Courtesy of Steve Keen, of Steve Keen’s Debtwatch

I’ve just wasted a perfectly good day reading the report of the Financial Crisis Inquiry Commission–the body appointed by Congress allegedly to inquire into what caused the Financial Crisis.

I’ve just wasted a perfectly good day reading the report of the Financial Crisis Inquiry Commission–the body appointed by Congress allegedly to inquire into what caused the Financial Crisis.

What it has delivered reads more like an unedited thesis by a journalism student (who is about to receive a “C” grade). There are plenty of quotes, lots of detail, some nice section headings and a few pretty graphs, but absolutely no analysis worthy of the name.

And I thought the WEF report on credit was bad… At least that report actually considered the level of credit and the role of credit in a market economy. It had simplistic assumptions and reached simplistic conclusions, but at least it engaged with the topic, and its attempt to devise metrics for measuring the degree of credit stress deserved some praise.

But this FCIC report was simply a waste of time. All I got out of the entire tome was one good analogy about why the ratings agencies (Moody’s and the like) got the probabilities of defaults by mortgagors so badly wrong:

In rating both synthetic and cash CDOs, Moody’s faced two key challenges: first, estimating the probability of default for the mortgage-backed securities purchased by the CDO (or its synthetic equivalent) and, second, gauging the correlation between those defaults—that is, the likelihood that the securities would default at the same time.

Imagine flipping a coin to see how many times it comes up heads. Each flip is unrelated to the others; that is, the flips are uncorrelated. Now, imagine a loaf of sliced bread. When there is one moldy slice, there are likely other moldy slices. The freshness of each slice is highly correlated with that of the other slices. As investors now understand, the mortgage-backed securities in CDOs were less like coins than like slices of bread. (p. 145)

But that’s about it: otherwise there’s lots of detail, and almost no insights worth even commenting upon. To my surprise, I found myself siding with the dissenting members of the Commission–not because their analysis was much better, but because they had the honesty to describe the majority report as simply useless. As one of the several dissenting reports put it:

The majority’s almost 550-page report is more an account of bad events than a focused explanation of what happened and why. When everything is important, nothing is. (p. 414)

The same dissenting report makes some sensible statements about what the Commission should have considered, and then concludes:

These facts tell us

that our explanation for the credit bubble should focus on factors common to both the United States and Europe,

that the credit bubble is likely an essential cause of the U.S. housing bubble, and

that U.S. housing policy is by itself an insufficient explanation of the crisis.

Furthermore, any explanation that relies too heavily on a unique element of the U.S. regulatory or supervisory system is likely to be insufficient to explain why the same thing happened in parts of Europe. This moves inadequate international capital and liquidity standards up our list of causes, and it moves the differences between the regulation of U.S. commercial and investment banks down that list. (p. 416)

That’s about all that is worthwhile in this entire report. All it amounts to is a journalistic overview of the events from early 2005 till late 2010. It’s reasonable as such–I’m sure some resourceful if unimaginative Hollywood hack writer could mine the document for a movie or two about the crisis. But as such it’s hardly new (Hank Paulson’s insider account of the crisis in “On the Brink” was far more timely and certainly more exciting) and certainly not worth the public dollars that would have been expended on it.

If this is the best the US Congress can do, then the USA can look forward to many more years of this crisis–and many more crises in future.

If you do have to read the report, then please don’t waste any money buying it–just download the PDF instead (I’m sure the hardback will be in a remainder bin at a nearby bookshop in the very near future).

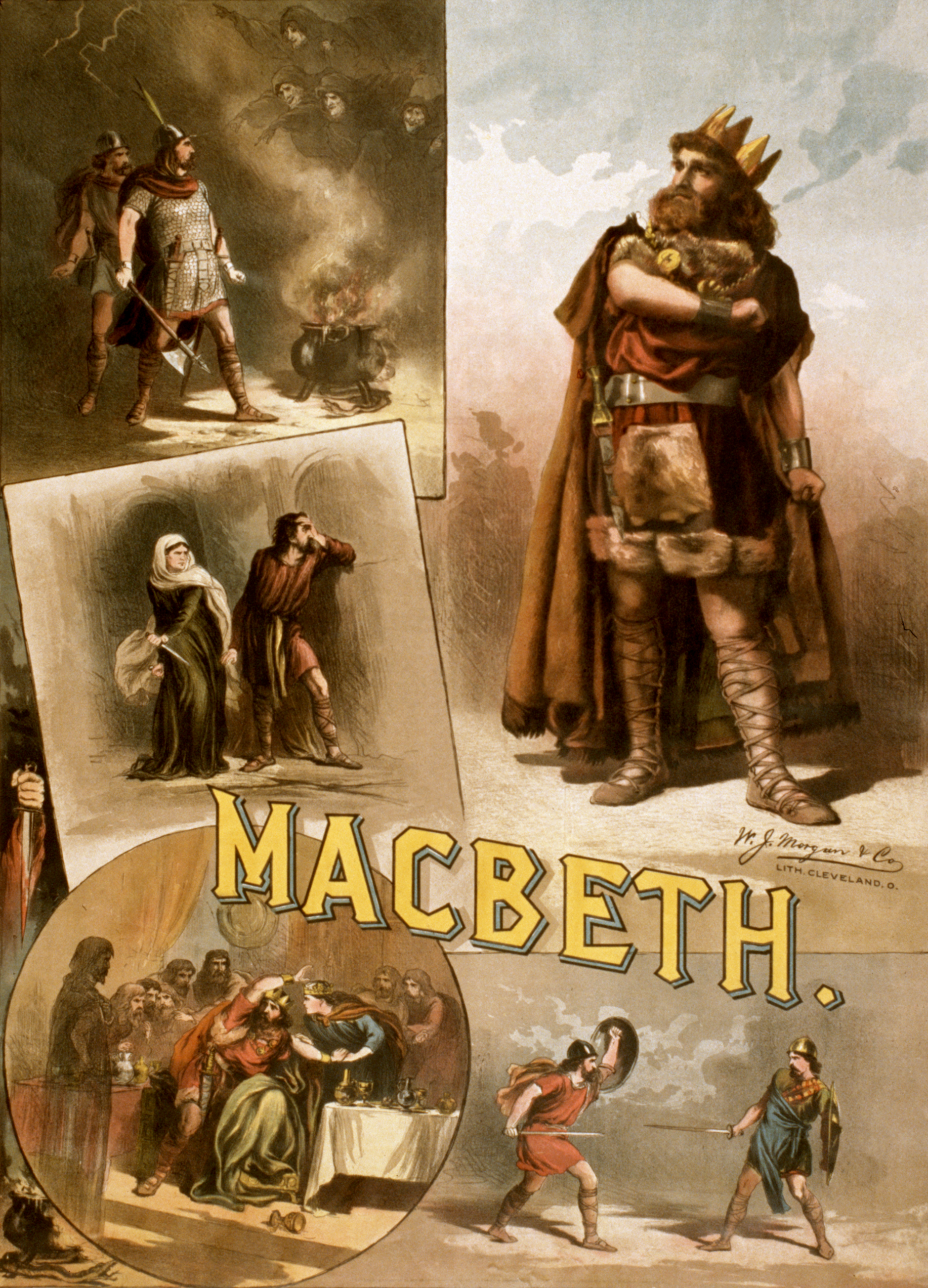

Now I’ll get back to a worthwhile use of my time–finishing the second edition of Debunking Economics. In closing, to make up for your time wasted reading this, here’s the verse in which that wonderful phrase “Sound and fury signifying nothing” entered the English lexicon: Act 5, Scene 5 of Shakespeare’s Macbeth, when Macbeth is told that Lady Macbeth is dead:

Now I’ll get back to a worthwhile use of my time–finishing the second edition of Debunking Economics. In closing, to make up for your time wasted reading this, here’s the verse in which that wonderful phrase “Sound and fury signifying nothing” entered the English lexicon: Act 5, Scene 5 of Shakespeare’s Macbeth, when Macbeth is told that Lady Macbeth is dead:

She should have died hereafter;

There would have been a time for such a word.

To-morrow, and to-morrow, and to-morrow,

Creeps in this petty pace from day to day

To the last syllable of recorded time,

And all our yesterdays have lighted fools

The way to dusty death. Out, out, brief candle!

Life’s but a walking shadow, a poor player

That struts and frets his hour upon the stage

And then is heard no more: it is a tale

Told by an idiot, full of sound and fury,

Signifying nothing.