We finally blew our levels!

We finally blew our levels!

Sadly, it’s time to flip bearish until we can retake our watch levels at Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635. If we can’t retake at least 2 of them today, we may be seeing 2.5% drops back to Dow 9,945, S&P 1,043, Nas 2,145, NYSE 6,630 and Russell 619. Since the Russell already blew 619 we have to consider the possiblitlity of even a test of our 5% lines at Dow 9,690, S&P 1,016, Nas 2,090, NYSE 6,460, and Russell 603.

Fundamentals are great but once panic sets in the market is all about technicals and we just need to strap in and go along for the ride. We have been playing for a bounce off our 10,200, 1,070 lines but, now that we lost it – it’s time to flip bearish – I was wrong and that’s that, time to move on and make some downside money. Of course it will take more than a single day to give us a trend but the same way we don’t get very bearish until we loser 3 of 5 of our center levels, we don’t get bullish again until we break back over. Yesterday I sent out an Alert to Members as we broke down, saying: "We could very easily drop 250 from here on the Dow (2.5%)."

We added a fresh DXD hedge but we already had a proper hedge from Friday when the morning trade idea was:

A better way to hedge at the moment is the DXD Sept $27s for $1.70. They have a delta of .62 but can be transferred into a vertical if the Dow goes up by selling the $25 puts (now .20) for .50 and covering with the $29s (now $1) for at least .70, leaving you in a $2 spread for .50. That would be the ESCAPE, at the moment I like the plain DXD $27s at $1.70 until we get a real move back up.

That was an addition to the Morning Alert Trade, which was the DIA Sept $99 puts at $1.50. Neither the DXD or the DIA plays have been paying off so far but they did provide cover for our speculative bullish plays as we tried to play the line. Of course we take our major disaster hedges when the market is high (it’s cheaper then), like on August 9th, when I wrote "Monday Market Momentum (or Lack Thereof)" and our longer-term protection was:

That was an addition to the Morning Alert Trade, which was the DIA Sept $99 puts at $1.50. Neither the DXD or the DIA plays have been paying off so far but they did provide cover for our speculative bullish plays as we tried to play the line. Of course we take our major disaster hedges when the market is high (it’s cheaper then), like on August 9th, when I wrote "Monday Market Momentum (or Lack Thereof)" and our longer-term protection was:

SDS – Sure, now you can do the Jan $31/35 bull call spread for $1.50 and sell 1/2 March $27 puts for $2.60 which is net .20 on the $5 spreads that are .20 in the money to start. You can sell 5 of the March $27 puts for $1,300 and about $5.5K in margin and buy 10 of the spreads that pay $5,000 if the S&P drops about 5% (to below 1,070). The $27 puts are almost 15% below so about a 7.5% gain in the S&P to over 1,200 by March for this to be put to you. Anything less than that is VERY cheap insurance.

We’ll see how that logic pans out but that’s what we call a "disaster hedge" and this market drop is exactly the kind of disaster we are guarding against. That same day we had a shorter-term hedge on QID (which I even posted for free readers on that Tuesday) which was:

QID Aug $16/17 bull call spread is .42 and is .42 in the money and you can sell $16 puts for .29 to drop the net to .13, which is a nice way to play the Nas down and we can kill the trade if we get green on the Russell (666) and the Dow (10,700) for a small loss vs. a potential .87 gain (669% upside).

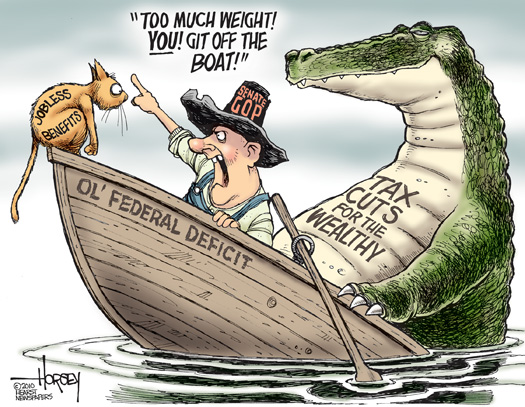

QID expired on Friday at $18.15 so a full 669% payoff on that one too! So forgive us if we are simply amused by this drop but it’s all part of the trading range we’ve been tracking all year. I had been hoping we would turn the middle of our range into a new floor after earnings but we didn’t get the stimulus we need and it looks like we aren’t going to get any help at all from our grid-locked government. In fact, this morning, House Minority leader, John Boehner demands that Obama "fire Timothy Geithner and Larry Summers" (and, of course, extend the Bush tax cuts for the wealthy), so I’m not really expecting the boys in DC to be sitting at a table and fixing anything any time soon!

The 8 a.m. speech is being billed by some as the beginning of a major rollout of the Republican party’s economic agenda — and also a preview of how Boehner would run the House if he becomes Speaker. Although the speech contains some fresh ideas — Boehner calls for a 20 percent tax cut

The 8 a.m. speech is being billed by some as the beginning of a major rollout of the Republican party’s economic agenda — and also a preview of how Boehner would run the House if he becomes Speaker. Although the speech contains some fresh ideas — Boehner calls for a 20 percent tax cut  I urge you to read the whole article as it’s a complex issue and, on the whole, the headlines are blowing it out of proportion as really the main objection of the seven dissenters is that the economy is strong enough to stand on it’s own and the Fed is sending the wrong signal by buying back Treasuries but, as I menitoned regarding last week’s visit to Treasury, it seemst that our government couldn’t be more pleased to see rates kept artificially low for as long as possible, despite the malinvestment it’s causing.

I urge you to read the whole article as it’s a complex issue and, on the whole, the headlines are blowing it out of proportion as really the main objection of the seven dissenters is that the economy is strong enough to stand on it’s own and the Fed is sending the wrong signal by buying back Treasuries but, as I menitoned regarding last week’s visit to Treasury, it seemst that our government couldn’t be more pleased to see rates kept artificially low for as long as possible, despite the malinvestment it’s causing.