Courtesy of Doug Short.

Earnings season starts in earnest this week. There are a number of key questions:

|

As I write this on Saturday, with a three-day weekend ahead, I know that the news from Greece will dominate on Tuesday. Whatever I write tonight could look silly, but I have been there before:)

By Thursday, we’ll all be talking earnings.

I will discuss how to play this in the conclusion. First, let us do our regular review of last week’s news.

Background on “Weighing the Week Ahead”

There are many good sources for a comprehensive weekly review. My mission is different. I single out what will be most important in the coming week. My theme for the week is what we will be watching on TV and reading in the mainstream media. It is a focus on what I think is important for my trading and client portfolios.

Unlike my other articles at “A Dash” I am not trying to develop a focused, logical argument with supporting data on a single theme. I am sharing conclusions. Sometimes these are topics that I have already written about, and others are on my agenda. I am trying to put the news in context.

Readers often disagree with my conclusions. Do not be bashful. Join in and comment about what we should expect in the days ahead. This weekly piece emphasizes my opinions about what is really important and how to put the news in context. I have had great success with my approach, but feel free to disagree. That is what makes a market!

Last Week’s Data

Last week saw an interesting change in tone. The news from Europe (at least until Friday) was better, while the US economic data was worse. The dollar strengthened, which for many months has been the signal for lower prices on commodities and stocks. With that in mind, stocks did pretty well.

The Good

- 2012 Earnings. The best news of the week is something that you will not see mentioned by most observers. The one-year forward earnings estimates are higher. I view as very significant for the market. Recently forward estimates have been drifting lower with European and recession worries. Brian Gilmartin has been all over this story, and writes that estimates on the S&P 500 have now increased to $107.

- The Beige Book, used by the Fed Open Market Committee as part of the decision on interest rate policy, reflected improved business conditions.

- Sentiment, when measured by behavior rather than polling remains sentiment. Mark Gongloff discusses with data and commentary from Doug Kass.

- Rail traffic ends the year with solid gains. See Steven Hansen’s complete analysis.

- University of Michigan sentiment registered a big increase to 74. For several years this measure has been helpful as a gauge of employment prospects, but more recently has been heavily influenced by gasoline prices and the debt ceiling debate. Doug Short does a great job of illustrating the relationship between this measure, other sentiment indicators, and the economy. There are several good charts, but this is my favorite:

The Bad

The important economic data was mostly negative.

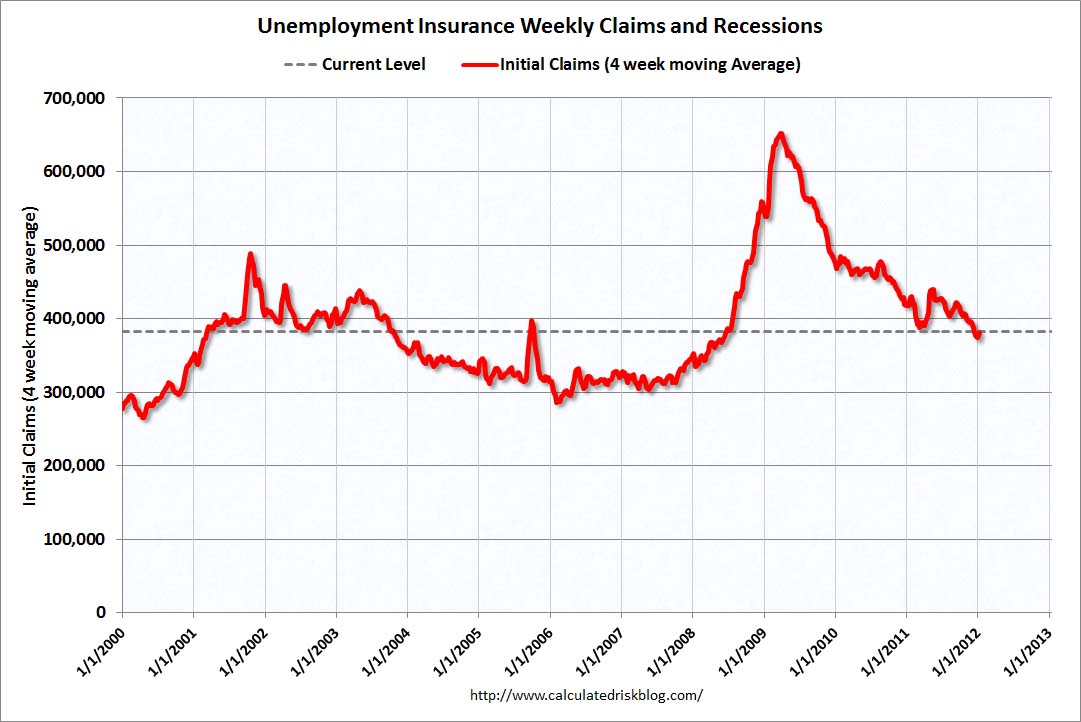

- Initial jobless claims rebounded to 399K. See a nice collection of employment charts at Calculated Risk.

- Job openings showed no growth. Good charts at Calculated Risk. An increase in the “quit rate” is one positive element of the report.

- Retail sales increased only 0.1%, well below expectations of 0.4%. Consumer behavior in the first quarter is a big focal point.

- The trade deficit expanded to $47 billion.

The Ugly

Congress is not in session, so our legislative leaders dodge the “Ugly Award” this week. Actually the Senate might be in session, but we will need the Supreme Court to decide. At the moment they are preoccupied with determining what constitutes indecency in broadcasting. Part of the oral argument before the court was whether the brief nudity on NYPD Blue was more graphic than the frieze in the Court itself. Even Scalia laughed.

The ugly news is the breakdown in the negotiations over the Greek debt haircut. While all parties want to avoid a disorderly Greek default, there is also general agreement on the need to reduce future obligations. Some observers do not think that a compromise is possible, despite the high stakes. This news weighed heavily on the euro and US stocks during Friday’s trading.

The Indicator Snapshot

It is important to keep the current news in perspective. My weekly snapshot includes the most important summary indicators:

- Economic/Recession Indicators. This week continues two new measures for our table. The C-Score is a weekly interpretation of the best recession indicator I found, Bob Dieli’s “aggregate spread.” I’ll explain the link to the C-Score next week. The second is the Super Index. You can read more about it in this article. It reflects extensive research and testing, and is well worth monitoring. (The Super Index includes the ECRI approach).

- The St. Louis Financial Stress Index.

- The key measures from our “Felix” ETF model.

The SLFSI reports with a one-week lag. This means that the reported values do not include last week’s market action. The SLFSI has moved a lot lower, and is now out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution. Before implementing this indicator our team did extensive research, discovering a “warning range” that deserves respect. We identified a reading of 1.1 or higher as a place to consider reducing positions.

Our “Felix” model is the basis for our “official” vote in the weekly Ticker Sense Blogger Sentiment Poll. We have a long public record for these positions. We voted “Bullish” this week.

[For more on the penalty box see this article. For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I’ll do my best to answer.]

The Week Ahead

There will be a lot of news this week, including the economy, speeches, Europe and, most important of all — earnings. As usual, I am highlighting the events that I see as most important.

On the economic front we’ll get inflation data on Wednesday and Thursday — PPI and then CPI. Among the various housing reports I will focus on Thursday’s building permits.

Thursday also brings the weekly report on initial claims, especially important given this week’s spike. I am not expecting much from the other economic data (industrial production, capacity utilization, and the regional Fed reports).

Thursday is the biggest day for earnings, with a long list of reports from major companies, but there will be significant reports all week.

For a consolidated list of earnings, European auctions, speeches, and economic releases, I like the weekly calendar from Mark Gongloff.

Trading Time Frame

Our trading accounts have been 100% invested for several weeks. Felix caught the recent rally quite well and still has several strong sectors in the buy range. While the overall ratings are not strong, it remains a marginally bullish forecast. This program has a three-week time horizon for initial purchases, but we run the model every day and change positions when indicated. We just closed a position in IWM (iShares Russell 2000) with a 6% gain since December 19th, initiated when things looked rather bad. Felix has been more confident than I have been on the trading time frame.

Investor Time Frame

Long-term investors should continue to watch the SLFSI. Even for those of us who see many attractive stocks, it is important to pay attention to risk. In early October we reduced position sizes because of the elevated SLFSI. The index has now pulled back out of our “trigger range,” but it is still high, but declining. For investors desiring this risk management approach we raised cash when the trigger hit the range. We have also been cautious with new accounts. We still do not have an “all clear” signal, but I am watching the decline in risk with great interest. Depending on the news this week, we may get more aggressive.

Our Dynamic Asset Allocation model is also very conservative, featuring bonds and other defensive holdings.

To summarize, we have a very conservative posture in most of our programs, recognizing the uncertainty and volatility. For new accounts we are establishing partial positions, using volatility to buy favored names and selling calls for those in the Enhanced Yield program. This program has been working very well, meeting the objectives of conservative, yield-oriented investors. It follows our key precept:

Take what the market is giving you.

Right now that continues to be dividend stocks at reasonable prices with the chance to sell call options at inflated prices. If the stocks do nothing, you can still get almost 10% per year from dividends and call premiums.

This does not work for those selling long-dated calls. It requires some active management, selling calls with a month or two before expiration to capture the most rapid time decay.

The Final Word

This will be an important week for gauging market tone. I expect most companies to offer cautious guidance, frequently citing European concerns and an uncertain US environment. There is little incentive to do otherwise. My reading of analyst reports suggests that these also reflect the same fears, helping to restrain estimates of future earnings.

The market reaction to earnings reports will provide important information. The overall negative sentiment provides an opportunity for long-term investors as long as we continue to see progress — not a perfect solution, but progress — in Europe.

(c) New Arc Investments

www.newarc.com

Email Jeff