Courtesy of Jr. Deputy Accountant

For a great read, check out No shortage of credit here (April 2010) via Minneapolis Fed’s Fedgazette. In it, Fedgazette editor Ronald Wirtz admits outright that federal incentives have pretty much kept munis afloat, leaving any reasonable person to wonder what happens when the incentives dry up:

In today’s skittish financial markets, this might seem like fantasy. But not so with municipal bonds, which are getting a generally warm reception from investors when state and local governments seek to borrow money for a new bridge, low-income housing or a variety of other public uses.

The reasons for this amenable credit environment generally have to do with the secure nature of municipal bonds, the lack of good, comparable alternatives and, more recently, a federal bond program that encourages municipal issuers to sell bonds and offers incentives for investors to buy them. Data on current bond issuance also omit a significant amount of additional local and state financing being propped up by other federal initiatives. While these federal supports might be viewed as a boon for municipal issuers that need to raise money, they also distort bond markets and impose significant costs on taxpayers.

Bring on the chart porn!

When local and state governments (including their related authorities) need to borrow money for capital projects and a host of other priorities, they sell municipal bonds—the umbrella term for these debt securities.

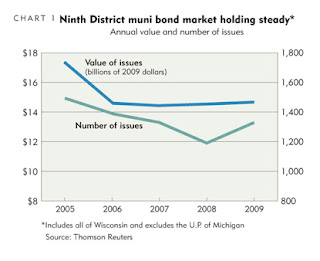

Last year, the value of municipal bonds issued in the Ninth District rose by just 1 percent; since 2006, annual values (inflation-adjusted) have been table-top flat. Gains were higher last year at the national level, though annual levels over the past few years have been more volatile compared with the Ninth District.

Meanwhile, California just issued $14 billion in municipal bonds, perhaps preemptively trying to capitalize on Bernanke’s goodwill tendency to monetize everything that isn’t nailed down. That’s awfully optimistic of California to believe individual and corporate investors might be interested in that large a dump of munis and frankly the math just doesn’t work out if a potential Fed municipal bond bailout isn’t factored into the equation.

Are we calling Build America Bonds a success? That remains to be seen, though the Minneapolis Fed seemed more than happy to trumpet the program’s success months before its planned expiration at the end of this year. It makes sense that municipalities are scrambling to issue as much debt as they can ($160 billion so far) but since when is manipulation a reasonable solution for sick markets? Oh wait, I forgot this is Bizarro World.

Check out BAB Expiration Could Have Upside via The Bond Buyer:

John Hawley, a portfolio manager with Aviva Investors, pointed out there was a time when taxable municipal yields were lower than comparably rated corporate yields: before BABs.

The market used to recognize that taxable municipal yields warranted a premium for poor liquidity and a discount for superior credit quality, Hawley said. On balance, that meant corporates traded at spreads to taxable municipals.

The Barclays Credit Index yield 134 basis points more than the 20-year Treasury at the end of 2006. The taxable muni index of comparable maturity, yielded 70 basis points more.

BABs didn’t change this calculus in any fundamental way, except that they invited almost $100 billion of new issuance annually into an industry that was accustomed to about $25 billion of taxable municipal bond sales a year.

The supply influx has pushed spreads on taxable munis up, Hawley said. The disappearance of new BAB supply would likely pull them back down.

Seriously, who thought taxable munis were a good idea?

Originally published at Jr. Deputy Accountant, Via the Minneapolis Fed, Munis are Where It’s At.