Courtesy of Lee Adler of the Wall Street Examiner

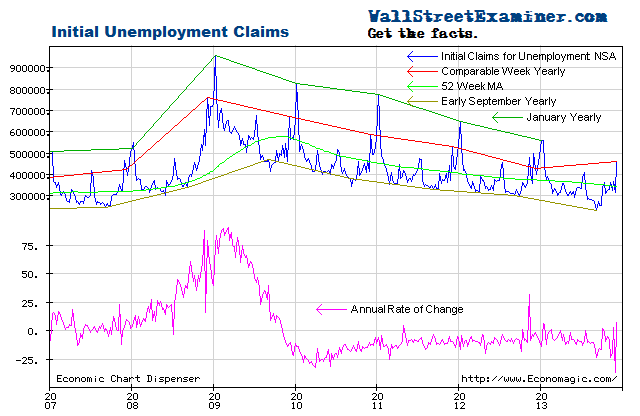

This week’s data on first time unemployment claims was slightly weaker, but not terrible. The gross numbers are still a big improvement over last year, but the momentum of the trend deteriorated.

Actual claims reported in the advance number for the week ended June 9 were 373,540. I always add 4,000 to that to account for the usual upward revision the following week when a full count including all interstate claims is available. The adjusted number of 377,540 was 23,068 or 5.8% less than the same week last year.

In the week ended June 2 actual claims (not seasonally finagled) were 378,000 (rounded) including the addition of 4,000 claims to adjust for incomplete state counts that do not include interstate claims at the time of the advance release (current week). The week was stronger than the week ended June 11, 2011 when new claims totaled 401,000. 23,000 or 5.7% fewer people filed first time claims this year than in the same week in 2011. It was also stronger than the 10 year average claims for this week of 420,000. However, the rate of change deteriorated sharply last week versus the same week in 2011. Claims increased by 53,000 in the current week versus 34,000 for this week in 2011 and a 10 year average increase for the same week of 47,000.

There’s a lot of week to week volatility in the data. Looking at a two week span, claims increased by 31,000 versus an increase of 19,00 in the same 2 weeks in 2011. The 10 year average for this 2 week period was an increase of 27,000. Overall, this week’s data shows that the trend is still improving, but the rate of improvements is slowing.

On the chart, the slope of the year to year line for this week shows a marked slowing. It is closing the gap with the slower 52 week moving average. This is a yellow flag, but it is not yet a reversal of the trend. The annual rate of decrease in new claims continues to oscillate around the -10% axis. The latest data was down by 5.8%. Should that difference drop to less than 3% that could be the first clear warning of a potential decline in employment ahead.

This data suggests that the Fed has slightly more reason to announce additional QE at next week’s FOMC meeting. It will need to at least continue the MBS purchase program to keep its balance sheet from shrinking (covered in the Professional Edition Fed Report). If it goes beyond that, it will run the risk of stocking another surge in commodities prices.

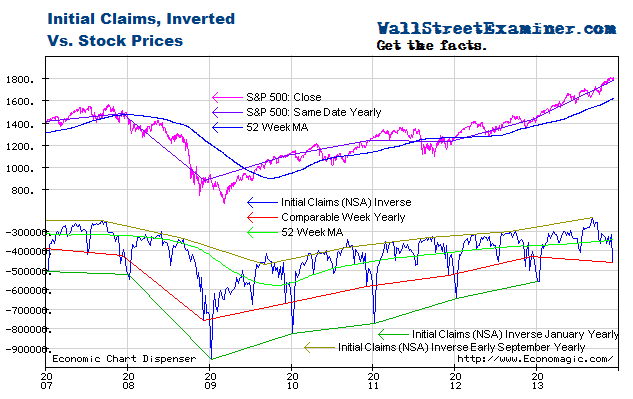

Plotted on an inverse scale, the correlation of the trend of claims with the trend of stock prices is strong. Both are driven by the Fed’s operations with Primary Dealers as covered weekly in the Professional Edition Fed Report. See also The Conomy Game, a free report. This chart suggests that the S&P may be vulnerable to 1200 as things stand now, and lower if the trend of claims worsens from here. The Professional Edition Daily Market Updates cover my take on the technical side of the market for those who follow the charts in that regard.

As the number of workers eligible for unemployment compensation has trended upward slightly since 2009, the percentage of workers filing first time claims has continued to decline. Comparing the current week yearly line to the 52 week moving average, as with the total first time claims, the trend of improvement slowed this week, but it hasn’t gone negative.

The chart below gives a longer term perspective. We can see the trend improving but still above the bubble years with their 10 million fake jobs taking orders for new and unneeded condos and houses, building them, and taking and processing mortgage applications. This however does not account for the thousands of mortgage industry executives and Wall Street bankers who should be in jail but who still have jobs, and still bribe politicians.

The following chart is a picture of reality versus the the Impressionist art of seasonal adjustments. Sometimes it represents reality to some degree, and sometimes it doesn’t. If you are following that data, at any given time you have no way of knowing which it is. One thing is certain–photo-realism it ain’t. There are ways to measure trends using actual data. One way is shown on this chart, which is to show the year to year line as of the current and corresponding date. Another is to view the annual rate of change as shown in the first chart above.

In the most recent weekly data, the SA data suggests that the data is weakening, with the SA claims trend rising since February. The arbitrary seasonal adjustment process has raised a couple of false alarms over the past 2 years with big counter trend pops early in the second half of 2010 and in the second quarter last year. This looks like another one.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.