In case you were on vacation, here’s what you missed:

In case you were on vacation, here’s what you missed:

The Dow is down 2.6% for the week, the S&P is down 2.3% and the Nasdaq is down 1.2%. Very likely, by the end of the day, these losses will be erased and we should have a nice, green close. For some reason (can’t imagine why) the VIX went up to 45, where we shorted the Hell out of it. One trade idea we had was on Wednesday Morning, where we sold the Aug $45 calls for $1.45 against the Sept $45 calls at $1.40. Even yesterday that one was looking good with the Augs down to .85 and the Sept $45s still $1.30 so the net .05 spread turned into net .45, a nice 800% gain in two days.

On Wednesday afternoon, Nicha had a great idea to short VXX as well, so we did the Sept $36/32 bear put spread at $2.50, selling the Aug $38 calls for $1.55 for net $1 on the $4 spread. Those Aug $38 calls have already dropped to $1 and the bear put spread is $2.60 so that’s net $1.60 – up 60% in two days on that one. This is why we ALWAYS sell into the initial excitement. On the whole, we have been TRYING to follow my philosophy, which I reminded everyone of of in last Friday’s Member Chat, of "Don’t Just Do Something, Stand There!" – which is still some of the best crisis management advice I can give people.

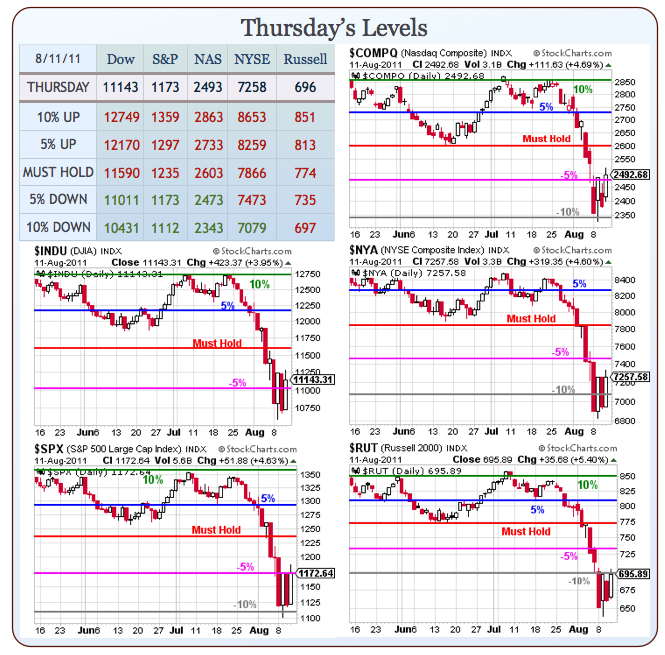

What does our Big Chart look like since last Friday?

Wow, those were four very silly days, weren’t they? As I noted above, we’re down about 2.5% for the week but the week isn’t over and we could still turn this puppy around and do you know what that would be? It would be a VERY bullish bottom candle on a weekly chart! In fact, if we can finish August back at that +5% line (a 10% gain into the month’s end), THAT would form a VERY bullish candle on a MONTHLY chart.

So Greece blah, blah and Italy, blah, blah and Merkel, Sarkozy, B-B-B-Bennie and the Fed, Inflation, Deflation, Unemployment, Debt and Taxes – whatever… Just wake us up when it’s over and we’ll consider pulling our cash off the sidelines. Meanwhile, as I lectured Members in this Morning’s Chat, CASHY AND CAUTIOUS remains a prudent strategy and we can use some of that cash to take a nice vacation and ignore this nonsense until they either announce QE3 and sent the markets on an upward path or fail to do so and send us straight to Hell.

You don’t NEED to be "in the market" when the market is acting stupid. Let’s say we were 80% in cash with a few favorite long-term positions held on to through the downturn. If it’s a $100K portfolio and we had $80K in cash and we allocated just net $200 (0.25%) to the VIX spread (40 contracts) with a stop at a $200 loss (risking 1/4 of 1%), the trade is already up $1,600, which is 1.6% of the ENTIRE portfolio in just 2 days. THAT is what you can do with cash – you take the opportunities that present themselves, which is much easier to do when you can focus on one trade you intend to get in and out of rather than sweating over 20 positions as the market jumps up and down 5% a day, right?

You don’t NEED to be "in the market" when the market is acting stupid. Let’s say we were 80% in cash with a few favorite long-term positions held on to through the downturn. If it’s a $100K portfolio and we had $80K in cash and we allocated just net $200 (0.25%) to the VIX spread (40 contracts) with a stop at a $200 loss (risking 1/4 of 1%), the trade is already up $1,600, which is 1.6% of the ENTIRE portfolio in just 2 days. THAT is what you can do with cash – you take the opportunities that present themselves, which is much easier to do when you can focus on one trade you intend to get in and out of rather than sweating over 20 positions as the market jumps up and down 5% a day, right?

As David Fry notes: "In the end this volatility and manic behavior is a massive turn-off to Main Street. The powers that be (TPTB) are pulling out all the stops to thwart action they don’t like. Margin requirements were raised on gold because rising gold prices are a Bronx Cheer to the Fed, Treasury and Administration. The Swiss National Bank is discussing a “euro peg” in order to stop the franc’s rally. Not only are the Swiss suffering with export difficulties but Swiss banks have been a large creditor to emerging European countries who must pay back loans in francs. And, just released news, France, Italy, Spain and Belgium have announced a 15 day short sale restriction for banks within these countries. This defies a ruling from the EU chief regulator and is being done unilaterally by each country. Will this solve things? It will for 15 days and that’s all you can say. Meanwhile, Sarkozy is having another date with Merkel to make sure they’re on the same page with regard to bailouts. She’s become very unpopular in Germany given the Germans will carry the lion’s share of the bailouts. And so it goes."

As I mentioned on Wednesday – THAT’S THE PLAN – "They" want Main Street out of the markets ahead of QE3. You listen to the MSM and the analysts on CNBC and you do not get the impression that we are in month 23 of an EXPANSION, nor do you get the feeling that this recession, although bad, is NOTHING like the Great Depression – yet there are many, many stocks (CSCO, WFR, IMAX..) trading as if we’re in the middle of Great Depression Part II. I’ll have more to say about this over the weekend but, for today, we’re just going to sit back and enjoy the rally – watching the Dollar to stay below that 74.50 line and give the markets a boost (as I predicted in Member Chat this morning).

Meanwhile, here’s a very cool chart on the Geography of Job Losses Over Time from Barry Rithotz’s site and I would encourage my Conservative friends to play with this and contemplate the utter catastrophe that faced our new President in 2009 and I would encourage the Bears out there to contemplate how much LESS BAD things are now. No, we did not immediately add back 10M lost jobs – that would require economic stimulus that is NOT in the form of tax cuts. Even bailouts only "save" jobs – they don’t create them.

Click on the map to see the animation.

No wonder people in Texas think everything is fine! They are fine in New York City too but we are a bunch of bleeding-heart Liberals who care what goes on in the rest of the country (see the Katrina damage in late 2005 on the chart!) – or maybe it’s just because all our Mothers are in Florida and we have friends in California (more Liberals!) and Chicago (more Traders!), so we’re a little more in touch with what’s going on in the country than people who think an island getaway is taken at South Padre or Galveston.

Have a great weekend,

– Phil