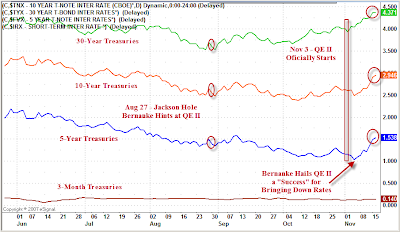

Investigation of Bernanke’s Proclaimed "Success" of QE II at Lowering Rates

Courtesy of Mish

Curve Watchers Anonymous is investing Bernanke’s claim that QE II has already been a success at lowering treasury rates.

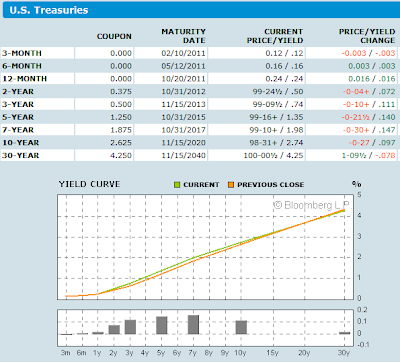

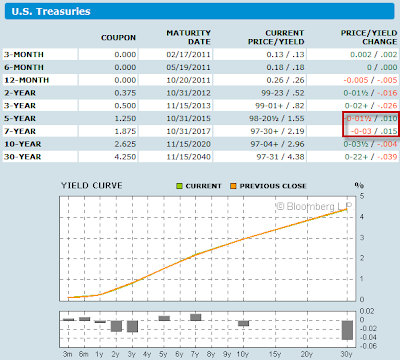

Yield Curve as of 2010-11-16

click on chart for sharper image

Curve Watchers Anonymous admits the "Success" of QE II in sending commodity prices soaring but given the price squeeze it has put on businesses, QE II looks more like a pyrrhic victory than a success.

Price Squeeze or Success?

Please consider NY Fed Manufacturing Survey: New Orders Index Plummets 37 Points to -24.4, Sharpest Drop Since September 2001; Prices Received Negative

Price Indexes Fall

Indexes for both prices paid and prices received were below their October levels. The prices paid index fell 8 points to 22.1, suggesting that the pace of price increases had slowed in November. The prices received index dropped below zero, falling 11 points to -2.6 — a sign of slight downward pressure on selling prices. Employment indexes were also lower. The index for number of employees fell 13 points but, at 9.1, remained above zero, indicating that employment levels were modestly higher in November. The average workweek index, however, fell below zero, to -13.0, indicating that the average length of the employee workweek was shorter.

Prices Paid vs. Prices Received

Small Business Squeeze

Please consider NFIB Report Shows Lack of Sales Still #1 Problem of Small Businesses, Inflation Barely Registers

Sales and Taxes are Two Biggest Problems

Historically inflation measured as a big concern in the mid-to-late 1970’s. Inflation concerns spiked again in the summer of 2008 along with gas prices. In spite of a huge recent rally in commodities there is no fear of inflation now.From the report "Seasonally adjusted, the net percent of owners raising prices was a net negative five percent, a six point increase from September. Plans to raise prices rose five points to a net seasonally adjusted 12 percent of owners. However, most plans to raise prices have been frustrated by the recession and weak sales during the past few years."

The number of business owners raising prices is a net negative 5%. The profit squeeze continues as small businesses are not able to pass along rising input prices. The result is easy to spot: " far more owners report that earnings are deteriorating quarter on quarter than rising."

Economists Petition Fed to End QE II

QE II has been such a success that in an Open Letter to Bernanke 23 Economists Complain About QE II; GOP Lawmakers Call for Abandoning $600 Billion Bond Purchase

Bernanke defended QE II based on a "Dual Mandate", something I say is tantamount to hiding behind a "Curtain of Idiocy". If you missed it, please click on the above link to see why.

Sell the News

Meanwhile the QE II "sure-thing" bet continues to unwind in commodities, global equities, and the yield curve.

The Fed was buying in the heart of the curve, and Curve Watchers Anonymous is watching the heart of the curve blow up in unusual ways.

I talked about this in QE II Bet Starts to Unravel

Signs in the yield curve, municipal bonds, junk bonds, and commodities suggest the one-way "sure thing" QE II bet has started to unravel.

Curve Watchers Anonymous is particularly interested in the yield curve.

Yield Curve 2010-11-12

click on any chart in this post to see a sharper image

A representative of Curve Watchers Anonymous said "I have never seen action like this before. The middle part of the curve is blowing up even as the long bond rallies. The action indicates that everyone who front-ran the Fed purchases is now unloading to the Fed. " …

I have another chart from today that shows this kind of unusual action as well.

Bear in mind those are point in time snapshots I managed to catch. They may not be indicative of a full day’s price action at all. However, they do show unusual patterns suggestive of unwinding of various "sure-fire" trades that cannot lose. They also show just how much Bernanke has distorted things.

Regardless of how you interpret the charts, it is crystal clear Bernanke did not lower rates, nor did QE II do a damn bit of good for business owners in the real economy.