Courtesy of Doug Short.

What constitutes progress in Europe? I certainly had it wrong last week!

With a general framework in place, my hope and expectation was that we could finally refocus on matters directly related to corporate earnings, the economy, and the implications for the markets. This hope lasted for less than 24 hours!

I have had a pretty good record of predicting the agenda for the week ahead, but I should have looked more carefully at that package we got from the Greeks!

News Background on Europe

The skeptics — and that includes nearly all of the punditry — want a pure and comprehensive solution. I’s dotted and t’s crossed. They want to analyze the deal the same way they would the Groupon IPO. Provide specific commitments. Who is on board? What will they do?

They expect progress at the same speed they would accomplish in their own business — problem, analysis, solution.

In democratic governments it does not work that way.

Progress on policy problems is messy, sloppy, imperfect, slow, and laden with compromises.

My expectation for Europe is a multi-faceted solution. The outline is in place and there are solid indications of commitment. The pieces of the puzzle will drop into place, but it is a gradual process.

I will suggest what we might look for in Europe at the end of the article. First, let us do our regular review of last week’s events.

Background on “Weighing the Week Ahead”

There are many good sources for a comprehensive weekly review. My mission is different. I single out what will be most important in the coming week. My theme for the week is what we will be watching on TV and reading in the mainstream media. It is a focus on what I think is important for my trading and client portfolios.

Unlike my other articles at “A Dash” I am not trying to develop a focused, logical argument with supporting data on a single theme. I am sharing conclusions. Sometimes these are topics that I have already written about, and others are on my agenda. I am trying to put the news in context.

Readers often disagree with my conclusions. (A commenter recently suggested that was proof that I was wrong — an amazing interpretation!) Do not be bashful. Join in and comment about what we should expect. This weekly piece emphasizes my opinions about what is really important and how to put the news in context. I have had great success with my approach, but feel free to disagree. That is what makes a market!

Last Week’s Data

The economic and earnings news was pretty good, but the main story was about Europe.

The Good

The economic story was pretty good when compared to our current modest expectations. Look more closely and you will see what I mean.

- The ISM manufacturing index was slightly below expectations, but this was mostly due to “prices paid.” Other subcategories were good and the overall reading is consistent with a 2.9% increase in GDP. This information is freely available in the ISM release, the result of their research. I have never seen this reported anywhere else. Why is that?

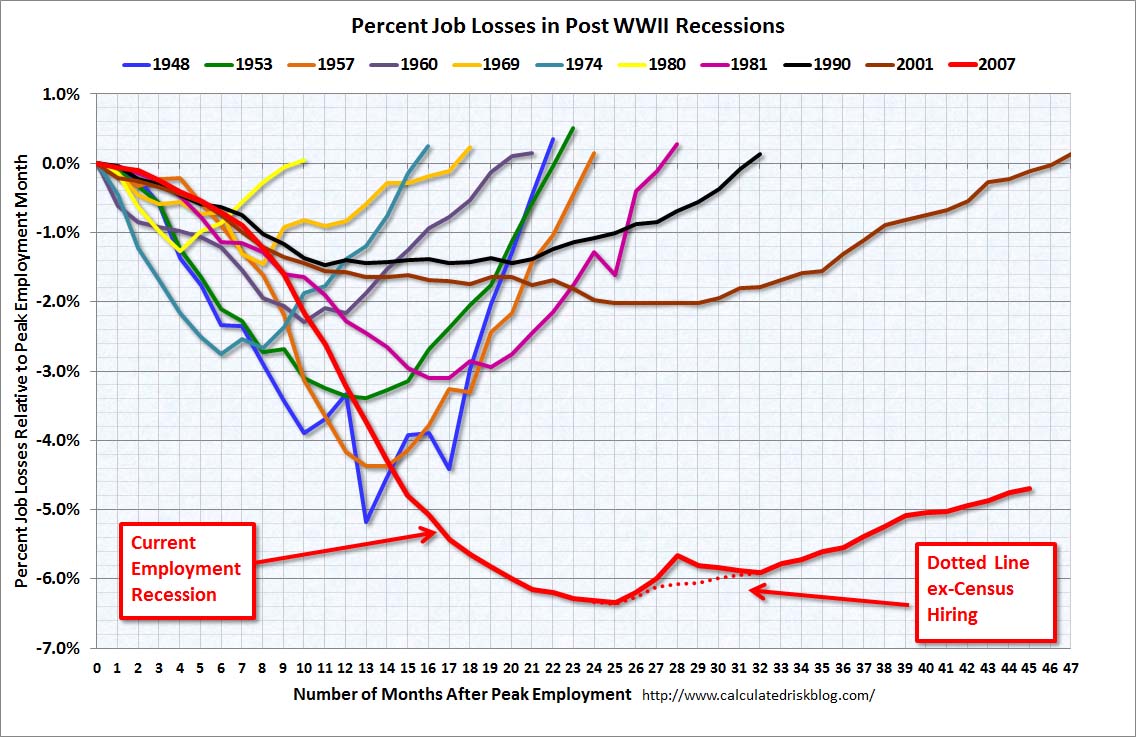

- The Employment Situation Report was basically positive. The payroll jobs gain, including revisions, was about 180K. The revisions reflected late-reporting businesses, not any adjustment by the BLS. I really like the balanced commentary from Steven Hansen, and I share his concern about the BLS seasonal adjustments. Meanwhile, no one is doing a good job on this story. The problem is that every media source focuses on net jobs change instead of labor market dynamics. This has been a multi-year crusade for me. Those who understand will profit, but the challenge is how I can explain this more effectively. Meanwhile, the positive report is still not enough. My favorite look at the overall labor market is from Calculated Risk. By lining up the various recessions you can see the depth of the decline and also the slow nature of the recovery.

- Initial jobless claims dipped below the 400K mark. Most observers are looking at this as a static target with 400K a mediocre reading, 500K a recession warning, and an expansion target in the low 300K range. We really should adjust our thinking to compensate for the changing size of the labor force. Scott Grannis does this very nicely:

- Auto sales were strong. Check out the charts from the Calafia Beach Pundit.

- Some economic forecasts from big-time sources are moving higher (via Calculated Risk).

- Earnings season is still strong, beating expectations by almost 65%, continuing a two-year pattern.

The Bad

As always, there was some negative news.

- The most important story was the surprise call for a referendum in Greece. I remind readers that “good” means market-friendly and “bad” means the opposite. I am making no social commentary on what is right for Greece or for Europe. The referendum threat is a clear negative for financial markets.

- The G20 did nothing. This is related to the Greek story, since the referendum threat seemed to alter the timetable. The outline of the plan remains in place, but the speechmaking impressed few observers.

- Revenue “beats” are weaker, as shown by The Bespoke Investment Group:

- This is leading to falling earnings expectations. Ed Yardeni and Brian Gilmartin both have fine coverage of this story. Estimates are still pretty solid, but continue to weaken. Recession worries, Europe, and possible decline in profit margins are combining to create this effect.

The Ugly

Despite the backdrop of slightly better economic news, the forward-looking ECRI indicators remain negative. I have not found confirmation from other forecasters with similar excellent records, but the ECRI is standing firm about an inevitable recession. So far we do not have a time frame. Doug Short has a typically fine chart of the ECRI data, as well as insightful commentary on the strident nature of the ECRI position.

The Indicator Snapshot

It is important to keep the weekly news in perspective. My weekly indicator snapshot includes important summary indicators:

- An Economic/Recession Indicator. I am evaluating several candidates.

- The St. Louis Fed Stress Index

- The key measures from our “Felix” ETF model.

The SLFSI reports with a one-week lag. This means that the reported values do not include last week’s market action. The SLFSI has moved a lot lower, and is now out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution.

There will soon be at least one new indicator, and the current choices are still under review.

Our “Felix” model is the basis for our “official” vote in the weekly Ticker Sense Blogger Sentiment Poll, now recorded on Thursday after the market close. We have a long public record for these positions.

We voted “Neutral” this week, adjusting the forecast on Friday.

[For more on the penalty box see this article. For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I’ll do my best to answer.]

The Week Ahead

This will be a relatively light week for economic data. I am especially interested in Thursday’s report on initial jobless claims and Friday’s preliminary report on the Michigan consumer confidence index.

There are a number of Eurozone meetings (Monday and Tuesday) and speeches by Fed members. I am not expecting much from the Fed folks, but who knows about Eurozone executives and finance ministers — not too mention any news from Greece.

Mark Gongloff has an excellent agenda of all events — economic, earnings, and political.

Trading Time Frame

Our trading accounts were fully invested last week, but the nature shifted dramatically away from US equities. Gold, oil, and emerging markets are moving higher. Inverse ETFs on the US market have moved higher in the ratings. It is a very fluid situation, with mixed implications for stocks. This program has a three-week time horizon.

Investor Time Frame

Long-term investors should continue to watch the SLFSI. Even for those of us who see many attractive stocks, it is important to pay attention to risk. A month ago we reduced position sizes because of the elevated SLFSI. The index has now pulled back out of our “trigger range,” but it is still high. We have some cash in these accounts, and will use volatility to establish new positions.

The Final Word

As part of my final word this week I want to join others in congratulating Josh Brown on the third anniversary of his blog, The Reformed Broker. He has had a rapid rise to prominence on many fronts, including print media and some well-deserved TV spots. In our office we back up the TIVO and turn up the sound when Josh is on. Abnormal Returns had a very nice piece highlighting some of Josh’s past articles. While I had read most of them in real time, it was a nice review, including his advice for bloggers.

Part of this advice is a recognition about what each blogger can and cannot do. Any of us who are trading and managing accounts, for example, will not be able to provide breaking news coverage on Greece. Any specific news I write tonight may be obsolete by the time you read it.

Instead, I try to add value by providing perspective and tools to help you interpret breaking news. With this in mind, here are some observations about the European situation:

- There is a commitment and a will among European leaders to maintain the Eurozone.

- Any plan will, at first, seem short on capital. As the pieces become clear, more participants will join in. We should not expect China or Middle East sovereigns to be the lead investors, but they may be ultimate particiants. Imagine you were putting together an underwriting, starting with some lead investors.

- European banks capital needs will also be met through a combination of requirements, guarantees, and direct investments.

- Exposure of US financial institutions is a source of worry according to stock prices, but not so much by other market indicators. This is the best risk/reward area if you think disaster in Europe will be avoided.

- The European fears partly reflect concern about counter-party failure and partly world economic growth effects. This is holding down earnings forecasts and stock prices.

Most importantly, there is little market edge for the average investor in following the daily twists and turns in Europe. Staying on top of this is a full-time job with little to gain. The volatility makes little sense. Many of the “events” are news stories and comments that add little fresh information, but stimulate trading.

The market swings can provide good opportunities if you follow my advice and think about both a buy and sell point for your positions.

(c) New Arc Investments

www.newarc.com

Email Jeff