Wheee, we’re recovering already!

Wheee, we’re recovering already!

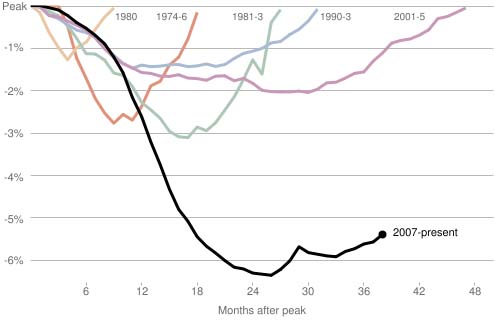

This is not sour grapes, we played for a recovery today (see Stock World Weekly’s wrap-up of last week) but it’s already getting silly with a half-point gain in pre-markets based on — nothing. As you can see from the chart on the left, 40 months into the downturn that has given us the worst number of job losses since the Great Depression, we are nowhere near a recovery. This is terrible, this is unprecedented, this is – great for business!

Bill McBride of Calcuclated Risk, reminds us that Wall Street’s "dirty little secret" is that Wall Street and corporate America like the unemployment rate to be a little high. Higher unemployment keeps wage growth down, and helps with margins and earnings – and higher unemployment also keeps the Fed funds flowing freely. Corporations like to see SOME job growth, so people have enough confidence to spend (and they can have a few more customers) but they don’t care if that job growth is in the US or China. "A SLOWLY declining unemployment rate (even at 9%) with some job growth is considered OK," says McBride.

Paul Krugman pointed out last week that "it wasn’t much of a recovery to start with. Employment has risen from its low point, but it has grown no faster than the adult population. And the plight of the unemployed continues to worsen: more than six million Americans have been out of work for six months or longer, and more than four million have been jobless for more than a year." Krugman continues:

Paul Krugman pointed out last week that "it wasn’t much of a recovery to start with. Employment has risen from its low point, but it has grown no faster than the adult population. And the plight of the unemployed continues to worsen: more than six million Americans have been out of work for six months or longer, and more than four million have been jobless for more than a year." Krugman continues:

It would be nice if someone in Washington actually cared.

It’s not as if our political class is feeling complacent. On the contrary, D.C. economic discourse is saturated with fear: fear of a debt crisis, of runaway inflation, of a disastrous plunge in the dollar. Scare stories are very much on politicians’ minds.

Yet none of these scare stories reflect anything that is actually happening, or is likely to happen. And while the threats are imaginary, fear of these imaginary threats has real consequences: an absence of any action to deal with the real crisis, the suffering now being experienced by millions of jobless Americans and their families.

Of course, Paul talks to a lot of Democrats and that may be where he gets the impression someone does care about jobs. The Republicans held a debate last week and, like the proverbial tree in the forest, it didn’t make much sound but the few sound bytes that did escape that black hole of an event were about gay rights and whether or not Osama Bin Laden’s trophy photos should be released – clearly the kind of things we are electing our leaders to decide in these troubled times.

Of course, Paul talks to a lot of Democrats and that may be where he gets the impression someone does care about jobs. The Republicans held a debate last week and, like the proverbial tree in the forest, it didn’t make much sound but the few sound bytes that did escape that black hole of an event were about gay rights and whether or not Osama Bin Laden’s trophy photos should be released – clearly the kind of things we are electing our leaders to decide in these troubled times.

The big trouble we expect this week is Wednesday’s 10-year note auction, capping off a week in which our Government will borrow another $72Bn, which many feel puts us over the debt ceiling already. “Debt managers were likely to maintain the status quo, since cutting coupon auction sizes now – though warranted – could add confusion to an already noisy debate,” said economists at RBS in Connecticut. “For example, the cuts could be misinterpreted as an effort by Treasury to avoid the debt limit.”

Speaking of spending money we don’t have – $23Bn of POMO money will be handed out to the IBanks in the first 3 days of the week as the Government props ’till we drop. The new POMO schedule comes out Wednesday at 2pm and, since this is, in theory, the second to last round, it will be scrutinized for signs of abating but, "in the shuffling madness — no way to slow down."

Remember GM? Remember how they were deeply in debt and losing money but people kept lending them more money and the government kept giving them money and everything was going to be OK until, finally, it wasn’t? Our whole country is kind of like GM now except there is no cosmic entity that is going to come down from above and bail us out since our ADMITTED debt burden is already 25% of the entire planet’s GDP. Keep in mind GDP is SALES, not PROFITS – that means it would take many, many years for the whole World to pay off the United State’s debt but, of course, we are not alone as the EU has their fair share as well and Japan – well Japan is about $11Tn in debt and they just had a $500Bn earthquake, which is the combined GDP of Greece, Portugal and Ireland but THEY have the strongest global currency – how messed up is that?

We began looking at the Dollar and its place in the Universe last week and this weekend I began to ask "How Much for that Dollar in the Window" as we seek to discover what a fair value for our currency really should be which, hopefully, will give us an idea of what PRICE (not value) the markets will arrive at to finish the year. Efforts were made in overnight trading to knock the Dollar back down from last week’s run but 74.50 hung tough at 4am and we’re back over 75 at 8:40 and that’s taking the indexes back down as sentiment changes and people would rather have dollars than iffy looking stocks and commodities.

We began looking at the Dollar and its place in the Universe last week and this weekend I began to ask "How Much for that Dollar in the Window" as we seek to discover what a fair value for our currency really should be which, hopefully, will give us an idea of what PRICE (not value) the markets will arrive at to finish the year. Efforts were made in overnight trading to knock the Dollar back down from last week’s run but 74.50 hung tough at 4am and we’re back over 75 at 8:40 and that’s taking the indexes back down as sentiment changes and people would rather have dollars than iffy looking stocks and commodities.

People would certainly rather have dollars than homes as Zillow reports this morning that housing prices fell ANOTHER 3% in Q1 this year – down 8.2% since last March with home prices now falling for a record 57 consecutive months – even in the Great Depression, people found a few buyers. Don’t forget that this is our housing market WITH the Government’s $8,000 home-buyer tax credit boosting us in the first half of last year! It’s also our housing market with a Fed Funds Rate of 0.25% and mortgages in the 5% range – as I pointed out to Members this weekend, a 2% rise in rates to 7% leads to a 20% increase in mortgage payments so, unless our government can continue to borrow $140Bn a month for less than 3% – we could get a pretty sharp drop in housing prices down the road…

Not only that, but the Foreclosure Tsunami is just beginning with FMCC and FNMAselling 94,000 foreclosed homes in Q1, a 23% increase over last year but that was NOTHING compared to the 218,000 properties they foreclosed on, which was a 33% gain over last year. So let’s do that math – 94,000 was a 23% increase in sales but that still netted them a rise in their backlog of 124,000 homes, which would have been a 73% increase over last year. There, that gives us a better view on how fast and how bad things are getting. FNM reported a $6.5Bn net loss in Q1 – despite the 23% increase in sales!

Not only that, but the Foreclosure Tsunami is just beginning with FMCC and FNMAselling 94,000 foreclosed homes in Q1, a 23% increase over last year but that was NOTHING compared to the 218,000 properties they foreclosed on, which was a 33% gain over last year. So let’s do that math – 94,000 was a 23% increase in sales but that still netted them a rise in their backlog of 124,000 homes, which would have been a 73% increase over last year. There, that gives us a better view on how fast and how bad things are getting. FNM reported a $6.5Bn net loss in Q1 – despite the 23% increase in sales!

People who don’t think this is a huge problem are simply delusional. Nobody, not even quasi-Government agencies like Freddie and Fannie, can remain in the business of holding onto roughly 500,000 homes that are collecting no rents and costing them property tax bills while they fall into disrepair – it’s a very dangerous combination, especially when the used home market in America is down to 5M all year – INCLUDING Freddie and Fannie’s 800,000 plus whatever other banks are dumping. No wonder you can’t get a good price for your house and no wonder there’s no indication that things will be improving any time soon.

The number of homes subject to a foreclosure filing may rise by 20 percent this year to 3.5 Million homes, up from a record 2.87 million properties in 2010, RealtyTrac, an Irvine (Calif.) data company, predicts. The market currently can absorb about a million foreclosures a year, the Mortgage Bankers Assn. estimates. Fannie and Freddie themselves estimate in regulatory filings that it will take "a number of years" to bring their foreclosure inventory down to pre-2008 levels. As their holdings of unsold homes increase, Fannie and Freddie eventually will need to drop prices and turn to investors, analysts predict.

The number of homes subject to a foreclosure filing may rise by 20 percent this year to 3.5 Million homes, up from a record 2.87 million properties in 2010, RealtyTrac, an Irvine (Calif.) data company, predicts. The market currently can absorb about a million foreclosures a year, the Mortgage Bankers Assn. estimates. Fannie and Freddie themselves estimate in regulatory filings that it will take "a number of years" to bring their foreclosure inventory down to pre-2008 levels. As their holdings of unsold homes increase, Fannie and Freddie eventually will need to drop prices and turn to investors, analysts predict.

"I think they’re just [postponing] the inevitable," says Michael Slaughter, a partner at New Providence Capital, a Dallas-based private lender. "If they don’t start with a systematic distribution of these properties to investors who have cash today and will buy them at the right price, they’re going to end up selling the entire virtual portfolio to Goldman Sachs (GS) or BlackRock (BLK) at a tenth of what they can get for them today."

Of course if you think the US looks like a train wreck in progress, you’d better look at the alternatives before jumping ship! Japan is, of course, radioactive and not a popular choice at the moment and the US we mentioned above but, at 8:30 this morning, the S&P cut it’s rating on Greece yet again to B/C AND put them on negative watch saying: "Although an extension of maturities with no principal discount would likely imply a recovery greater than 50%, our projections suggest that principal reductions of 50% or more could eventually be required to restore Greece’s debt burden to a sustainable level, given trend growth potential of the Greek economy."

Of course if you think the US looks like a train wreck in progress, you’d better look at the alternatives before jumping ship! Japan is, of course, radioactive and not a popular choice at the moment and the US we mentioned above but, at 8:30 this morning, the S&P cut it’s rating on Greece yet again to B/C AND put them on negative watch saying: "Although an extension of maturities with no principal discount would likely imply a recovery greater than 50%, our projections suggest that principal reductions of 50% or more could eventually be required to restore Greece’s debt burden to a sustainable level, given trend growth potential of the Greek economy."

In a WSJ editorial, Timo Soini lays out the case for rejecting any more EU bailouts, calling them little more than schemes, with "opaque constructs … that make Enron look simple," to transfer bank losses to taxpayers. He blasts politicians, either for not understanding, or for being more worried about missing the next invite to dinner in Brussels. Greek CDS spreads increase by 3.2% as investors confrontrenewed worries about the ability of the country to pay its debt. Irish and Portuguese spreads rise as well, but worst performing of all are Spanish CDS, which rise 4.1%, but remain just one fifth the level of Greece.

In short, today is NOT a dip we will be buying – we got our little bounce and I really don’t see the fundamentals for renewed confidence – at least not until Wednesday’s POMO release when da boyz can feel safer programming the trade bots for more shenanigans.

Be careful out there.