Wheeeeeeeeeeeee!

Wheeeeeeeeeeeee!

I love the smell of capitulation in the morning (illustrated nicely by David Fry). It smells like — opportunity. We haven’t had a good bottom-fishing expedition in ages and it’s amazing to think that less than two weeks ago I was having to tell our Members NOT to BUYBUYBUY at the top. On Friday, July 22nd, when Jimmy Cramer was crowing Thursday night over "29 of 30 Dow Stocks" closing higher as if that meant you should buy everything that wasn’t nailed down, I was warning that the new EU rescue fund only indicated things were worse than they seemed. My comment that morning (7/22) was:

I like shorting the Futures here: S&P (/ES) at 1,346, Nas (/NQ) 2,415, Dow (/YM) 12,720 and Rut (/TF) 842.6 – as long as 74.20 hold on the Dollar, we should get a bit of a sell off so these are levels to look for as the Dollar heads back over that line but we can scale into position between 75.20 and 75.10 but, below that, too dangerous! Oil is good too below $99.50 with tight stops (now $99.66 so a patience game) – couldn’t quite get back to $100 ahead of the EU open.

I was wrong (so far) on shorting gold as our GLL Aug $22 calls have fallen from .50 to .10 (we rolled down to the $20s but those are not faring much better at the moment) but that was much more than made up for with the MASSIVE gains on the short futures as well as huge winning spreads like that morning’s Alert to Members, where my trade idea was to buy the SQQQ Aug $21/24 bull call spread for .90 and sell the AAPL weekly $375 puts for .80 for net .10 on the $3 spread. Of course the AAPL puts expired worthless and SQQQ is now at $25.29 and the spread is $1.85 so up 1,750% so far (and half off the table with stops on the rest at this point, of course).

I was wrong (so far) on shorting gold as our GLL Aug $22 calls have fallen from .50 to .10 (we rolled down to the $20s but those are not faring much better at the moment) but that was much more than made up for with the MASSIVE gains on the short futures as well as huge winning spreads like that morning’s Alert to Members, where my trade idea was to buy the SQQQ Aug $21/24 bull call spread for .90 and sell the AAPL weekly $375 puts for .80 for net .10 on the $3 spread. Of course the AAPL puts expired worthless and SQQQ is now at $25.29 and the spread is $1.85 so up 1,750% so far (and half off the table with stops on the rest at this point, of course).

THAT’s why we love our disaster hedges – they really help balance out your virtual portfolio in the event of an actual disaster with every $1,000 hedged paying $17,500 on that play. We then turn around (like today) and cash out that money and use it to buy more longs or roll our existing long positions. If we break down further, we simply add another hedge that pays us 1,000% in a down market so we can buy MORE longs at the next possible bottom. As I have been saying all of July – we are short-term bearish but long-term bullish. This fast bottom test is PERFECT for our bullish premise! Assuming we do recover, of course…

At 1:36pm on the 22nd, the market was still heading up and the pundits on CNBC were foaming at the mouth that oil was going back over $100 and the indexes were about to make new highs and snake oil would cure baldness – whatever the sheeple would believe – but I warned Members that earnings looked good but guidance did not, saying:

That’s the key to this thing – we caught a good Q as Japan’s problems boosted our manufacturing and the dollar tanked, sending our exports flying and, of course, oil got jacked up and our energy and commodity pushers made a fortune at the same time as Obama pumped 2% back into people’s paychecks to fake a consumer recovery. It was a very nice sugar rush and now comes the crash...

Also, of course, although many Conservatives would argue otherwise, lack of Government spending is also bad for the markets as are millions of people not getting paychecks and benefits. On the other hand, a debt deal will lower our borrowing costs (not that they are high now) and, if paired with budget cutbacks, should also strengthen the Dollar so, either way, It’s not the best time to go long on the market.

Am I saying all this to brag? Of course I am – what’s the fun of being right if nobody pays attention. I am also going over this to remind our Members that I am about to call a bottom for the same reason I called a top – TOO MUCH, TOO FAST! Should we have sold off – of course we should have – that was my (very accurate) fundamental call and I was 100% in disagreement with the punditocracy. In fact, that Friday we were joking about how many times CNBC could say "China" in a single segment so they could steer another boatload of retail suckers into the very top of a rally (EDZ was another great short hedge for us).

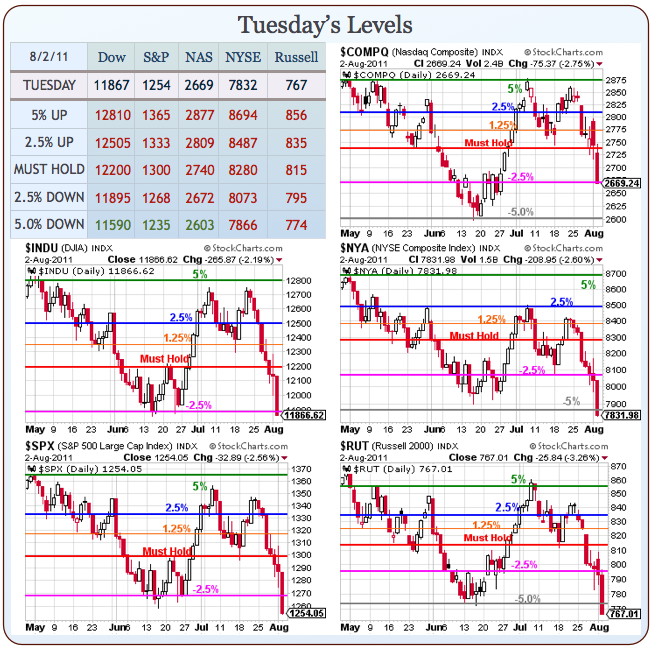

UNTIL AND UNLESS we break below the bottom of our range – we have no reason to be bearish at our -5% lines. The -5% line is the same support level (adjusted for the Dollar) that we predicted last Summer (July 25th), when we called that turn on the nose and again on Feb 19th of this year, when we called the top of that rally.

UNTIL AND UNLESS we break below the bottom of our range – we have no reason to be bearish at our -5% lines. The -5% line is the same support level (adjusted for the Dollar) that we predicted last Summer (July 25th), when we called that turn on the nose and again on Feb 19th of this year, when we called the top of that rally.

So I am doing this as a time saver because I know all day it will be "Cramer said sell" and "the technicals clearly show DOOM" and "the last guy on CNBC said to buy gold" etc… I am just humbly pointing out that MY levels, which are based on market fundamentals and not technicals – have been holding up fine since March of 2009 so I’m really not inclined to dump them this morning.

I already sent out an Alert to Members this morning with long ideas on the futures with the Nasdaq (/ES) over the 2,300 line (already had a quick win this morning and a chance to reload), oil over $93 ($93.50 already) and gasoline (/RB) over $3 (still $3) ahead of inventories at 10:30 but NO WAY do we risk oil inventories, which are likely to be bearish.

I already sent out an Alert to Members this morning with long ideas on the futures with the Nasdaq (/ES) over the 2,300 line (already had a quick win this morning and a chance to reload), oil over $93 ($93.50 already) and gasoline (/RB) over $3 (still $3) ahead of inventories at 10:30 but NO WAY do we risk oil inventories, which are likely to be bearish.

We are, at this point, cashy and cautious. We made a ton of money on our bearish plays and now we will watch to confirm that our lower levels are holding. If we get a good spike down at the open, we will want to do some bottom fishing but, if we drift down slowly, that would be more bearish. The dollar is very low at 74.10 and, as I said on BNN yesterday, the BOJ has TOLD US the WILL intervene on the Yen and that means boosting the Dollar and boosting the Dollar means knocking down the PRICE (not value) of equities and commodities.

I am expecting at least a bounce, between now and Friday, back to test our 2.5% lines. If we can’t get that, then things are going to be very scary heading into the weekend, especially as we expect oil to sell off below $92.50 next week and that will hit the energy sector and maybe even drag metals lower as well. The Yen is testing the 77 line this morning (way too strong) and the Nikkei was off another 2% this morning, down to 9,637 and that’s down 8.5% for the year.

I would expect 9,500 to be strongly defended by the Japanese government as the last thing they need is a market collapse on top of all their other problems BUT surely they know that pumping up the Dollar will tank the US markets and that won’t help them either so maybe, just maybe, they will hold off long enough for us to find some support.

After all, it’s only Wednesday.