Lions and tigers and bears don't bother this market so we'll see what data does this morning.

Lions and tigers and bears don't bother this market so we'll see what data does this morning.

We are already right back to where we were on March 9th, when we flipped bearish on Crashiversary day. The market did sell off the next day, BEFORE the earthquake but, as we often do – we went down too far, too fast and by Tuesday, the 15th, I was already flip-flopping and titled that morning's post "Duck this Fip!" and the next day was, as predicted, "Whipsaw Wednesday" as we got our final spike down where we went on a major shopping spree, picking up the following longs in Member Chat:

- HIT ($47, now $54), GE ($19.20, now $19.53) and SHAW ($31.50, now $33.87) – From the main post

- FAS Apr $32 calls for .80, now .45

- TBT June $35 puts sold for $1.72, now $1.23

- TBT June $32/37 bull call spread at $1.90, now $3

- NCR Oct $16 puts sold for $1.10, now .86

- EWJ June $10 calls at .58, now .93

- FCX Jan $45 puts sold for $5.85, now $4.15

- BTU 2013 $50 puts sold for $6, now $5.40

- BTU Jan $65/80 bull call spread at $6, now $7.20

- QQQQ 3/31 $53 calls at $1.48, now $2.73

Most of those trades are stocks we track all the time. We were mainly in cash and we were READY, WILLING and ABLE to take advantage of the sale that was being thrown that day (read post for the set-up logic on the day). This is simply following Warren Buffett's advice to "Be greedy when others are fearful." Today, as we get back to the levels we were last fearful at to the upside – I will remind members that the rest of Mr. Buffett's statement is "Be fearful when others are greedy." Today is a great day to take some cash off the table as we retest our Breakout levels – just in case we don't make it!

Cash is nice, cash is good – cash leaves us flexible and allows us to take advantage of unexpected opportunities like the one we had last Tuesday and Wednesday. Panic is for people who are fully invested and under-hedged – NEVER be one of those people, please….

The cycle on the right has been true for hundreds of years but only recently have our markets moved from Despondency to Euphoria on a weekly – sometimes daily – basis. You can blame the light-speed of the modern exchanges, the 24-hour news cycle, the global markets, the MSM or the Bankster market manipulators, who don't care which way the market goes as long as it forces people to churn their accounts – it doesn't really matter – what matters is you don't let your emotions run your trading.

I spend a lot of time in Member chat talking people off the ledge. Notice Capitulation is just on the other side of hope but most retail traders have a very hard time gutting out that part of the cycle as it's always "different this time," no matter how many times we cycle up and down. Unfortunately, the same traders have just as much trouble taking profits at the top of the ranges. Notice the quote in that area: "Temporary set back – I'm a long-term investor" – That's fine when you are one but not when you have a call that expires in 3 weeks!

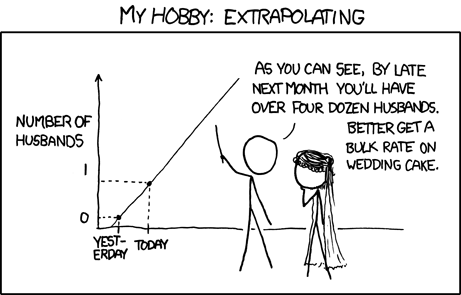

There's a reason we constantly repeat in our Education Section and in the various Sample Virtual Portfolios, "Plan the trade, trade the plan" – When you pick up trades like the ones we made last week and they go up 20, 40, 60 percent a week later – TAKE SOME PROFITS! We were hoping the market would recover to these levels in a month – the fact that it recovers in 5 days doesn't change the plan and the fact that something goes up 10% in 5 days does not mean it will go up 100% in 50 days – that's another cartoon I can't repeat often enough!

There's a reason we constantly repeat in our Education Section and in the various Sample Virtual Portfolios, "Plan the trade, trade the plan" – When you pick up trades like the ones we made last week and they go up 20, 40, 60 percent a week later – TAKE SOME PROFITS! We were hoping the market would recover to these levels in a month – the fact that it recovers in 5 days doesn't change the plan and the fact that something goes up 10% in 5 days does not mean it will go up 100% in 50 days – that's another cartoon I can't repeat often enough!

We were wary yesterday heading into a Durable Goods report we were sure was going to be a miss and, of course, it was a huge miss – down 0.9% in February and down 0.6% ex-transportation vs. up 0.2% and up 0.5% ex-transport that was expected by "expert" economists who OH MY GOD, WHY DO THESE PEOPLE STILL GET TO BE CALLED EXPERTS?!?!

Oh, sorry – just had to get that out of my system. 382,000 people lost their jobs last week and that's only 12,000 more than expected and about the same as last week so all is well there, I suppose. Look, with 135M people still working, it's not shocking that 0.3% of them lose their jobs in any given week. That's a person getting fired, on average, every 6 years and I know quite a few people who blow that curve for everyone else so it's not the job losses that are an issue – it's job creation. We'll be getting Non-Farm Payrolls next week and we have to create 150,000 jobs a month just to keep up with population growth and it will take 5 straight years of 300,000 jobs a month being created just to get us back to 5% unemployment – THAT'S a number we need to pay attention to.

We still have the same inflation that bothered us 2 weeks ago, we still have the same unrest in the Middle East (and now Brussels!), we still have an irradiated Japan, we still have struggling consumers (now movie box office receipts are down 20% from last year), we still have $105 oil, we still have an unresolved Federal budget, we still have dozens of states and thousands of municipalities struggling to balance their own budgets and we still have EU debt issues getting out of control with Moody's just this morning downgrading 30 Spanish banks.

We still have the same inflation that bothered us 2 weeks ago, we still have the same unrest in the Middle East (and now Brussels!), we still have an irradiated Japan, we still have struggling consumers (now movie box office receipts are down 20% from last year), we still have $105 oil, we still have an unresolved Federal budget, we still have dozens of states and thousands of municipalities struggling to balance their own budgets and we still have EU debt issues getting out of control with Moody's just this morning downgrading 30 Spanish banks.

Does all of this really not matter just because some blowhard on CNBC sings "Sunshine and Lollipops" while their trained chimp tells you to BUYBUYBUY stocks that already have p/e's above 50? Come on folks – let's play the markets that are real – not the markets we wish for in either direction…

When in doubt, we play our levels and we'll be watching them closely today – especially the Nasdaq as they try to get back to 2,750 and, of course, the hyper-critical S&P 1,300 line while 815 on the Russell has been a good flip indicator. Remember – our bullish premise is simple – INFLATION. Whether the economy is good or bad, things will get more expensive and that includes stocks. Just like the gallon of gas you buy for $4 doesn't get you any farther than the gallon of gas you bought for $2.50 last year – the MCD company who's stock is at $74 doesn't really make much more than they did last year at $60 but the rising tide of inflation lifts all ships and we'd better be on board or we will most assuredly end up under water.

Stay dry!