Courtesy of Tyler Durden, Zero Hedge

When the Fed announced that MBS/agency purchases would be a part of QE1 way back in 2008, few were surprised. After all that was the easiest way to lower interest rates on mortgages: a topic that back then seemed critical as there was still hope that the Fed had some control over housing (a premise since proven false now that housing is well into its double dip round). Yet the Fed’s purchases of Treasurys seemed somewhat arbitrary: after all, why buy the most liquid rate security, and more importantly, which derivative asset class was the Fed targeting through UST purchases? And just before QE Lite and QE2 was announced there were additional rumors that the Fed would go after MBS again to assist housing (recall all those Pimco purchases of MBS on margin – of course, only later was it discovered that Gross hopes to get them all put back to Bank of America). To the surprise of many, the Fed picked Treasurys as the preferred security of choice once again. The debate was open: if the Fed is targeting the housing market it should be buying MBS again. No such luck. So now that two years of QE (in their 1, Lite and 2 iterations) are in the history, we finally can run some correlation analyses to see just what asset class the Fed had been targeting all along. The attached chart presents the very simple result.

The chart below shows total Fed holdings of USTs and of the SPY.

Now here’s a thought: the Fed has another $800 billion in UST purchasing dry powder left under QE2 alone…

…Of course the chart above excludes the price of gold in US currency, which confirms that on a real basis, the value of the black line has declined over the same period as it has gotten progressively more diluted with pieces of linen courtesy of the red line.

*****

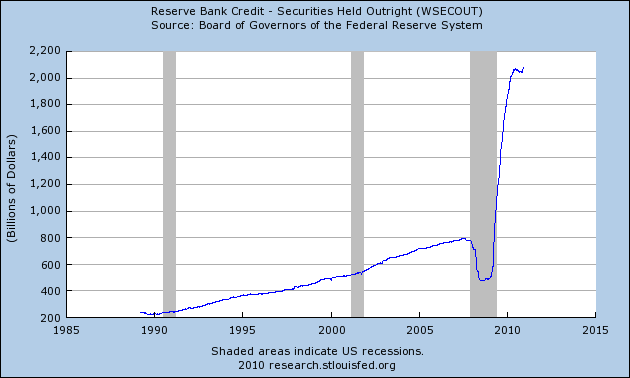

From Fish Gone Bad in the ZH comment section, take a look at this chart:

Reserve Bank Credit – Securities Held Outright (WSECOUT)

Note: The amount of securities held by Federal Reserve Banks. This quantity is the cumulative result of permanent open market operations: outright purchases or sales of securities, conducted by the Federal Reserve. Section 14 of the Federal Reserve Act defines the securities that the Federal Reserve is authorized to buy and sell.