The Dollar is down 1%.

The Dollar is down 1%.

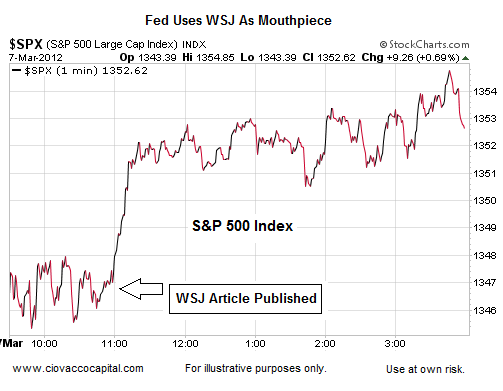

That makes the markets go up 1%. Mostly, the Dollar is down based on a FABRICATION in Uncle Rupert's Wall Street Journal – the most widely read financial publication in the World (next to Philstockworld, of course!). Although Jon Hilsenrath, the WSJ chief economist who started this nonsense made it VERY CLEAR that the story was predicated on IF they decide to do more "capital I, capital F," Jon says – THEN this is the kind of bond buying that might happen.

That's all it took yesterday to send the S&P up 1% but, if there were a volume measure, you'd see that, on the Dow, 25M shares were traded before 11, and just 35M shares between 11 and 3:30 and then 50M shares were traded between 3:30 and 4pm, almost 100% down volume. The only people that are fooled by these word games are the beautiful sheeple who are so well-trained to buy the F'ing dips that even a misstatement like this sends them into a buying frenzy.

Ah, fresh meat – we love it! Oil (/CL) was back at $107 this morning and we already caught a nice dip off our favorite sell spot in Member Chat and gold is giving us a good short entry at $1,700 (/YG) as well. All we have to do is watch the Dollar and see if it can hold 79.40 once real trading begins. The Euro is up at $1.324, off the $1.31 line yesterday so up 1% and the Pound is up from $1.57 yesterday to $1.58 this morning and the Yen is loving it at 81.71 (weaker) as they've been solidly backing the Euro over at the BOJ this month and the Nikkei futures (/NKD) shot up from 9,500 yesterday to 9,835 this morning (3.5%) on a 1% drop in their currency so this would be a great spot (below 9.850) to short the Nikkei.

For the Futures impaired, the EWJ April $10 puts at .20 should be a fun way to play the Nikkei reversing, assuming reality sets in at some point. It's 8:25 now and oil just hit $106.50 and that's our take the money and run spot in the futures as we pick up $500 per contract off my 4:56 comment in Member Chat this morning:

For the Futures impaired, the EWJ April $10 puts at .20 should be a fun way to play the Nikkei reversing, assuming reality sets in at some point. It's 8:25 now and oil just hit $106.50 and that's our take the money and run spot in the futures as we pick up $500 per contract off my 4:56 comment in Member Chat this morning:

Oil (/CL) just failed $107, gold (/YG) $1,700 with the Dollar very bouncy off 79.45 so those are the stop lines for the short plays.

Of course, we discussed my oil targets in yesterday's post (and a couple of great short spreads as well), as well as on my TV spot Monday so it's not a big secret where we're drawing our line in the sand and it's very telling that, so far, it's held up quite well for us. As to our short plays, we cashed in our bullish QQQ spread into yesterday's rally as we thought investors MIGHT be smart enough to understand that the WSJ story was fake and, THEREFORE, there was no reason for the rally but – as PT Barnum pointed out – "no one ever went broke underestimating the stupidity of the general public."

That's why we held off on rolling up and adding to our short positions with our long profits (except for more USO puts at $106.50, which I thought we were lucky to get) and it looks like we'll be rewarded this morning with an even higher open to short. As David Fry notes on his USO chart, now that we've gotten bored with Iran as a driver for oil – we're back to old faithful QE3 to justify the insanity of $105 oil.

That's why we held off on rolling up and adding to our short positions with our long profits (except for more USO puts at $106.50, which I thought we were lucky to get) and it looks like we'll be rewarded this morning with an even higher open to short. As David Fry notes on his USO chart, now that we've gotten bored with Iran as a driver for oil – we're back to old faithful QE3 to justify the insanity of $105 oil.

Refineries cut 2% off their capacity last week to fake an additional supply shortage and crude imports to the US were cut by 475,000 barrels per day, short-shipping us 3.3M barrels for the week. Gasoline production was cut by 392,000 barrels for the week but, for the whole week, the draw on gasoline stocks was just 400,000 barrels – indicating the lowest demand measured since the beginning of this century at the same time as we are paying the highest prices of the century!

According to the IEA, Total products supplied over the last four-week period have averaged 18.3 million barrels per day, down by 6.1 percent compared to the similar period last year. Over the last four weeks, motor gasoline product supplied has averaged about 8.4 million barrels per day, down by 7.8 percent from the same period last year. Distillate fuel product supplied has averaged nearly 3.6 million barrels per day over the last four weeks, down by 7.6 percent from the same period last year – yet there are those who will tell you that the 10% INCREASE in price is somehow not the result of speculation…

Note that not only are we still at record inventory levels DESPITE the fact that the US Energy Cartel is shorting us 1,189,000 barrels of production PER DAY (35Mb/month) but that same gang of criminals is EXPORTING 1,246,000 barrels per day for another monthly loss to the US of 37Mb/month. So we are using 72Mb/month less oil than last year, that's 3.9 days PER MONTH (13%) of total US energy consumption that consumers have cut back trying to save money – but all that has done is left the door wide open for speculators to jack up the prices to fill in the gap – defying all logic of supply and demand to simply bend you over the gas pump and rape you repeatedly – and you take it, don't you?

You vote for some schlub and send him to Washington but you can't take 5 minutes to write a letter (or 5 seconds to Email this article) and DEMAND that he do something or maybe, just maybe, next time you will wake up from your mindless political stupor and vote for someone who does have the balls to stand up to these bastards.

Use this link to contact your Congresspeople and feel free to send them all or part of this article but put in your own personal message and tell them how you feel about being screwed over by speculators and the US Energy Cartel that includes the very banks we bailed out with our tax Dollars and continue to fund with our FREE MONEY from the Fed as well as the refiners who refuse to refine and the drillers who refuse to drill and the shippers who circle their tankers around in the Gulf of Mexico, waiting for a price spike to unload their tankers and, of course, let us not forget the people who want to build a pipeline so we can ship MORE US oil OUT of the country and away from American consumers.

Use this link to contact your Congresspeople and feel free to send them all or part of this article but put in your own personal message and tell them how you feel about being screwed over by speculators and the US Energy Cartel that includes the very banks we bailed out with our tax Dollars and continue to fund with our FREE MONEY from the Fed as well as the refiners who refuse to refine and the drillers who refuse to drill and the shippers who circle their tankers around in the Gulf of Mexico, waiting for a price spike to unload their tankers and, of course, let us not forget the people who want to build a pipeline so we can ship MORE US oil OUT of the country and away from American consumers.

If you can't spend 60 seconds of your life to make your opinion heard by the people YOU elected to represent you in Washington, then you forfeit the right to complain next time you are raped at the pumps. You can click "like" on Facebook or "tweet" this article and spread awareness or you can be part of the problem and just keep letting it happen. This country is being bled dry by oil speculators – that's a FACT – millions of jobs go up in smoke as we pay $130Bn a year more for oil at $105 than we do at $85 and that's just the US – Globally, this is a $700Bn a year problem and that amount doubles as barrels are marked up along the pipeline and those prices flow into food, transportation and other energy-related costs.

$1.4Tn a year is a lot of money. And that's just the amount we're paying OVER $85 a barrel. Oil was $20 a barrel under Clinton and we used MORE oil per day then and had LESS oil in storage and there was LESS oil being produced globally then than there is now. But let's forget the $6Tn rip-off they've already accomplished (10% of global GDP going to energy costs over what we paid under Clinton) – let's just focus on the 28M $50,000 jobs that are represented by the $1.4Tn we are being ripped off THIS year, on top of the 112M jobs worth of money that has already been sucked out of the economy between $20 and $85.

WHEN WILL YOU GET MAD – WHEN WILL ***YOU*** DO SOMETHING ABOUT IT?