Spain is up 2.3% this morning (7:30).

Spain is up 2.3% this morning (7:30).

They are bouncing Europe with them despite a pretty poor round of trading in Asia (flat). Why? Because Spain's 3 & 5-year note sales "only" went for 100 more basis points than last time with the 3-years coming in at 4.04%, up 54% from last year's auction at 2.62% and the 5-year notes fetched 4.75%, up only 28% from the last 5-year note sale so YAY – Spain is fixed!!!

A whole $3.3Bn worth of bonds were sold or about 1/3 of 1% of what has been allocated through bailout programs to buy this junk but this autction is moving $80Tn worth of global equities up 1% ($800B) – talk about getting bang for your bailout buck!

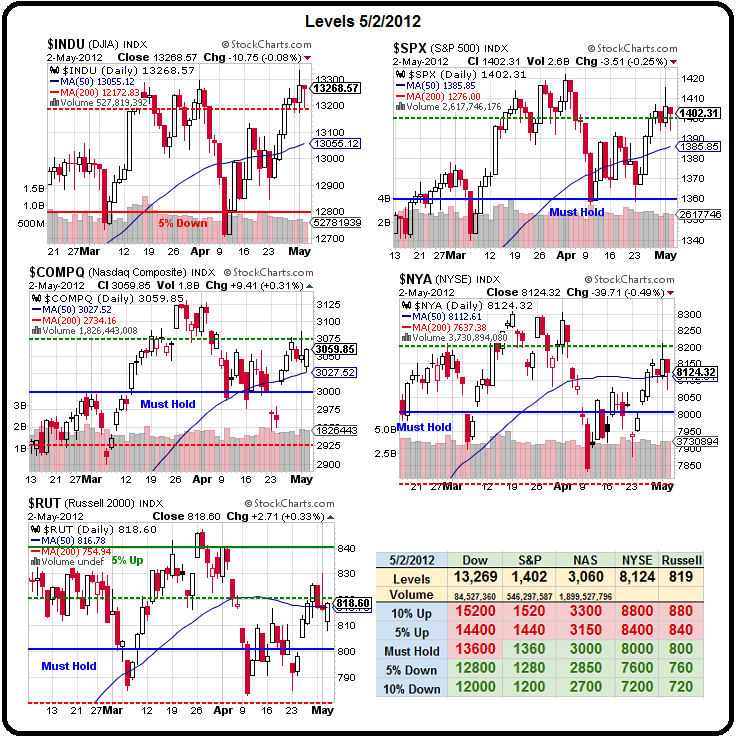

I'm not going to get into how silly this is getting – we went through this all in '07 and '08 and the markets can be amazingly silly when they are in denial so we'll just go with the flow and pick up some nice upside momentum plays – as long as we can stay over 3 of 5 of our Big Chart's 2.5% lines and, if the pre-market move up holds – they should have no problem taking back 3,075 on the Nasdaq, 820 on the Russell and 8,200 on the NYSE. We're already over 1,400 on the S&P on yesterday's stick-save close and the poor Dow has 800 whole points to go before they catch up at 14,000 so it looks like the Dow will be the logical bullish bet if the other 3 indexes join the S&P over the line.

So IF the Dow is over 13,300 AND the other indexes are over our mark – how much money can we make playing for the Dow to catch up and make it to 14,000. 700 points is a lot, so there should be many ways to play this to our advantage. DIA $133 calls are $1 and have a delta of .44 so you capture 44% of a move up, which means a 100-point rise in the Dow will get you a 44% gain – it's a good trade to enter with tight stops below 13,300 as the Dow has 2 weeks and two days left to make those 800 points and that should be a cake-walk as they're already up 400 points in the last 7 sessions and, as we know from our friends at CNBC – what goes up, must go up forever.

We can also use spreads to lever our Dow plays – here's a couple of ideas but keep in mind that no battle strategy survives engagement with the enemy so we'll have to make adjustments in Member Chat depending on how we actually open but that 13,300 line is a great on/off, along with our other 2.5% lines to confirm the move:

We can also use spreads to lever our Dow plays – here's a couple of ideas but keep in mind that no battle strategy survives engagement with the enemy so we'll have to make adjustments in Member Chat depending on how we actually open but that 13,300 line is a great on/off, along with our other 2.5% lines to confirm the move:

DDM is an ultra-long on the Dow, moving at twice the percent of the Dow's moves. Currently at $71.12, the 5% move the Dow needs to catch up should take DDM to about $78.50 and we can take the May $73 calls all by themselves for .60 and those could be worth $5 of more if we hit our target – not a bad return for a hedge!

If we offset that with a stock we REALLY want to own at a lower price (or GMCR should be fun to sell puts against this morning – we'll have to see in Chat), like BA for $65. Wouldn't you like to buy BA (now $77.26) for $65? If so, you can sell the Jan $65 puts for $2.50 and that will pay for almost 4 different attempts at catching a Dow rally. Other puts we like to sell were noted in yesterday's post – some were still available.

Of course, if you are REALLY bullish on the Dow, then you can just sell the DDM June $61 puts for .65 and you have a nickel credit and don't have to deal with owning DDM unless the Dow goes 5% the other way (12,635). Another way we can be bullish on DDM is a bull call spread, like the June $67/71 bull call spread at $2.60 and that's already 100% in the money for a near double if the Dow simply holds that 13,300 line through expiration. Using an offset like selling FCX June $37 puts for $1.30 drops the net cash entry to $1.30 with a 207% upside in just 43 days and all the Dow has to do is hold 13,300 (assuming FCX, now $38.12, holds $37 as well).

We'll look for more of these in Member Chat this morning – IF WE NEED TO – to initally cover our bearish bets and, if we're forced to stop out the bear side (by the same 3 of 5 rule), then these hedges become our new bullish plays. Overall, I'm still waiting for the other shoe to drop, probably a French shoe this weekend as France flips Socialist, followed closely by the German boot as they refuse to start paying for France to be kind to their citizens when Greece and Italy and Spain and Portugal still aren't making their citizens suffer enough in German eyes.

We'll look for more of these in Member Chat this morning – IF WE NEED TO – to initally cover our bearish bets and, if we're forced to stop out the bear side (by the same 3 of 5 rule), then these hedges become our new bullish plays. Overall, I'm still waiting for the other shoe to drop, probably a French shoe this weekend as France flips Socialist, followed closely by the German boot as they refuse to start paying for France to be kind to their citizens when Greece and Italy and Spain and Portugal still aren't making their citizens suffer enough in German eyes.

Mario Draghi said the ECB will NOT be lowering rates or providing more QE or doing anything for the moment and that is already knocking the EU markets back to Earth. Meanwhle, 365,000 Americans lost their jobs last week and the prior week was revised up from 388,000 to 392,000 job losses. Same-store sales numbers in the US are also weak, with expectations now down to 1.4% growth, WAY down from March's 3.9% number that was caused, as we warned at the time, by pulling Easter forward this year. Now we pay on the other side.

As the data was mixed so far, I guess the ISM Service number at 10:00 wiill be a big deal but Plosser speaks at 11 and I doubt he'll say anything to inspire the bulls as he hangs a bit hawkish overall. Tomorrow is the Big Kahuna – the Non-Farm Payroll report and we will have to wait and see if the level of job creation in this country is bad enough to be good news because – let's face it – no one on Wall Street gives a damn if anyone on Main Street has a job – they just want MORE FREE MONEY from Uncle Ben – more free money that is ultimately billed to Main Street – the victims of the biggest, longest. most expensive con ever played.

Have fun with that!