Bernanke’s “All In"

Courtesy of Bruce Krasting

“We need to do our part to help the economy recover” and ensure job growth in the U.S The labor market is growing “too slowly,”

Today William Dudley (FRB NY) chimed in:

The outlook for U.S. job growth and inflation is “unacceptable” and that the Fed will probably need to take action to spur the recovery and avert deflation.

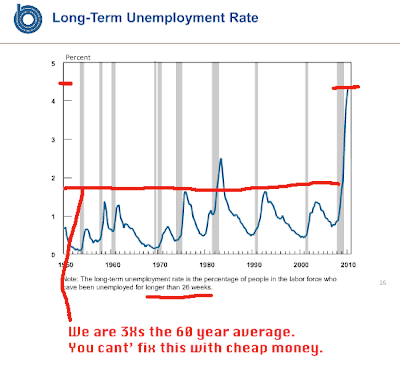

We all know that the unemployment story is a disaster. This graph from the CBO tells the story in a different way.

Current unemployment is 9.5%. The concept of “Full Employment” would still have unemployment at around 5%. So the status today is better stated, “We are about 4.5% above what we would like to be on unemployment”. Looking again at the CBO graph you see that unemployment for greater than 26 weeks is now at a post WWII record of 4.5%. Exactly the same as the current shortfall to the desired Full Employment.

That is not a coincidence. The long-term nature of unemployment we face today is structural. We have exported too many jobs. You can’t fix that problem overnight. And you can’t fix it with another jolt of short-term monetary stimulus. As Philadelphia Fed’s Charles Plosser said this week:

“It is difficult, in my view, to see how additional asset purchases by the Fed, even if they move interest rates on long-term bonds down by 10 or 20 basis points, will have much impact on the near-term outlook for employment.”

What troubles me is that Bernanke is well aware of the fact that his is pushing on a string. There is nothing he can do to address America’s structural unemployment. Yet it is increasingly clear that he will act on November 4th. The comment, “We need to do our part”, says it all. Bernanke is committed with these words.

Do we really need to go down this dangerous road? From the Fed:

9/21/2010 (minutes)The Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be modest in the near term.

This says to me, “We are going in the right direction, we wish it were faster though”. There is no sense of urgency in the Feds words. “Modest” recovery does not justify extraordinary measures. From Bernanke at Jackson Hole on 8/27:

“The deep economic contraction had ended, and we were seeing broad stabilization in global economic activity and the beginnings of a recovery.”

Nothing scary in those words.

“For a sustained expansion to take hold, growth in private final demand–notably, consumer spending and business fixed investment–must ultimately take the lead. On the whole, in the United States, that critical handoff appears to be under way.”

Sounds encouraging to me.

“I expect the economy to continue to expand in the second half of this year, albeit at a relatively modest pace.”

Why is modest such a bad thing? Should we gamble big time to get growth above modest?

Bernanke has been doing his level best to sell QE-2. He has been parading Fed Governors and talking on the quiet to the press. I feel like I am being barraged by an ad campaign. But he has not sold me. To do that he has to convince me that there is a direct correlation to QE-2 and the structural unemployment problem. He can’t do that. There is no connection.

The next QE starts at 1 Trillion. I think it has to be an open ended approach this time. In other words, “The sky is the limit”. It could easily go to $2T. At that point we will have monetized nearly 50% of public sector debt. Nothing like this has ever been done before (successfully).

Bernanke is gambling with our future. He is making an all in bet on our behalf. QE-2 will cause all manner of distortions. But it won’t address the central problem we are facing. For the life of me I can’t imagine how Bernanke can roll the dice like this. Why bet so big when there is so little to gain?