Have you seen this?

Frontline did this very good documentary and I'd file it under "those who forget the past are CONDEMNED to repeat it" – let's all TRY not to repeat the mistakes of 2008… "Wall Street got bailed out and Main Street didn't" is the quote that neatly sums up the present situation. Wall Street and the top 10% of this country – of this World – are partying like it's 1999 while the bottom 90% continue to languish in the worst Recession since the Great Depression.

Despite a myriad of worrying data, the Corporate Media is in full-blown promotional mode – pushing stocks as if it were modern snake oil – the panacea that will cure all your ills. We often forget that essentially ALL of our news sources are publicly traded companies and have a vested interest in the stock market going higher. Hell, we have an interest in that too, as our longer-term virtual porfolios are entirely bullish – but that shouldn't preclude us from making a realistic assessment of the CURRENT situation, should it?

Caterpillar, 3M, United Technologies and ABB are among the manufacturers that have reported weak performances in China in the first quarter as economic growth has slowed nearly to a three-year low. Caterpillar’s sales in China fell between $250 million and $300 million in the first quarter, pushing the company, the world’s largest maker of earth-moving equipment, to export to other countries a large share of the equipment it made in China.

Caterpillar, 3M, United Technologies and ABB are among the manufacturers that have reported weak performances in China in the first quarter as economic growth has slowed nearly to a three-year low. Caterpillar’s sales in China fell between $250 million and $300 million in the first quarter, pushing the company, the world’s largest maker of earth-moving equipment, to export to other countries a large share of the equipment it made in China.

Concerns about China overshadowed better-than-expected earnings at the company, which is based in Peoria, Illinois, and led investors to push the stock down 5 percent Wednesday, which was great for us as CAT was on our Long Put List.

ABB, a maker of power equipment, reported profits in the past week that were below analysts’ expectations, caused by weak Chinese demand. “It was a very slow start to the year for China. China in January was extremely weak,” ABB’s chief financial officer, Michel Demaré, said Wednesday.

“Our business in China is off to a slow start,” said Gregory J. Hayes, the chief financial officer of United Technologies, whose Otis arm is the world’s biggest maker of elevators. The unit’s China sales dropped 9 percent in the first quarter. “The ongoing government effort to bring housing prices down has negatively impacted the higher end of the residential sector, which represents about half of Otis’s China sales,” he added.

“Our business in China is off to a slow start,” said Gregory J. Hayes, the chief financial officer of United Technologies, whose Otis arm is the world’s biggest maker of elevators. The unit’s China sales dropped 9 percent in the first quarter. “The ongoing government effort to bring housing prices down has negatively impacted the higher end of the residential sector, which represents about half of Otis’s China sales,” he added.

Beijing in March cut its official forecast for 2012 economic growth to an eight-year low of 7.5 percent, which analysts said signaled that the authorities would be more focused on economic reforms than stimulus. The Finnish escalator maker Kone Oyj said growth in its Chinese markets would slow from 10 percent in the first quarter to between zero and 5 percent in the second. The truck maker Volvo AB cut its forecast Thursday for the Chinese construction equipment market this year to a fall of 15 to 25 percent from an outlook for a flat market.

I could go on but it's almost humorous that I have to make a case that we should be concerned about China. Why aren't we simply concerned about China? THAT'S what should concern you. Why is the topic verboten in the MSM? What are they keeping from you? Even the best sports teams in the World get the occasional critical article written about them but when you hear CHINA!!! in the Corporate Media – it is the tonic that cures all of the World's ills, isn't it?

I could go on but it's almost humorous that I have to make a case that we should be concerned about China. Why aren't we simply concerned about China? THAT'S what should concern you. Why is the topic verboten in the MSM? What are they keeping from you? Even the best sports teams in the World get the occasional critical article written about them but when you hear CHINA!!! in the Corporate Media – it is the tonic that cures all of the World's ills, isn't it?

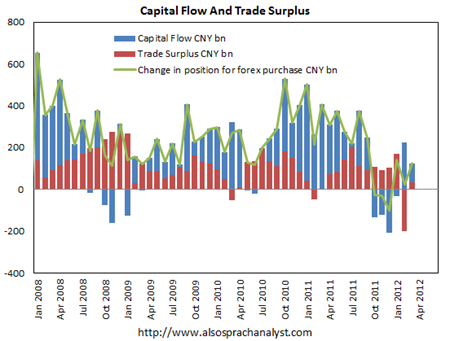

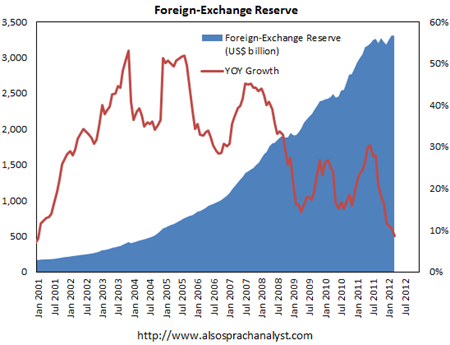

Meanwhile, here's chart after chart showing that China isn't just slowing down, but plunging into a greater downward spiral than it was in in the spring of 2008, another time when investors were ignoring the flashing warning signs until it was far, far too late.

Who else is going to save us? Oh yes, GERMANY! Germany is another word the MSM clubs you over the head with to get you to BUYBUYBUY because Germany will fix everything. As you can see form the Markit chart on the left – German is not, and never has been immune to conditions that affect the rest of the Eurozone – they are simply a lagging indicator, which makes perfect sense since their economy is almost 1/2 of the Eurozone and thus slower to move up or down.

Who else is going to save us? Oh yes, GERMANY! Germany is another word the MSM clubs you over the head with to get you to BUYBUYBUY because Germany will fix everything. As you can see form the Markit chart on the left – German is not, and never has been immune to conditions that affect the rest of the Eurozone – they are simply a lagging indicator, which makes perfect sense since their economy is almost 1/2 of the Eurozone and thus slower to move up or down.

But slower to move does not mean unaffected, does it? Come on folks, you know how to read a chart(s) – why are we investing in stocks as if it were the spring of 2007 (and even then we were idiots to pay those prices) when the charts are CLEARLY telling us it's really the spring of 2008?

In both cases, we are CURRENTLY in conditions that mirror the BOTTOM of the 2001-2003 crash, when the S&P was ALSO at 800 – not 1,400.

Keep in mind – these are the results we're getting WITH Trillions of dollars of Global stimulus spending – over 25% of the World's GDP has been thrown into the pot by the G20 in the past 3 years, averaging 8% a year so, in a HEALTHY economy, one would expect an 8% boost to Global GDP. Obviously, we are barely staying flat and that gives you a pretty good idea of how big of a hole there was to fill.

Yet the media has nothing to say but how "great" things are going. Pending Home Sales were up 4%, for instance but that 4% was from a run rate of 328,000 homes to 341,000 homes per year. Between 2003 and 2006, the United States sold and average of 1,100,000 homes per year – the additional 13,000 homes sold (working out to 21 more homes per month, per state) are not even a rounding error to a healthy market – yet we RALLIED on that news as if cold fusion had been invented.

Yet the media has nothing to say but how "great" things are going. Pending Home Sales were up 4%, for instance but that 4% was from a run rate of 328,000 homes to 341,000 homes per year. Between 2003 and 2006, the United States sold and average of 1,100,000 homes per year – the additional 13,000 homes sold (working out to 21 more homes per month, per state) are not even a rounding error to a healthy market – yet we RALLIED on that news as if cold fusion had been invented.

Doesn't any of this give you pause? Why is the MSM so afraid to confront reality? It's an election year and, if you listen to Fox, you would think the US Economy is going to hell in a handbasket – all because of that fiend, Obama and his evil policies (that have led to a 100% rally in the markets) but then you switch to the Fox Business Network and it's all sunshine and lollipops as far as the eye can see.

Doesn't any of this give you pause? Why is the MSM so afraid to confront reality? It's an election year and, if you listen to Fox, you would think the US Economy is going to hell in a handbasket – all because of that fiend, Obama and his evil policies (that have led to a 100% rally in the markets) but then you switch to the Fox Business Network and it's all sunshine and lollipops as far as the eye can see.

The media doesn't make any money unless you watch it and Wall Street doesn't make any money unless you give them yours to play with and politicians don't have any power unless you give them your vote – which is why they all lie to you – over and over again. They will say anything, do anything, to keep the game afloat and the media, the politicians, the analysts, the "financial advisers", the Central Bankers – are all working together to kick that can as far down the road as possible.

Who knows, maybe we'll get lucky and the World will end on December 12th. If not – we still have a Hell of a big mess to clean up!