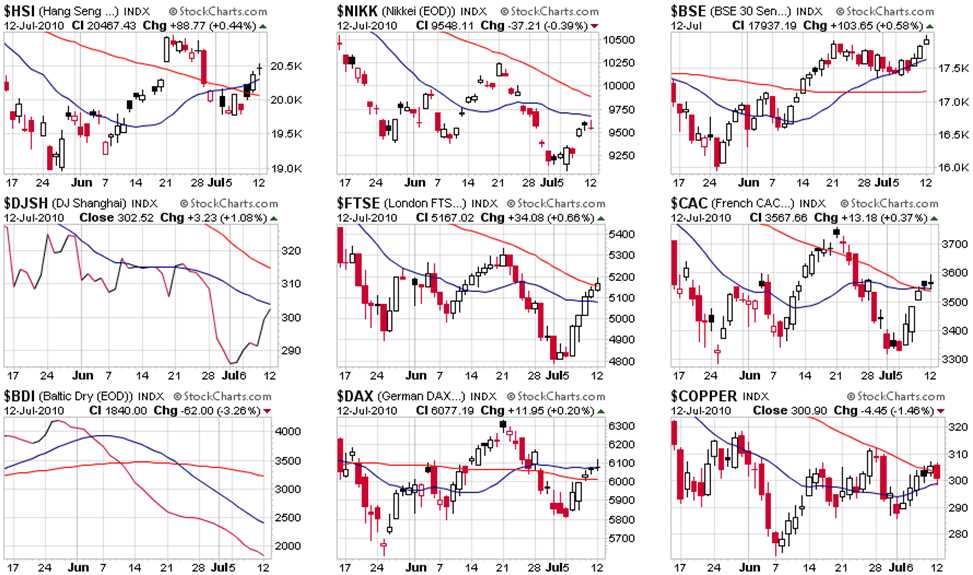

Europe is hitting all of our levels this morning on a 1.6% relief rally after seeing the first day of US earnings. This despite Moody's downgrading Portugal and Sarkozy having to defend allegations of corruption. Things have gotten so bad for Sarkozy that he had to cancel the Bastille Day Party (lest the peasants get any bright ideas). Asia was generally flat other than the Shanghai, which pulled back 1.6% on a sharp rejection at 2,500. The Baltic Dry Index is still looking like it should be renamed "Voyage to the Bottom of the Charts" and that just can't be good – probably our most worrying global indicator although increased shipping volumes may play more of a role in the drop than actual lack of demand:

It is still all about copper, which is about to test a "life cross" as the 20 dma crosses over the 50 dma and if that can't give copper a nice pop back to 320 then we will have to assume that it's been artificially supported and will be collapsing along with the BDI and probably followed by oil and gold. Natural gas (not charted above) has already been knocked down to $4.38 with just one more month to go until the start of hurricane season so – if copper does pop, then I'd chase nat gas with plays like UNG and CHK. Oil also made a life cross and you can see the critical test lines in our local indexes:

Notice how the 50 dmas (red lines) are converging on our 5% test levels (and also notice how cool it is that we were able to predict where the 50 dma would be two weeks ago!) so we can expect some very interesting action around there and if we can clear them without a pullback – then we are good to go for another 5% run before the next serious resistance. It will take some good earnings reports to justify 1,157 on the S&P but so far, so good with sales at AA up 18% despite lower aluminum prices and CSX reporting "volume gains across all major markets."

NVLS also had great earnings, with revenues up 169% over last year. Later today we hear from AIR, ADTN, HCSG, INTC, INXI and YUM and tomorrow morning it's AMR, JTX, PGR and TXI and THEN things begin to get crazy (as you can see from this Bespoke chart). Bespoke studied all 65,210 earnings since 2001 and found that, overall, 62% beat estimates and 25% missed with 13% in-line. Revenues, on the other hand, never seem to be in-line with 62% beating and 38% missing for the full 100% there.

Later this week we get MAR, FCS, JPM, AMD, GOOG, SCHW, BAC, C and GE with our last three Financials on Friday and that's why our current hedge is FAZ but only until then, after which we switch to a more general, long-term index hedge – hopefully with our indexes much higher!

Still, in this "flash crash" environment, we will need to begin protecting our gains today because you never know when the market will drop 1,000 points for no apparent reason. It's a silly, irrational thing to have to worry about but, fortunately, that means it can be covered with silly, irrational hedges that have huge leverage. Small investors have been fleeing the market in droves for quite some time and we can never get too comfortable playing all day against Uncle Lloyd's TradeBots so we will play it a little bit cautiously until the sheeple come back to play as their behavior is much more predictable (and Cramer was already herding them back last night as he goes into full reverse mode without missing a beat). "Could we be seeing a cease-fire, or even a truce, in Washington’s war against business?” Cramer asked viewers on Monday. “That would be about the most bullish thing that could happen right now.”

Much more data tomorrow including Retail Sales for June, Import/Export Pricing for June, Business Inventories for May, Oil Inventories for July 10th and Fed Minutes at 2pm. Thursday we get another 450,000 layoffs (remember them?), 24 earnings reports, PPI, Empire Manufacturing, Industrial Production and Capacity Utilization and the Philly Fed and Friday we finish the week off with CPI, TIC Flows and Michigan Sentiment. While this is going on, FinReg should be passing by the end of the week and keep in mind that this is all the same stuff that was blamed for taking us down a month ago in this silly, silly market.

Much more data tomorrow including Retail Sales for June, Import/Export Pricing for June, Business Inventories for May, Oil Inventories for July 10th and Fed Minutes at 2pm. Thursday we get another 450,000 layoffs (remember them?), 24 earnings reports, PPI, Empire Manufacturing, Industrial Production and Capacity Utilization and the Philly Fed and Friday we finish the week off with CPI, TIC Flows and Michigan Sentiment. While this is going on, FinReg should be passing by the end of the week and keep in mind that this is all the same stuff that was blamed for taking us down a month ago in this silly, silly market.

Barry Rhitholtz reminds us that: "The President had barely been in office for 18 months when the pushback to his agenda became fierce. The media and the opposing political party all focused on the budget deficit. Most of it had been accrued long before this President came into the office, but that did not stop him from getting the full blunt of the blame. “We must stop this fiscal profligacy, or it will be the end of us!” the critics all cried. But the president ignored the critics, and put forth a deficit laden budget that contained a massive stimulus and tax cuts. He even joked about the debt issue: “I am not worried about the deficit. It is big enough to take care of itself."

Of course that President was Ronald Reagan, not Barack Obama who is is also dealing with huge deficits and targeting tax cuts to his electoral base while allowing policiies of his predecessor to expire. "I continue to see the Austerian movement in the United States as thinly disguised partisan politics," says Barry. "These are people who will say anything to keep the subsidies and tax benefits flowing to their electoral base. They will say anything –regardless of whether they actually believe these things — to thwart the opposing fellows priorities. Anyone who believes the new deficit fighters care about deficits has not been paying attention.

"This is simply about power and money and legislative priorities and cash. With only a very few exceptions, it has nothing to do actual fiscal priorities and debt loads and deficits. The vast majority of these new deficit chickenhawks — who voted for unfunded entitlement program (prescription drugs), who gave away trillions in unfunded tax cuts, who voted for a trillion dollar war of choice, are simply not to be believed. Their past actions speak far louder than anything they might say today."

Amen!