Courtesy of williambanzai7 at Zero Hedge

ONe MoDeST NeW YeaR PReDiCTioN…

"Stock prices rose and long-term interest rates fell when investors began to anticipate this additional action…Easier financial conditions will promote economic growth."

Ben Bernanke

"I don’t know where the stock market is going, but I will say this, that if it continues higher, this will do more to stimulate the economy than anything we’ve been talking about today or anything anybody else was talking about."

Alan Greenspan

WB7: As we look forward to 2011 and the media pundits spin their predictions for the new year, I feel obligated to offer one modest prediction.

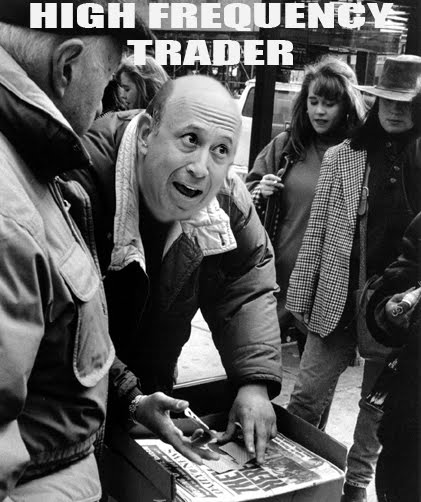

We are constantly being reminded of the record capital outflows form the US equity markets. We hear that somewhere around 80 percent of daily trading activity amounts to churning by high frequency traders.

Retail investors are apparently an endangered species, with good reason.

Meanwhile, there is absolutely no credible reason to believe that the "real economy" is improving. Which explains the fear filled stuttering performance by Emperor Benron on Sixty Minutes earlier this month. The fool is scared shitless and QE2 is the only poker card in his feeble Keynesian hand.

We all know that printing QE2 money and pumping up a new new equity bubble is his tired old game plan.

So here’s my modest prediction, come 2011, the desperate power elite will go full tilt into trying to stir retail investors into an equity driven speculative frenzy. We will hear 24/7 about all the fabulous missed paper opportunities and the stupidity of precious metals. Sitting on the sidelines will be painted tantamount to unpatriotic behavior. We will hear it from the PhDs, the politicians, the talking heads, the CBimboCs, the Bankstas, the brokers and the asset pimps talking up their book. Good luck!

The problem is instead of getting better, the fundamentals appear to be getting progressively worse. We have more concentration in the financial industrial complex and the ratio of the financial to the productive economy has gotten perverse. Timmah’s bullshit leftovers from 2008 have not been liquidated and/or restructured. They’ve just been shoveled into another pot.

Not a good time to be the hopeful sucker on the other side of Bernanke’s bet.

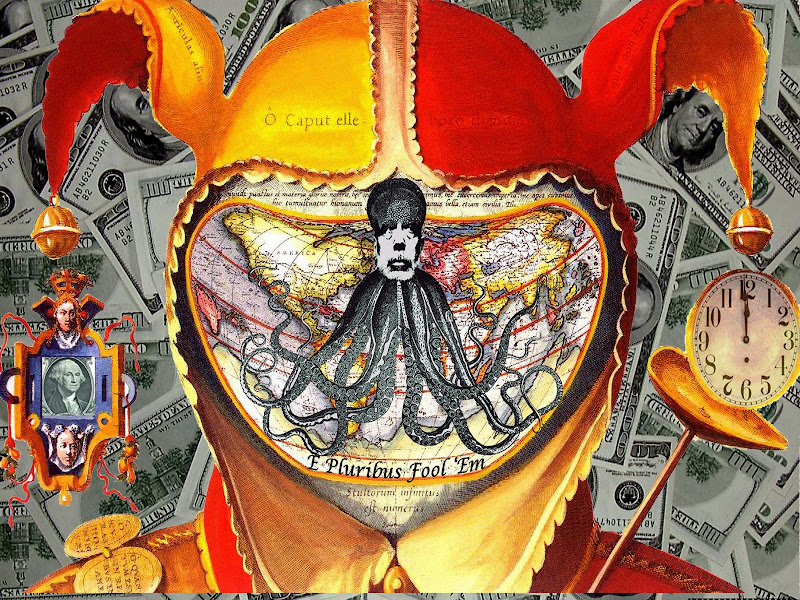

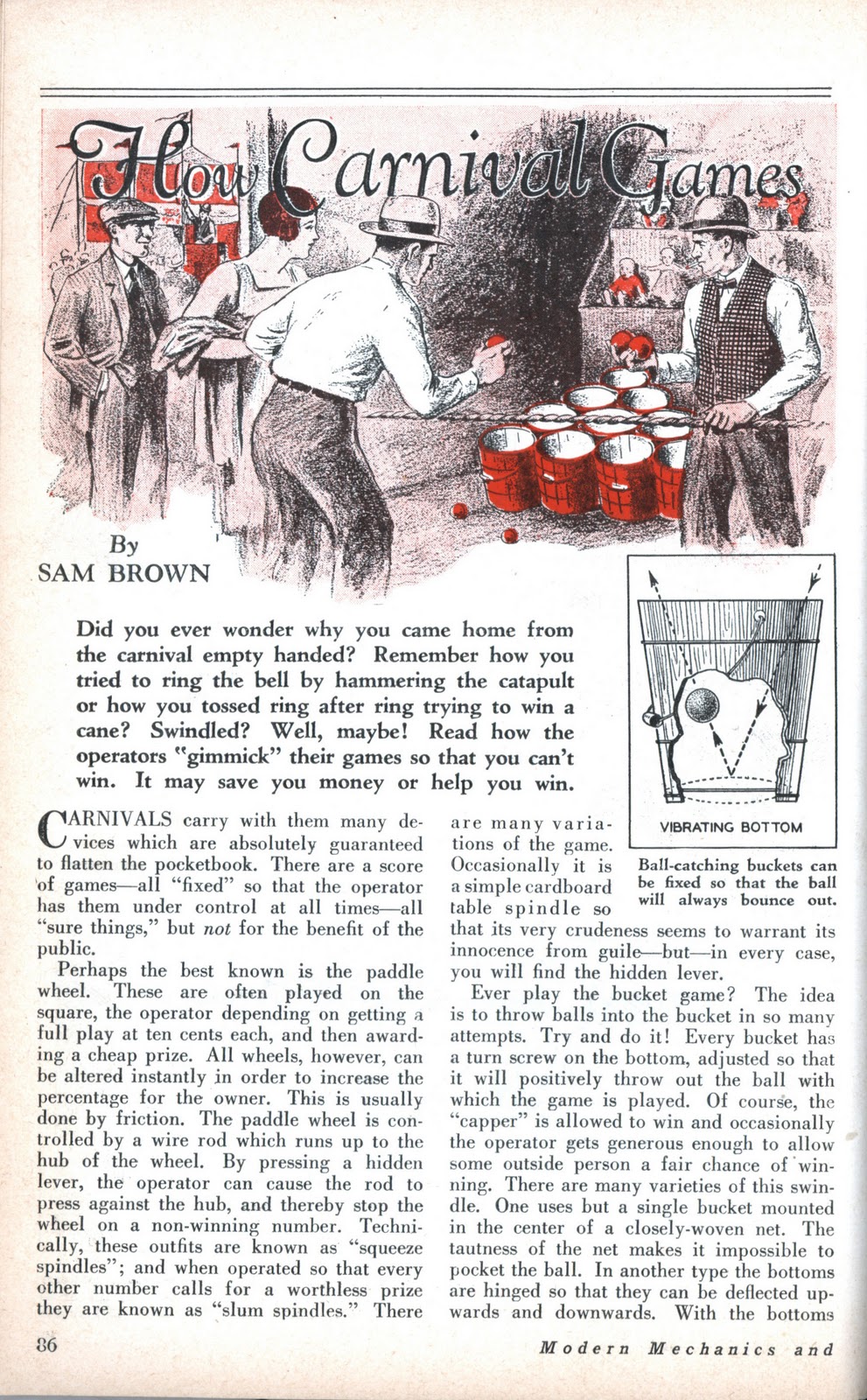

Most importantly, we now know much better than we did in 2008, what a giant rigged game the markets have become. They are literally a stupendous carnival operated by the Emperor Benron and his TBTF posse. I will not recount the details this ongoing Ponzinomic spectacle which all of you know as well or better than I do.

Instead I will quote a lawyer named Franklin C Keyes who made the following warning a little over 100 years ago:

"Suppose in crossing the Atlantic, on one of the great ocean liners, you fall in with some "poker sharps" who have been lying in wait for you. They have the cards all plainly marked, but in such a manner that the marks cannot be seen by you even if suspected. Now, what chance do you think that there would be for you to win, no matter how well you understand the game? As with the insiders in the stock market, these sharpers take no chances…What folly to put up your money in such conditions.

So it is with the Wall Street game, you, inexperienced, are playing with marked cards, as it were, and are in the hands of old sharpers, who, through the press and brokers’ and tipsters’ letters, are actually telling you how to play into their hands…[Y]our chances of winning are just as propitious in Wall Street as in the poker game on the steam liner…."

Sounds familiar, right?

Be sure to warn your close relations, twitter feed and Facebook friends 😉

Meanwhile, in the spirit of the rigged game, I think you will be entertained reading this. After all, life in P.O.N.Z.I. USA is just a Wall Street carnival.

"Wall Street is dominated by by some of the brainiest and shrewdest men in the country, natural born sharpers and schemers, and before the average man can get the better of them, except through the merest chance, he will have to eat brain food for a long time." –Franklin C Keyes, Wall Street Speculation, Its Tricks and Its Tragedies (1904)

The clock is ticking and the Keynesian Fool knows it…

WB7