Obama did not satisfy the markets last night.

Obama did not satisfy the markets last night.

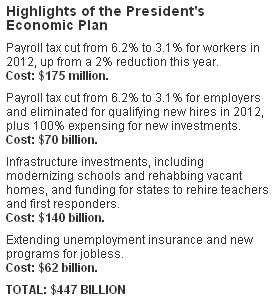

Although his $447Bn American Jobs Act is a step in the right direction, $307Bn (68%) of the money is coming in the form of tax cuts and Unemployment Insurance extensions, leaving just $140Bn to go towards the creation of actual jobs. Even if every single dollar of that money went directly towards paying a $40,000 salary – the entire amount would employ just 3.5M people, not even 1/4 of the amount of people who are out of work.

Is that the best America can do? Come up with a jobs program that MIGHT lower unemployment from 9% to 7% over the next year? Of course we won’t create 3.5M jobs for $140Bn because a lot of that money gets spent on parts and materials. It’s certainly not that the projects are unnecessary, it’s just that the scope of the program is too limited to have a substantial impact.

In fact, exactly one year ago, I wrote "Jobless Thursday – America’s Infrastructure Crisis" where I laid out the TRILLIONS of Dollars worth of repair work that MUST be done in this country sooner or later. Why don’t we do them SOONER, while 20M potential workers are sitting on the sidelines? We MUST spend at least $2Tn on infrastructure in the next 10 years so why not spend $400Bn this year and next rather than waiting until the last minute to do anything? The money is all borrowed over time either way but NOW is when people need to get back to work and, of course, if we get necessary projects done now instead of 10 years from now, then we, the People, get to enjoy 10 years of beneficial use out of them. This is not complicated stuff folks, just common sense…

Nonetheless, $447Bn is 3% of our GDP and figure about 2/3 gets spent in the first year so the program SHOULD keep us out of Recession in 2012 – yay for that at least. If Recession is off the table, then the markets are underpriced – now we have to consider whether or not the bill can get past the Republicans in Congress. By the way, if you have not read "Reflections of a GOP Operative" yet, please do – it’s an excellent insight into the current political climate.

Nonetheless, $447Bn is 3% of our GDP and figure about 2/3 gets spent in the first year so the program SHOULD keep us out of Recession in 2012 – yay for that at least. If Recession is off the table, then the markets are underpriced – now we have to consider whether or not the bill can get past the Republicans in Congress. By the way, if you have not read "Reflections of a GOP Operative" yet, please do – it’s an excellent insight into the current political climate.

We had flipped bearish yesterday, anticipating the potential for disappointment with both Bernanke and Obama’s speeches after a nice 5% run-up in anticipation of the same in the first two trading days of the week. In Member Chat we grabbed the SDS Sept $23/24 bull call spread at .30 with bullish offsets so not too bearish but a nice 3.1:1 pay-off (not including the offset) if the S&P pulls back and SDS ends up over $24 next Friday. We finished the day at $23.70 on the sell-off but, as I just said above, it looks like we won’t need the hedge as this jobs bill, IF PASSED, has an excellent chance of keeping us from contracting.

Since our hedges (there were 3 new ones in Member Chat yesterday) are fully offset with bullish bets, we can afford to hold them over the weekend – especially as New York and DC are on terror alert this morning (and Southern California lost power last night), which is hopefully nothing with 9/11 coming on Sunday but, just in case, we are better safe than sorry.

Since our hedges (there were 3 new ones in Member Chat yesterday) are fully offset with bullish bets, we can afford to hold them over the weekend – especially as New York and DC are on terror alert this morning (and Southern California lost power last night), which is hopefully nothing with 9/11 coming on Sunday but, just in case, we are better safe than sorry.

It wasn’t all bearish betting yesterday, though, we found long trade ideas we liked (hedged, of course!) on HPQ, WFR, DF and XLF with shorts on USO (as oil touched $90 again), Oil (/CL) Futures (huge winner this morning with oil at $87.50!) and AGQ so mixed betting – down with commodities, bottom-fishing in stocks, was the theme but we do stand ready to tip more bearish if our levels fail to hold (see yesterday’s post).

There will be more Fed Speak today as SF Fed Dove, John Williams speaks at 11:15. Williams helped send the markets lower yesterday as he cut his growth forecast for the second half of the year to 2% (not too bad) and called for immediate and strong action by both Congress and the Fed, without which he sees no change in the 9.1% unemployment rate saying: "The real threat is an economy that is at risk of stalling and the prospect of many years of very high unemployment, with potentially long-run negative consequences." We’ll see how he feels about Obama’s proposal later this morning. Williams’ great concern is the same as everyone’s – that "Europe’s debt crisis has the potential to slam U.S. financial markets and deal a further blow to already fragile confidence. A downturn in Europe could knock the props out from under the U.S. recovery.”

Speaking of Europe, they are down about 1% this morning but it’s the Euro itself that’s the real story, dropping all the way to $1.377 as the EU heads into lunch. That’s the lowest the Euro has been since February, when the Dollar was way up at 78.50. That’s another 2.5% up from here and, as we all know, a 2.5% rise in the Dollar can very easily give us a 2.5% or GREATER drop in the markets. If we’re going to have any silver lining from the rising dollar (aside from falling commodities) let’s look for the Russell to begin to outperform as a strong Dollar is good for small companies who do most of their business in the US (and not at all good for the few exporters we have left).

Speaking of Europe, they are down about 1% this morning but it’s the Euro itself that’s the real story, dropping all the way to $1.377 as the EU heads into lunch. That’s the lowest the Euro has been since February, when the Dollar was way up at 78.50. That’s another 2.5% up from here and, as we all know, a 2.5% rise in the Dollar can very easily give us a 2.5% or GREATER drop in the markets. If we’re going to have any silver lining from the rising dollar (aside from falling commodities) let’s look for the Russell to begin to outperform as a strong Dollar is good for small companies who do most of their business in the US (and not at all good for the few exporters we have left).

There’s a G7 Meeting this weekend As central bankers and finance ministers from the Group of Seven nations convene in Marseille, France, for their first face-to-face talks since they promised "coordinated action" Aug. 8 to calm financial markets, Europe’s failure to stamp out investor worries over sovereign debts are set to be the focus. Any global recession "will have Europe’s fingerprints on it," said Constance Hunter of Aladdin Capital Management LLP in Stamford, Connecticut. "Europe is the real risk." It’s not the only risk as policy makers race to head off a recurrence of the contraction, the worst since the Great Depression, that followed the collapse of Lehman Brothers Holdings Inc. three years ago this month. The Organization for Economic Cooperation and Development yesterday said the G-7 will barely expand in the final quarter as the euro region shrinks.

The cost of insuring Greece’s debt against default shot to a new high on Thursday, as investors increasingly see the country in a risk class of its own, even compared with other troubled euro-zone economies. Greece’s five-year credit default swaps rose to 3008 basis points, up 288 basis points from Wednesday, according to data provider Markit. The Greek government said Thursday the economy contracted in the second quarter even more than was originally thought, by 7.3% instead of 6.9%. Officials conceded the government will fail to cut its budget shortfall as planned this year.

The cost of insuring Greece’s debt against default shot to a new high on Thursday, as investors increasingly see the country in a risk class of its own, even compared with other troubled euro-zone economies. Greece’s five-year credit default swaps rose to 3008 basis points, up 288 basis points from Wednesday, according to data provider Markit. The Greek government said Thursday the economy contracted in the second quarter even more than was originally thought, by 7.3% instead of 6.9%. Officials conceded the government will fail to cut its budget shortfall as planned this year.

The rest of Europe is losing patience with Greece. Germany has hinted Greece will not get its next bailout check unless it gets its act together, and Finland reiterated its insistence on collateral for more Greek aid, a controversial condition that has Europe divided and threatens to delay new agreements. “The euro zone has spent a year trying to bail out an overindebted country by loaning it more money,” LeBas said. “That’s not going to work in the long run. Some form of Greek default is a largely foregone conclusion.”

Japan has revised their annualized GDP to NEGATIVE 2.1%, down from the -1.3% initial reading as Capital Spending was revised to -0.9% from +0.2%. China, meanwhile, is looking at 6.2% August Inflation, led by rising food prices which, unfortunately, make up 40% of the average Chinese family’s budget.

It looks like the G7 have plenty to discuss this weekend.

Have a good one,

– Phil